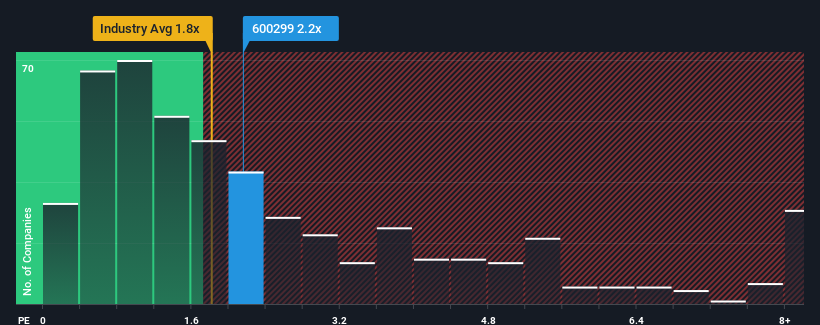

There wouldn't be many who think Bluestar Adisseo Company's (SHSE:600299) price-to-sales (or "P/S") ratio of 2.2x is worth a mention when the median P/S for the Chemicals industry in China is similar at about 1.8x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

How Has Bluestar Adisseo Performed Recently?

Bluestar Adisseo hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Bluestar Adisseo.Is There Some Revenue Growth Forecasted For Bluestar Adisseo?

In order to justify its P/S ratio, Bluestar Adisseo would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a frustrating 4.9% decrease to the company's top line. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 12% in total. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Retrospectively, the last year delivered a frustrating 4.9% decrease to the company's top line. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 12% in total. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Turning to the outlook, the next year should generate growth of 18% as estimated by the four analysts watching the company. That's shaping up to be materially lower than the 23% growth forecast for the broader industry.

With this in mind, we find it intriguing that Bluestar Adisseo's P/S is closely matching its industry peers. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

What Does Bluestar Adisseo's P/S Mean For Investors?

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our look at the analysts forecasts of Bluestar Adisseo's revenue prospects has shown that its inferior revenue outlook isn't negatively impacting its P/S as much as we would have predicted. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Bluestar Adisseo, and understanding them should be part of your investment process.

If you're unsure about the strength of Bluestar Adisseo's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com