As of the midday close, the Shanghai Composite Index rose 0.38% to 2880.61 points, the Shenzhen Component Index rose 0.49%, and the Chinext Price Index rose 0.09%.

In early trading, the major A-share indexes hit bottom and rebounded. As of the midday closing, the Shanghai Composite Index rose by 0.38% to 2880.61 points, the Shenzhen Component Index rose by 0.49%, and the Chinext Price Index rose by 0.09%. More than 3,000 individual stocks rose, and the two markets traded 425.3 billion yuan in half a day, an increase of 52.1 billion yuan from the previous day.

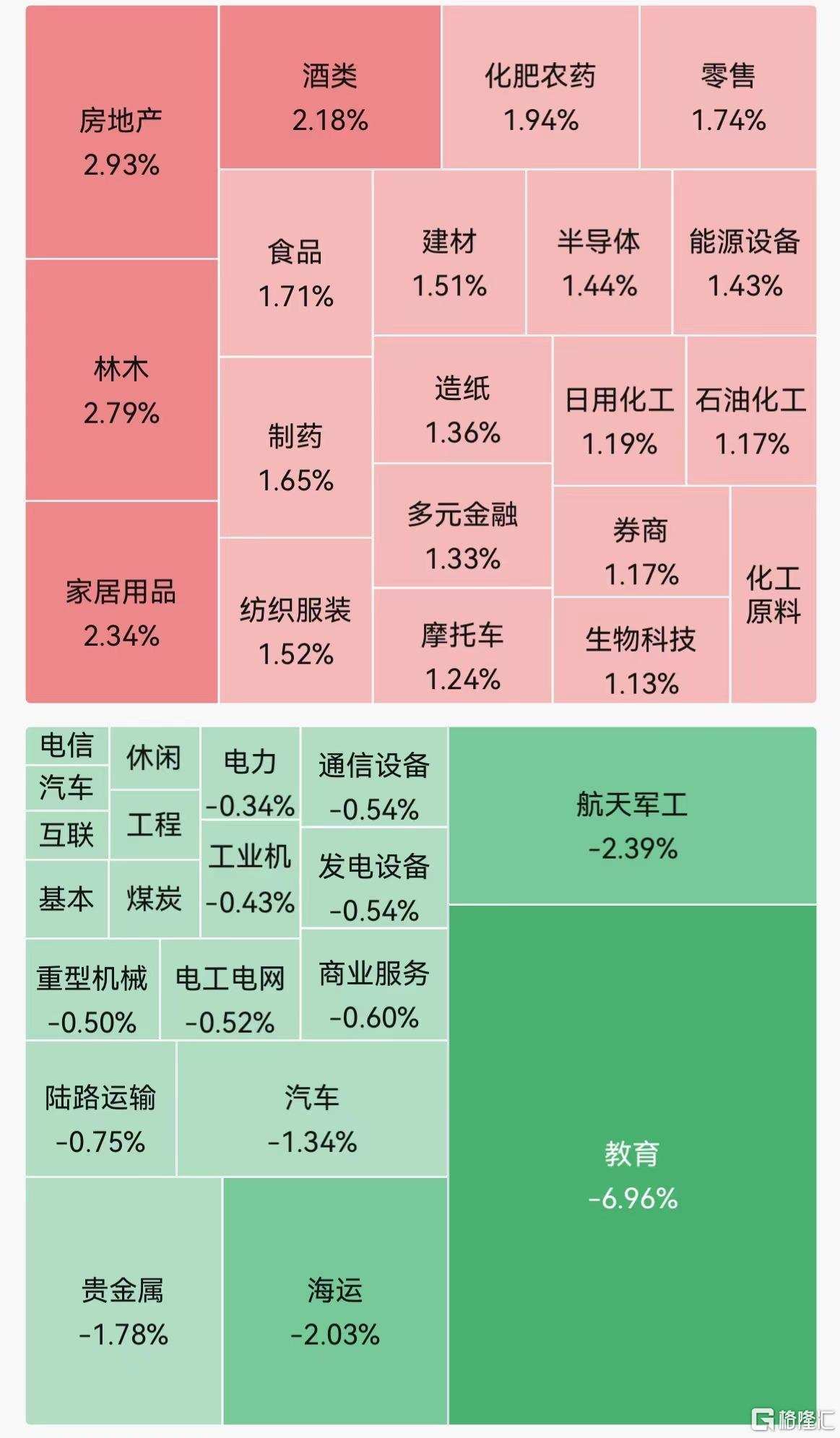

On the market, the vitamin concept continues to strengthen, Erkang Pharmaceuticals, Minsheng Health, Northeast Pharmaceutical and other stocks have risen by limit; theater stocks have risen, Tangde Film and Television 20CM has risen by limit, happiness blue sea has increased nearly 87%, and the total box office in the summer file has exceeded 8.5 billion; liquor stocks rebounded, Huangtai Wine Industry, Guijiu shares rose by limit, Kweichow Moutai rose by nearly 2%, and the liquor industry achieved a situation of simultaneous rise in quantity, price and profit in the first half of the year; the real estate sector rose, Shenzhen Properties & Resources Development(Group) Ltd., Shenzhen Worldunion Group Incorporated rose by limit, and Guangshen joined the construction of indemnificatory apartments, and analysis shows that Beijing and Shanghai are expected to follow suit. Traditional Chinese medicine, retail, planting industry and other sectors are leading in the gains.

Education stocks collectively fell back, Offcn Education Technology, Shanghai Xinnanyang Only Education & Technology both fell by limit, Shanghai Xinnanyang Only Education & Technology issued a profit warning, expecting a net loss of 17.6 million yuan in the first half of the year; commercial aerospace concept stocks fell, Aerosun Corporation, Shanghai Hugong Electric Group both fell by limit; automobile stocks fell across the board, Baic Bluepark New Energy Technology fell by more than 8%, and Jiangling Motors Corporation fell by more than 4%; military industry, online car-hailing, precious metals and other sectors were among the top decliners.

Education stocks collectively fell back, Offcn Education Technology, Shanghai Xinnanyang Only Education & Technology both fell by limit, Shanghai Xinnanyang Only Education & Technology issued a profit warning, expecting a net loss of 17.6 million yuan in the first half of the year; commercial aerospace concept stocks fell, Aerosun Corporation, Shanghai Hugong Electric Group both fell by limit; automobile stocks fell across the board, Baic Bluepark New Energy Technology fell by more than 8%, and Jiangling Motors Corporation fell by more than 4%; military industry, online car-hailing, precious metals and other sectors were among the top decliners.

The vitamin concept continues to strengthen, and Erkang Pharmaceuticals and other stocks have risen by limit.

Erkang Pharmaceuticals, Minsheng Health, Northeast Pharmaceutical, Shengda Bio-Pharm, Guangji Pharmaceutical, Zhejiang Medicine, and N-Tech Tech and other stocks have risen by limit, and Garden Bio-Pharmaceutical and Shanxi Zhendong Pharmaceutical have risen more than 10%. On the news front, BASF, the German chemical giant, stated that its Ludwigshafen plant had stopped production due to a fire on July 29th, and the delivery of some of the company's vitamin A, vitamin E, carotenoids and aromatic compound products was subject to force majeure.

Baijiu stocks rebounded, with Shanghai Guijiu Co., Ltd. hitting the limit.

Huangtai Wine Industry, Guijiu shares rose by limit, Jiangsu King's Luck Brewery Joint-Stock, Shanxi Xinghuacun Fen Wine Factory rose more than 4%, Hebei Hengshui Laobaigan Liquor, Shede Spirits, Kweichow Moutai, Luzhou Laojiao and others followed the increase. In terms of news, Song Shuyu, chairman of the China Alcoholic Drinks Association, said at the "2024 National Judges' Annual Meeting of Chinese Liquor" that in the first half of this year, the national liquor production, sales revenue and realized profit increased by 3%, 11% and 15% respectively year on year, achieving a situation of simultaneous rise in quantity, price and profit.

The real estate sector rose, Shenzhen Properties & Resources Development(Group) Ltd., Shenzhen Worldunion Group Incorporated and Gemdale Corporation all rose by limit, Shenzhen joined the construction of indemnificatory apartments, and analysis shows that Beijing and Shanghai are expected to follow suit.

Shenzhen Properties & Resources Development(Group) Ltd., Shenzhen Worldunion Group Incorporated and Gemdale Corporation rose by limit, SDG Service rose more than 11%, 5i5j Holding Group, Langold Real Estate, Shahe Industrial and other stocks were among the top gainers. On the news side, Guangshen joined the construction of indemnificatory apartments, and the market's digestion capacity is stronger. Analysis shows that Beijing and Shanghai are expected to follow suit.

Education stocks collectively fell back, and Offcn Education Technology and other stocks fell by limit.

Offcn Education Technology and Only Education & Technology both hit the daily limit down, while Kaiwen Education Technology, Qtone Education Group(Guangdong), and Suzhou Kingswood Education Technology all fell more than 8%. DouShen Education, Action Education, and Chuanzhi Education also fell more than 5%. On the news front, Only Education & Technology announced that it expects to achieve revenue of 546.5 million yuan and a net loss attributable to shareholders of the listed company of 17.6 million yuan, and a net loss attributable to shareholders of the listed company after deducting non-recurring gains and losses of 16.6 million yuan in the first half of 2024. The company is expected to have a performance loss in the first half of 2024. We kindly ask all investors to make rational decisions and invest prudently.