The Solo Brands, Inc. (NYSE:DTC) share price has fared very poorly over the last month, falling by a substantial 50%. For any long-term shareholders, the last month ends a year to forget by locking in a 81% share price decline.

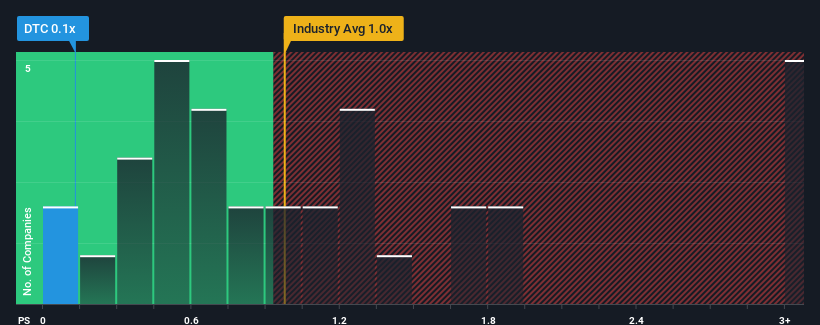

Since its price has dipped substantially, when close to half the companies operating in the United States' Leisure industry have price-to-sales ratios (or "P/S") above 1x, you may consider Solo Brands as an enticing stock to check out with its 0.1x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

How Solo Brands Has Been Performing

The recently shrinking revenue for Solo Brands has been in line with the industry. One possibility is that the P/S ratio is low because investors think the company's revenue may begin to slide even faster. If you still like the company, you'd want its revenue trajectory to turn around before making any decisions. In saying that, existing shareholders may feel hopeful about the share price if the company's revenue continues tracking the industry.

Keen to find out how analysts think Solo Brands' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as low as Solo Brands' is when the company's growth is on track to lag the industry.

The only time you'd be truly comfortable seeing a P/S as low as Solo Brands' is when the company's growth is on track to lag the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 6.1%. Still, the latest three year period has seen an excellent 168% overall rise in revenue, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to climb by 5.9% per annum during the coming three years according to the seven analysts following the company. That's shaping up to be materially higher than the 2.2% each year growth forecast for the broader industry.

With this information, we find it odd that Solo Brands is trading at a P/S lower than the industry. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What We Can Learn From Solo Brands' P/S?

Solo Brands' recently weak share price has pulled its P/S back below other Leisure companies. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

A look at Solo Brands' revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. There could be some major risk factors that are placing downward pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

You need to take note of risks, for example - Solo Brands has 3 warning signs (and 2 which are potentially serious) we think you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.