The headline news that was jointly reported by global financial media last night and this morning mainly included:

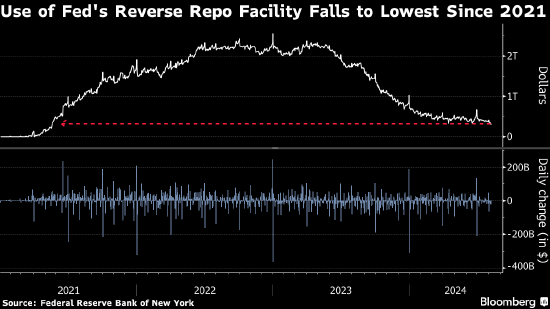

Usage of Fed's reverse repo tool falls to a three-year low.

The usage amount of the Fed's reverse repurchase agreement tool fell below $30 billion for the first time since 2021.

On Tuesday, 60 participants deposited a total of $2.92 billion in the Fed's overnight reverse repurchase agreement (RRP) tool. According to data from the New York Fed, this marks a sharp drop from the record $2.554 trillion on December 30, 2022.

Market participants are closely watching the usage of RRP. Some Wall Street insiders warn that the decrease in usage indicates that excess liquidity has been removed from the financial system, and that bank reserve balances are not as sufficient as policy makers think.

The Federal Reserve's balance sheet is a key tool for monetary policy and financial stability, according to the New York Fed.

The New York Fed published an article on Tuesday stating that the Fed's balance sheet is a "key tool" for supporting the Federal Open Market Committee's (FOMC) monetary policy goals and supporting financial stability "in rare cases".

The Fed mainly sets its monetary policy stance by adjusting the target range for the federal funds rate, but the FOMC has also supported the overall financial situation by purchasing U.S. Treasuries and mortgage-backed securities (MBS), especially when the federal funds rate is close to zero.

Purchases have also been used to address market dysfunction, such as during the disturbance of the financial market by the COVID-19 in March 2020.

German retail chain Dirk Rossmann GmbH announced on Tuesday that it will no longer purchase Tesla's autos for its fleet, citing Elon Musk's support for Donald Trump.

Rossmann announced the decision in a statement on Tuesday. The company has more than 0.062 million employees and over 4,700 branches in Europe. The concentrated holding company said that although it will continue to use existing Teslas for sustainable purposes, future auto orders will be directed to other manufacturers and models.

"Elon Musk does not hide his support for Donald Trump. Trump has repeatedly described climate change as a hoax," said Raoul Rossmann, the billionaire founder of the company, in a statement. "This attitude is in stark contrast to Tesla's mission of making contributions to environmental protection through the production of electric autos."

Walt Disney Co will raise the price of its streaming service, with the lowest-priced version, the ad-supported Disney+, rising 25% to $9.99 per month.

Disney is raising streaming prices up to 25% and adding new channels.

According to Tuesday's announcement, the ad-free version of Disney+ will rise 14% to $15.99 per month. The bundle price for Disney+ and Hulu with ads will rise 10% to $10.99 per month. The price increase takes effect on October 17. Hulu and ESPN+ will also raise prices.

In this adjustment, the company will add program options, including continuous channels, to Disney+. Starting on September 4, Disney+ subscribers will be able to watch ABC News Live and preschool programs. Later this year, advanced subscribers can watch documentaries, action films and pop culture channels.

Goldman Sachs CEO David Solomon expects the Fed to avoid taking emergency measures to lower borrowing costs, and believes the US economy has avoided a recession.

Goldman Sachs CEO expects that the Federal Reserve will not cut interest rates before September, and the economy will avoid recession.

"I don't think we'll see anything before September," Solomon said. "The economy will move steadily forward, and we probably won't see a recession."

Investors have increased their bets that policy makers will take action before the September rate-setting meeting, following a global stock market crash and Friday's employment data showing weaker-than-expected US economic performance. Derivatives markets briefly showed a 60% chance of a 25 basis point Fed rate cut within the next week.

Following the significant movement caused by Friday's US non-farm payroll report, Morgan Asset Management said its base-case scenario remains for a soft landing of the US economy and that it does not expect the Fed to cut rates before its regular meeting.

Morgan Asset Management: The Federal Reserve will not cut interest rates urgently. There is a possibility of a 50 basis point rate cut in September.

Kim Crawford, the fixed income portfolio manager at Morgan Asset Management, said in an interview that the report could have some "noise" and that subsequent data could show labor market slowing down very gradually.

"If by the September Fed meeting there is no overall improvement in the labor market, then a 50 basis point rate cut could become an option from a risk management perspective," she said.