We Think Joby Aviation (NYSE:JOBY) Can Afford To Drive Business Growth

We Think Joby Aviation (NYSE:JOBY) Can Afford To Drive Business Growth

Even when a business is losing money, it's possible for shareholders to make money if they buy a good business at the right price. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. But while history lauds those rare successes, those that fail are often forgotten; who remembers Pets.com?

即使企業虧錢,如果股東以正確的價格購買一家優秀的企業,則有可能獲利。舉例來說,生物科技和採礦勘探公司通常會連續數年虧損,之後才通過新療法或礦物發現獲得成功。但儘管歷史記錄了這些少數成功的案例,失敗的案例往往被遺忘;誰還記得Pets.com?

So should Joby Aviation (NYSE:JOBY) shareholders be worried about its cash burn? For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). First, we'll determine its cash runway by comparing its cash burn with its cash reserves.

那麼,Joby Aviation(紐交所:JOBY)的股東們應該擔心現金燒燬嗎?在本文中,我們將現金燒燬定義爲公司爲了資助其增長而每年支出的現金金額(也稱爲負自由現金流)。首先,我們將通過比較其現金燒燬和現金儲備來確定其現金可用時間。

When Might Joby Aviation Run Out Of Money?

Joby Aviation何時才能用盡資金?

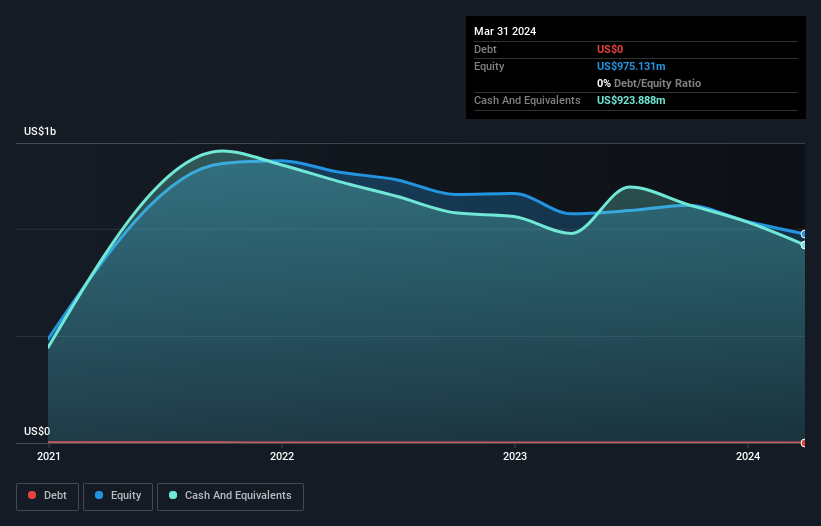

You can calculate a company's cash runway by dividing the amount of cash it has by the rate at which it is spending that cash. When Joby Aviation last reported its March 2024 balance sheet in May 2024, it had zero debt and cash worth US$924m. Importantly, its cash burn was US$371m over the trailing twelve months. That means it had a cash runway of about 2.5 years as of March 2024. That's decent, giving the company a couple years to develop its business. The image below shows how its cash balance has been changing over the last few years.

您可以通過將公司的現金金額除以其花費現金的速度來計算公司的現金儲備。當Joby Aviation在2024年5月報告其2024年3月資產負債表時,其沒有債務,其現金價值爲9,2400萬美元。重要的是,其過去12個月的現金燒燬總額爲3,7100萬美元。這意味着截至2024年3月,它的現金可用時間爲約2.5年。這還不錯,這給了公司幾年時間來發展業務。下面的圖片顯示了過去幾年其現金餘額的變化情況。

How Is Joby Aviation's Cash Burn Changing Over Time?

Joby Aviation的現金燒燬如何隨時間變化?

Whilst it's great to see that Joby Aviation has already begun generating revenue from operations, last year it only produced US$1.1m, so we don't think it is generating significant revenue, at this point. Therefore, for the purposes of this analysis we'll focus on how the cash burn is tracking. With the cash burn rate up 21% in the last year, it seems that the company is ratcheting up investment in the business over time. However, the company's true cash runway will therefore be shorter than suggested above, if spending continues to increase. Clearly, however, the crucial factor is whether the company will grow its business going forward. So you might want to take a peek at how much the company is expected to grow in the next few years.

雖然很高興看到Joby Aviation已經開始從業務產生收入,但去年僅產生了110萬美元的營業收入,因此我們認爲它在這一點上並未產生顯着的收入。因此,爲了分析,我們將重點放在現金燒燬的跟蹤上。去年的現金燒燬率增加了21%,這意味着公司隨着時間推移會不斷增加對業務的投資。但是,如果支出繼續增加,公司的真實現金可用時間將會比上面提到的時間更短。然而,顯然,關鍵因素在於公司是否將發展其業務。因此,您可能需要瞥一眼公司在未來幾年中的預計增長速度。

Can Joby Aviation Raise More Cash Easily?

Joby Aviation能夠輕鬆籌集更多現金嗎?

While Joby Aviation does have a solid cash runway, its cash burn trajectory may have some shareholders thinking ahead to when the company may need to raise more cash. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

雖然Joby Aviation確實擁有可靠的現金可用時間,但現金燒燬軌跡可能會使一些股東提前考慮公司何時可能需要籌集更多資金。一般來說,上市公司可以通過發行股票或負債來籌集新的現金。上市公司所擁有的主要優勢之一是,它們可以向投資者出售股票以籌集資金併爲業務發展提供資金。通過比較公司的現金燒燬與其市值,我們可以了解如果公司需要籌集足夠的資金來覆蓋另一年的現金燒燬,股東們將被稀釋多少。

Joby Aviation's cash burn of US$371m is about 10% of its US$3.6b market capitalisation. As a result, we'd venture that the company could raise more cash for growth without much trouble, albeit at the cost of some dilution.

Joby Aviation的現金燒燬約爲3,7100萬美元,約佔其36億美元的市值的10%。因此,我們可以嘗試斷言該公司可以輕鬆籌集更多資金以支持增長,儘管這可能會帶來某種稀釋。

So, Should We Worry About Joby Aviation's Cash Burn?

因此,我們應該擔心Joby Aviation的現金燒燬嗎?

As you can probably tell by now, we're not too worried about Joby Aviation's cash burn. In particular, we think its cash runway stands out as evidence that the company is well on top of its spending. Although its increasing cash burn does give us reason for pause, the other metrics we discussed in this article form a positive picture overall. Considering all the factors discussed in this article, we're not overly concerned about the company's cash burn, although we do think shareholders should keep an eye on how it develops. On another note, Joby Aviation has 5 warning signs (and 1 which makes us a bit uncomfortable) we think you should know about.

正如您現在可以看到的那樣,我們對Joby Aviation的現金燒燬並不太擔心。特別是,我們認爲其現金可用時間突出表明公司對其支出的控制不錯。儘管其現金燒燬的增加確實讓我們稍感擔憂,但本文中討論的其他指標總體呈現出積極的態勢。考慮到本文中討論的所有因素,我們對公司的現金燒燬並不過分擔心,儘管我們認爲股東們應該密切關注其未來的發展情況。另外值得一提的是,Joby Aviation還有5個警示標誌(以及1個我們覺得有點不舒服的標誌),我們認爲您應該了解一下。

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies with significant insider holdings, and this list of stocks growth stocks (according to analyst forecasts)

當然,您也可以通過在其他地方尋找找到出色的投資機會。因此,請查看具有重要內部股權的公司的免費列表,以及此分析師預測的股票成長列表。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對本文有任何反饋?對內容有任何疑慮?請直接與我們聯繫。或者,發送電子郵件至editorial-team@simplywallst.com。

這篇文章是Simply Wall St的一般性文章。我們根據歷史數據和分析師預測提供評論,只使用公正的方法論,我們的文章並不意味着提供任何金融建議。文章不構成買賣任何股票的建議,也不考慮您的目標或您的財務狀況。我們的目標是帶給您基本數據驅動的長期關注分析。請注意,我們的分析可能不考慮最新的價格敏感公司公告或定性材料。Simply Wall St沒有任何股票頭寸。

Whilst it's great to see that Joby Aviation has already begun generating revenue from operations, last year it only produced US$1.1m, so we don't think it is generating significant revenue, at this point. Therefore, for the purposes of this analysis we'll focus on how the cash burn is tracking. With the cash burn rate up 21% in the last year, it seems that the company is ratcheting up investment in the business over time. However, the company's true cash runway will therefore be shorter than suggested above, if spending continues to increase. Clearly, however, the crucial factor is whether the company will grow its business going forward. So you might want to take a peek at how much the company is expected to grow in the next few years.

Whilst it's great to see that Joby Aviation has already begun generating revenue from operations, last year it only produced US$1.1m, so we don't think it is generating significant revenue, at this point. Therefore, for the purposes of this analysis we'll focus on how the cash burn is tracking. With the cash burn rate up 21% in the last year, it seems that the company is ratcheting up investment in the business over time. However, the company's true cash runway will therefore be shorter than suggested above, if spending continues to increase. Clearly, however, the crucial factor is whether the company will grow its business going forward. So you might want to take a peek at how much the company is expected to grow in the next few years.