Financial giants have made a conspicuous bearish move on Monolithic Power Systems. Our analysis of options history for Monolithic Power Systems (NASDAQ:MPWR) revealed 10 unusual trades.

Delving into the details, we found 30% of traders were bullish, while 40% showed bearish tendencies. Out of all the trades we spotted, 4 were puts, with a value of $589,000, and 6 were calls, valued at $702,126.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $680.0 and $840.0 for Monolithic Power Systems, spanning the last three months.

Analyzing Volume & Open Interest

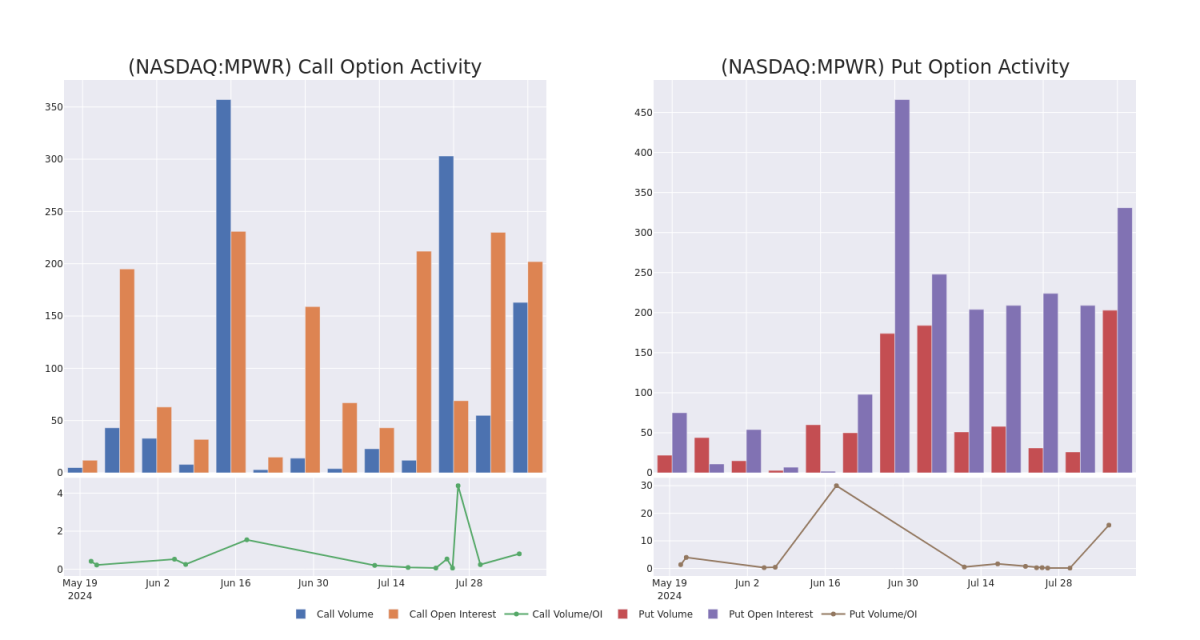

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Monolithic Power Systems's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Monolithic Power Systems's whale activity within a strike price range from $680.0 to $840.0 in the last 30 days.

Monolithic Power Systems Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MPWR | CALL | SWEEP | BULLISH | 09/20/24 | $59.7 | $59.0 | $59.7 | $790.00 | $292.5K | 51 | 55 |

| MPWR | PUT | SWEEP | BEARISH | 09/20/24 | $53.2 | $52.3 | $53.2 | $790.00 | $266.0K | 9 | 54 |

| MPWR | CALL | SWEEP | BULLISH | 09/20/24 | $61.5 | $58.8 | $61.5 | $790.00 | $166.0K | 51 | 82 |

| MPWR | PUT | SWEEP | BULLISH | 09/20/24 | $52.9 | $51.2 | $51.2 | $790.00 | $153.6K | 9 | 84 |

| MPWR | CALL | SWEEP | BEARISH | 12/20/24 | $89.6 | $88.2 | $88.2 | $840.00 | $97.0K | 42 | 15 |

About Monolithic Power Systems

Monolithic Power Systems is an analog and mixed-signal chipmaker, specializing in power management solutions. The firm's mission is to reduce total energy consumption in end systems, and it serves the computing, automotive, industrial, communications, and consumer end markets. MPS uses a fabless manufacturing model, partnering with third-party chip foundries to host its proprietary BCD process technology.

After a thorough review of the options trading surrounding Monolithic Power Systems, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Present Market Standing of Monolithic Power Systems

- Currently trading with a volume of 531,854, the MPWR's price is up by 2.56%, now at $790.16.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 83 days.

What The Experts Say On Monolithic Power Systems

In the last month, 5 experts released ratings on this stock with an average target price of $951.0.

- An analyst from Deutsche Bank persists with their Buy rating on Monolithic Power Systems, maintaining a target price of $900.

- An analyst from Keybanc persists with their Overweight rating on Monolithic Power Systems, maintaining a target price of $975.

- An analyst from Rosenblatt has decided to maintain their Buy rating on Monolithic Power Systems, which currently sits at a price target of $880.

- Consistent in their evaluation, an analyst from Raymond James keeps a Outperform rating on Monolithic Power Systems with a target price of $925.

- Maintaining their stance, an analyst from Keybanc continues to hold a Overweight rating for Monolithic Power Systems, targeting a price of $1075.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.