Warren Buffett's favorite Japanese trading companies are even cheaper, possibly giving the billionaire another opportunity to increase his shareholding.

As of Monday's close, the market value of Buffett's holdings in Japanese trading companies evaporated by about 980 billion yen ($6.7 billion), but the scale of evaporation had shrunk to around 550 billion yen by Wednesday's close as the Japanese stock market rebounded.

"If he can buy these stocks at a cheaper price, it would be very profitable," said Mineo Bito, president and CEO of Bito Financial Service Co. He has been attending the annual shareholder meetings of Berkshire Hathaway, Buffett's company, since 2014.

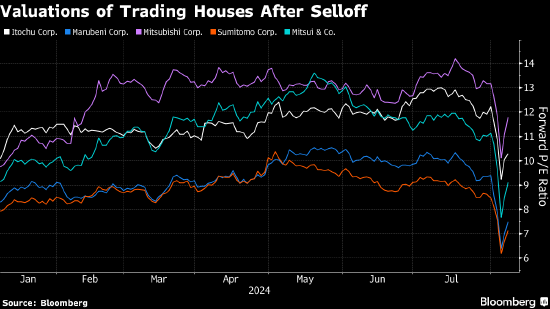

Currently, Berkshire holds an average of 8.2% stake in Marubeni, Mitsubishi Corp., Itochu Corp., Mitsui & Co., and Sumitomo Corp. During the recent market downturn, Marubeni and Mitsui & Co. had the largest drop, with a decline of up to 31%. Trading company stocks have fallen more than the large cap, and the market is concerned that a stronger yen may reduce their overseas income.

Currently, Berkshire holds an average of 8.2% stake in Marubeni, Mitsubishi Corp., Itochu Corp., Mitsui & Co., and Sumitomo Corp. During the recent market downturn, Marubeni and Mitsui & Co. had the largest drop, with a decline of up to 31%. Trading company stocks have fallen more than the large cap, and the market is concerned that a stronger yen may reduce their overseas income.

As of Wednesday, Marubeni and Mitsui's expected PE ratios had fallen to about 7.5 times and 9.1 times, respectively, similar to the levels when Buffett increased his shareholding from April to June last year.

"Buffett has been very successful in value investing, and maybe he thinks that the current valuation of Japanese stocks is an opportunity," said Hiroshi Namioka, chief strategist at T&D Asset Management Co. in Tokyo.

If Berkshire decides to increase its holdings, its record cash reserves will come into play. After significantly reducing its stake in Apple in the second quarter, Berkshire's cash reserves reached $276.9 billion.

目前伯克希尔平均持有丸红、三菱商事、伊藤忠商事、三井物产和住友商事各8.2%的股份。最近股市下跌期间,丸红和三井物产跌幅最大,达到31%。商社股票跌幅超过大盘,市场担心日元走强可能会减少它们的海外收入。

目前伯克希尔平均持有丸红、三菱商事、伊藤忠商事、三井物产和住友商事各8.2%的股份。最近股市下跌期间,丸红和三井物产跌幅最大,达到31%。商社股票跌幅超过大盘,市场担心日元走强可能会减少它们的海外收入。