Will it be a safe haven for global capital?

The massive retreat of Yen-carry trade funds has triggered a global stock market shockwave, with ripple effects continuing.

Yesterday, the U.S. stock market opened high and fell, closing down more than 1%. Funds once again saw a large-scale retreat and the Asia-Pacific markets were also spooked. The Nikkei closed down 0.74% today.

However, Hong Kong stocks seem to have shown resistance to the fall. Yesterday, the three major Hong Kong stock indices rose more than 2% at one point and closed up more than 1%. Although Hong Kong stocks fell briefly by 1% in early trading today, they quickly rebounded and rose nearly 1% at one point. Even though they fell back at the close, the upward trend is obvious.

Compared with the mid-July market, Hong Kong stocks have shown stronger resistance to the fall. The Nasdaq fell more than 13% from its high point, the Nikkei fell by nearly 20%, while Hong Kong stocks fell by only about 7%, especially given that the Nikkei plunged 20% in three days earlier this month, the Nasdaq fell 8% and Hong Kong stocks fell by less than 4%.

It is clear that with the end of the yen-carry trade game in the global market, hedging has become the mainstream choice for global funds as the U.S. stock market also begins trading under the expectation of economic weakness.

Will Hong Kong stocks be a safe haven for global funds in the future?

01

Super double kill

The sudden sharp retreat in the U.S. and Japanese stock markets may be catalyzed by two major direct "culprits".

One is the recurrence of weakness in some macroeconomic data in the United States that has raised concerns in the market. Last Friday, the U.S. added 0.114 million non-farm workers, well below the previous figure of 0.179 million. The unemployment rate (U3) rose from 4.1% to 4.3%, reaching its highest level in nearly three years, exacerbating concerns about a recession in the U.S. economy.

In recent days, the debate over the "economic recession theory" has skyrocketed on Wall Street, with more and more large bank analysts believing that the possibility of a "soft landing" for the U.S. economy is clearly increasing.

Of course, this view of "recession," more accurately speaking, should be "stagnation."

Some people also believe that the Federal Reserve will cut interest rates more than expected to steady the economic situation, but this expectation has been overplayed by the market, leading investors to feel that the higher the rise of U.S. stocks, the colder they feel. The direction of the U.S. stock market has also turned to "trading recession."

According to reports, ahead of "Black Monday", Bank of America had already sent a report to its clients urging them to sell their stocks when the Federal Reserve cut interest rates for the first time.

Even the staunchest supporter of U.S. enterprise, Warren Buffett, has cut his position in the largest weighted stock, Apple, for the first time in years, hoarding cash and buying U.S. bonds. His cash reserves have hit a new high, showing a clear sign of smelling different risks and choosing to take precautions early.

The concern is still brewing and has become a resistance to the rebound of the U.S. stock market, especially in the context of some tech giants with real growth but insufficient indicators failing to meet the market's strong expectations and experiencing a steep decline in their stock prices after their results were released.

This worry is still fermenting and has become a resistance to the rebound of U.S. stocks.

The other, more important culprit is the mass retreat of Yen-carry trade funds.

Some institutions believe that the mass retreat of this fund and the chain reaction that should follow it have not yet played out.

Prior to this, the long-term ultra-low interest rates on the yen drew massive arbitrage funds from around the world to participate in the yen-carry trade of "borrowing yen to buy high-yield assets. especially with the dollar in this crazy interest rate cycle, the difference in interest rates between the US and Japan is as high as nearly 5%, constantly stimulating the game towards a climax.

There are reports that this type of arbitrage trading has a scale of at least tens of trillions of dollars.

According to statistics from Japan, in the first quarter alone, net international investment of Japanese investors reached 487 trillion yen ($3.4 trillion), most of which came from foreign exchange reserves. The Bank of Japan is also a major arbitrageur. The Japanese government's $1.8 trillion government retirement investment fund (GPIF) has about half of its funds allocated to overseas stocks and bonds. In addition, according to Deutsche Bank analysts, the total value of the Japanese government's balance sheet is about 500% of GDP, or $20 trillion, which is used for arbitrage trading, so that the Japanese government can maintain nominal debt and interest payments that continue to grow.

Regardless of the actual data, it reflects that there is a massive carry trade fund that has helped drive the continuous rise and over-crowded trades of the US-Japanese stock market in recent years.

The biggest downside of this game is that once the interest rate on the yen rises sharply, the game will instantly expose a terrible consequence -- stampede selling.

On July 31, Japan suddenly raised interest rates, adjusting the current policy rate from 0.0-0.1% to 0.25%, triggering a global "sell stocks and buy back yen" stampede effect, ultimately leading to the collapse of the US-Japanese stock market.

Although the deputy governor of the Bank of Japan came out on Wednesday to say that he would not raise interest rates when the market was unstable, it stabilized the market sentiment in the short term, but most people do not believe that this matter will end.

International institutions generally believe that the recent large decline in the US-Japanese stock market has already offset most of the yen carry trade funds, but due to the statement of the Bank of Japan and the still considerable difference between US and Japan monetary interest rates, as well as the accumulated floating profits in long-term stock market investments, there are still a large number of carry trade funds waiting and not "unwinding."

According to Bloomberg, JPMorgan's global forex strategy co-head said:

"At least among the speculative group, closing carry trade positions is only half complete, and market pain since Monday has more room to run."

He added that technical harm to investment portfolios means that large fluctuations will not be easily reversed. Therefore, he believes that the recovery of any carry trade transaction before the yen soars is unlikely to occur in the short term.

Regardless of the situation, the expectation that the interest rate of the yen will rise while the interest rate of the US dollar will lead to the accelerated narrowing of the interest rate gap between the two countries is already rising rapidly, and combined with the over-crowding of the US and Japanese stock markets, the risk of stampede still exists.

Under this concern, investors will fall into a prisoner's dilemma of whether to run first.

Therefore, in the next period of time, this game will continue, but even so, it cannot stop funds from leaving and waiting to watch, or finding other safe haven assets as short-term transitions.

And among them, perhaps some of the funds will flow back to the Hong Kong stock market.

02

Opportunities in the Hong Kong Stock Market in August

Because the Hong Kong dollar is pegged to the US dollar, the Hong Kong dollar has a certain "US dollar attribute," and the Hong Kong stock market also has a feature that the US stock market does not have -- ultra-low valuation.

"US dollar attribute," makes the Hong Kong dollar interest rate continue to push up, attracting some global funds and domestic funds to be allocated.

Ultra-low valuation is particularly valuable in the current situation of significant bubbles in the US-Japanese stock market.

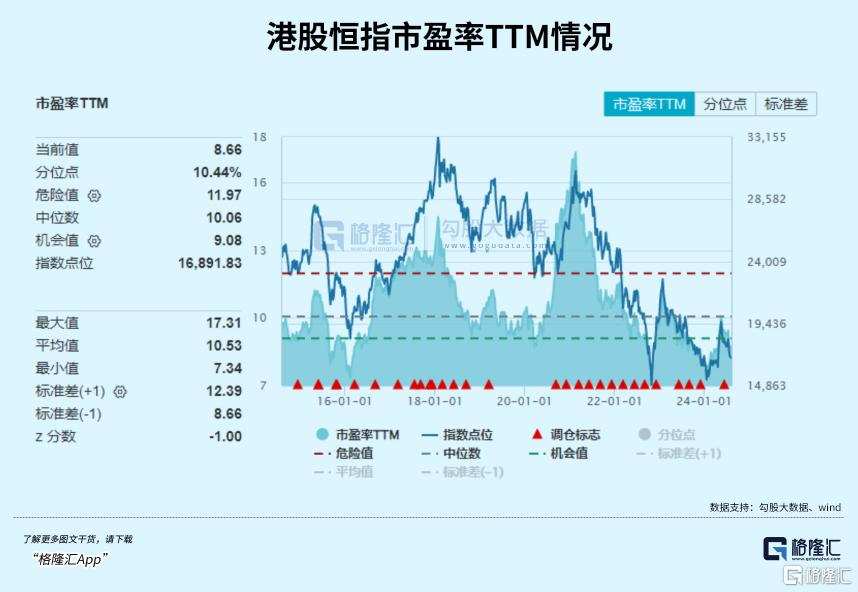

As of now, the P/E ratio of the Hang Seng Index is only 8.7, which is in the 10.44 percentile in nearly 10 years. The P/B ratio is only 0.84, and the percentile is even in the 3.07 percentile in the past decade.

With these two advantages, when the US dollar starts to weaken, the Hong Kong stock market will show a certain degree of resistance to the decline. It may even benefit from the return of some global funds and may bring a wave of prosperity.

According to statistics from ICBC International Research Report, in each interest rate cut stage since the listing of Hong Kong stocks in 1983, the Hang Seng Index has an average increase of 22%, a cumulative increase of 264.2%, and a performance higher than during the interest rate hike cycle.

Despite Hong Kong stocks following Mainland A shares to drop this year, the cumulative inflow of southbound funds has reached 407.8 billion yuan, and most trading days have been in a net inflow state. Regarding QDII fund issuance in the past two years, the latest net asset value has reached 437.726 billion yuan, a significant increase from the beginning of the year. There is a considerable proportion of funds that are allocated to Hong Kong assets. As of the end of Q2 this year, there are a total of 3,594 public funds in Mainland China that can invest in Hong Kong stocks (except for QDII), with a market value of HKD 375.7 billion, up 23.0% from RMB 305.5 billion in Q1. The proportion of Hong Kong stock holdings is 24.1%, which is higher than 19.0% in Q1. Among them, active equity-oriented funds increased their holdings from 17.1% in Q1 to 21.7%, reaching the highest level since the end of 2021.

The scale of QDII fund issuance has also expanded rapidly in recent years, and the latest net asset value has reached 437.726 billion yuan, a significant increase from the beginning of the year. There is a considerable proportion of funds that are allocated to Hong Kong assets.

As of the end of Q2 this year, a total of 3,594 public funds in Mainland China can invest in Hong Kong stocks (except for QDII), with a market value of RMB 375.7 billion, up 23.0% from RMB 305.5 billion in Q1. The proportion of Hong Kong stock holdings is 24.1%, which is higher than 19.0% in Q1. Among them, active equity-oriented funds increased their holdings from 17.1% in Q1 to 21.7%, reaching the highest level since the end of 2021.

This indicates that the Mainland still holds great enthusiasm and expectations for Hong Kong stocks.

On the other hand, from January to May this year, Hong Kong stocks rebounded by more than 30% from their lows, but then began to fall again in mid-May with a cumulative decline of 14% as first-quarter earnings were released.

One important catalyst for this is the first-quarter earnings release of Hong Kong stocks.

Institutions have very low consensus expectations for the 2024 earnings forecast of Hong Kong stock companies. According to Bloomberg's consensus expectations, it is only about 6.6%, even lower than the level for the entire year of 2023.

However, Hong Kong stocks' first-quarter performance was better than market expectations. Among internet giants, except for Alibaba's performance growth is not significant, Tencent, Meituan, Baidu and other giants' revenue growth was actually not bad, and their profit recovery was quite obvious.

The profit performance of the financial, energy, public services, and consumer sectors has also been impressive.

Now in August, it is the time for the mid-year report disclosure of Hong Kong stocks. According to institutional predictions, the second-quarter performance of industries such as internet giants, cyclicals, and medicals may continue to perform well, becoming an important catalyst for Hong Kong stocks to do well.

Even if not, Hong Kong stocks' attractiveness is reflected in its high dividend and high return on capital. Currently, the dividend yield of the Hang Seng High Dividend Yield Index is about 7%, and even taking into account the 20% dividend tax, the dividend yield is still as high as 5%, significantly stronger than similar domestic performances, with some high dividend stocks having a dividend yield of even more than 10%.

At the same time, Hong Kong stocks' share buyback efforts are much larger than A shares', with giants such as Tencent, Meituan, Alibaba, JD.com, and financial giants such as HSBC and AIA repurchasing shares in amounts of tens of billions or even hundreds of billions of yuan, which is very helpful for stabilizing stock prices. This situation is the same as the operation of US technology giants' buybacks to improve capital return performance.

As of August 6th, more than 200 Hong Kong-listed companies initiated repurchases this year with a cumulative amount of HKD 203.177 billion, far exceeding 131.3 billion and 179.1 billion Hong Kong dollars in 2022 and 2023, respectively.

Mid-year reports generally also come with repurchase plans, which may attract attention as another point of interest in the Hong Kong stock market.

As mentioned above, the short-term demand for global funds is not about where to make more money, but is more focused on risk aversion.

03

Epilogue

Whether it is the US economic recession or the shrinking of the yield spread caused by the increase in the yen interest rate and the decrease in the US dollar interest rate, this process has only just begun, and the outflow of carry trade funds and the impact it brings are likely to persist.

Of course, we do not need to worry about whether US stocks will collapse as a result, because many economic indicators are much stronger than before, and there are also interest rate reduction tools as buffers.

In this situation, it is advantageous for Hong Kong stocks, which have already been oversold, and have even been undervalued for a long time compared to other markets. Although the trend of Hong Kong stocks may still need to reflect the Mainland's economic situation from a deeper level in the future, short-term resistance to falling market is also possible based on their own undervaluation + mid-year performance catalysis. (End of the full text)

For the already oversold domestic market and the long-underestimated Hong Kong stock market, such a situation is actually advantageous.

Although the Hong Kong stock market still needs to align itself with the domestic economic situation from a deeper level, there may be many uncertainties in the future direction of volatility, but based on its own undervaluation and mid-year catalysis, it is also possible to achieve a resistant decline in the short term. (End of text)