Deep-pocketed investors have adopted a bearish approach towards Exxon Mobil (NYSE:XOM), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in XOM usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 17 extraordinary options activities for Exxon Mobil. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 35% leaning bullish and 52% bearish. Among these notable options, 3 are puts, totaling $929,958, and 14 are calls, amounting to $809,281.

What's The Price Target?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $100.0 and $120.0 for Exxon Mobil, spanning the last three months.

Insights into Volume & Open Interest

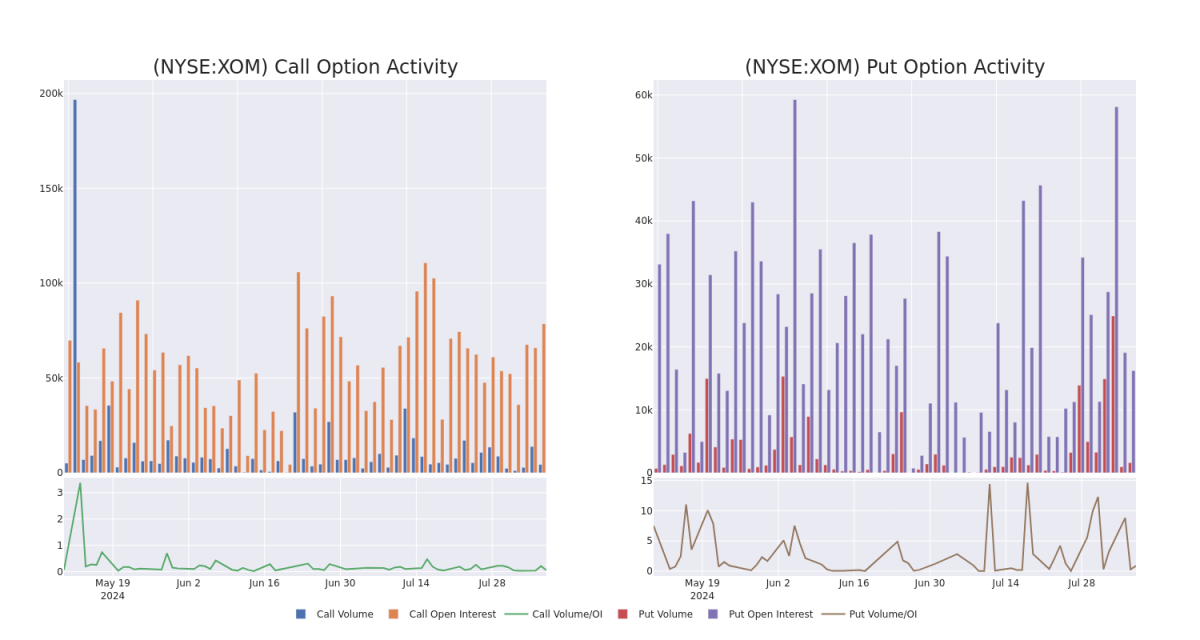

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Exxon Mobil's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Exxon Mobil's significant trades, within a strike price range of $100.0 to $120.0, over the past month.

Exxon Mobil Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| XOM | PUT | SWEEP | BEARISH | 01/17/25 | $6.75 | $6.5 | $6.65 | $115.00 | $841.7K | 8.9K | 1.2K |

| XOM | CALL | SWEEP | BULLISH | 09/20/24 | $4.55 | $4.45 | $4.5 | $115.00 | $134.5K | 11.4K | 1.5K |

| XOM | CALL | SWEEP | BEARISH | 12/20/24 | $5.35 | $5.15 | $5.21 | $120.00 | $110.0K | 8.1K | 213 |

| XOM | CALL | TRADE | BEARISH | 09/20/24 | $7.9 | $7.75 | $7.81 | $110.00 | $78.1K | 2.7K | 116 |

| XOM | CALL | SWEEP | BEARISH | 01/17/25 | $8.5 | $8.4 | $8.4 | $115.00 | $75.6K | 10.6K | 100 |

About Exxon Mobil

ExxonMobil is an integrated oil and gas company that explores for, produces, and refines oil around the world. In 2023, it produced 2.4 million barrels of liquids and 7.7 billion cubic feet of natural gas per day. At the end of 2023, reserves were 16.9 billion barrels of oil equivalent, 66% of which were liquids. The company is one the world's largest refiners with a total global refining capacity of 4.5 million barrels of oil per day and is one of the world's largest manufacturers of commodity and specialty chemicals.

Having examined the options trading patterns of Exxon Mobil, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Exxon Mobil's Current Market Status

- Trading volume stands at 7,815,756, with XOM's price up by 1.49%, positioned at $115.86.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 79 days.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.