Deep-pocketed investors have adopted a bearish approach towards Moderna (NASDAQ:MRNA), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in MRNA usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 18 extraordinary options activities for Moderna. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 22% leaning bullish and 66% bearish. Among these notable options, 9 are puts, totaling $474,376, and 9 are calls, amounting to $342,609.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $75.0 to $150.0 for Moderna over the recent three months.

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $75.0 to $150.0 for Moderna over the recent three months.

Analyzing Volume & Open Interest

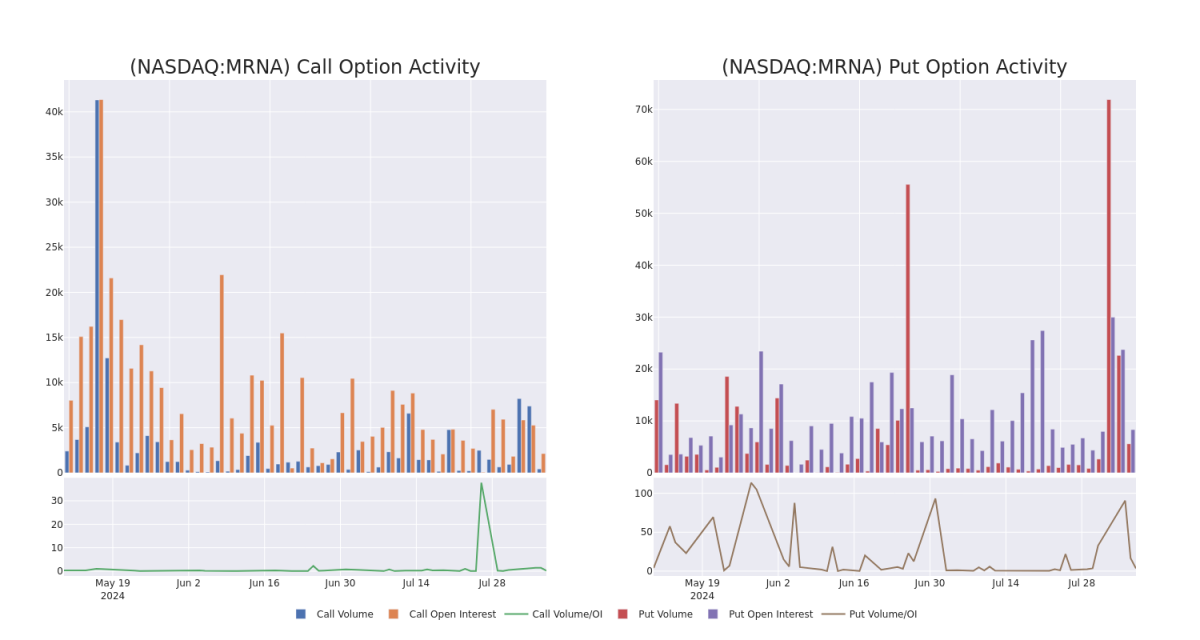

In today's trading context, the average open interest for options of Moderna stands at 871.33, with a total volume reaching 6,015.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Moderna, situated within the strike price corridor from $75.0 to $150.0, throughout the last 30 days.

Moderna Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MRNA | PUT | TRADE | BEARISH | 06/20/25 | $12.05 | $9.6 | $11.25 | $75.00 | $141.7K | 1.2K | 0 |

| MRNA | PUT | SWEEP | BEARISH | 09/20/24 | $10.35 | $10.25 | $10.25 | $90.00 | $94.7K | 2.3K | 86 |

| MRNA | CALL | SWEEP | BEARISH | 01/17/25 | $12.05 | $11.85 | $11.85 | $90.00 | $50.9K | 596 | 64 |

| MRNA | PUT | SWEEP | BULLISH | 08/16/24 | $1.08 | $0.9 | $0.9 | $78.00 | $44.5K | 1.9K | 500 |

| MRNA | CALL | TRADE | BEARISH | 06/20/25 | $14.0 | $13.0 | $13.0 | $100.00 | $44.2K | 109 | 36 |

About Moderna

Moderna is a commercial-stage biotech that was founded in 2010 and had its initial public offering in December 2018. The firm's mRNA technology was rapidly validated with its COVID-19 vaccine, which was authorized in the United States in December 2020. Moderna had 39 mRNA development candidates in clinical trials as of mid-2023. Programs span a wide range of therapeutic areas, including infectious disease, oncology, cardiovascular disease, and rare genetic diseases.

After a thorough review of the options trading surrounding Moderna, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of Moderna

- Currently trading with a volume of 1,421,559, the MRNA's price is up by 0.88%, now at $83.03.

- RSI readings suggest the stock is currently may be oversold.

- Anticipated earnings release is in 85 days.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Moderna options trades with real-time alerts from Benzinga Pro.