The earthquake's impact is limited.

There are two major news in the semiconductor industry.

On the one hand, a major earthquake occurred in Japan's semiconductor stronghold, causing concerns that the supply may be affected. However, according to current information, it seems that it has not been affected much.

On the other hand, the head of the industry's second-quarter performance was impressive, showing that the industry is on the road to recovery.

The earthquake's impact is limited.

Yesterday afternoon, a 7.1 magnitude earthquake occurred in the sea area near Kyushu Island, Japan.

Japan is one of the important supplying countries of global semiconductor products, and Kyushu, where the earthquake occurred, is a major semiconductor industry center in Japan, also known as Japan's Silicon Island.

More than half of Japan's semiconductor factories are located in Kyushu, and every time there is an earthquake in Kyushu, the production capacity of semiconductors is affected.

At present, it seems that the impact of this earthquake is not significant.

Taiwan Semiconductor has issued a statement saying that Kumamoto plant is safe and that it is not expected to affect operations as the seismic intensity did not reach the evacuation standard.

Rohm Semiconductor has suspended operations at its Miyazaki plant for inspection, and there has been no major damage so far.

A representative of the company said, 'Once confirmed safe, we will immediately resume operations.'

At the same time, this earthquake did not cause a tsunami, and the Japan Meteorological Agency has lifted all tsunami warnings.

Industry recovery

Yesterday, China's domestic wafer foundry leader SMIC and Hua Hong Semiconductor released their second-quarter results.

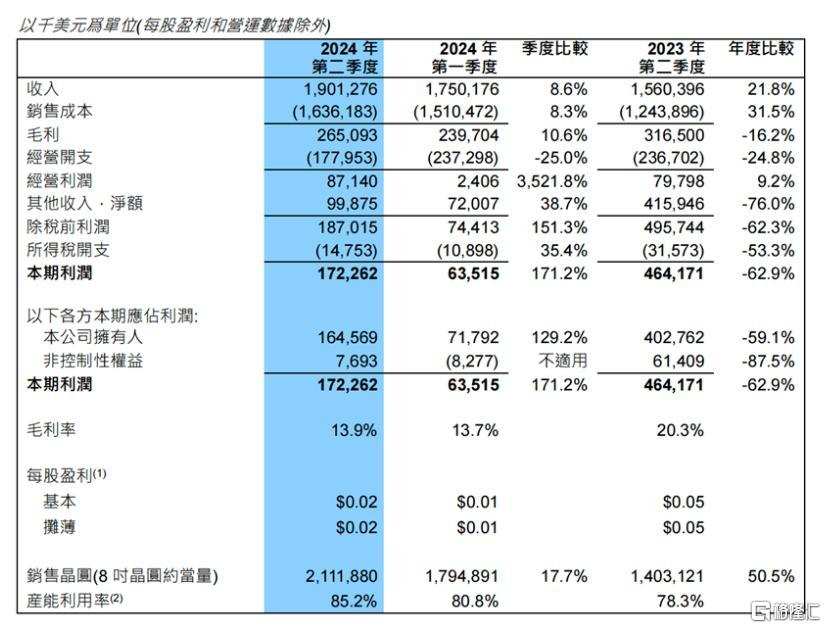

In Q2, SMIC's sales revenue reached $1.901 billion, a year-on-year increase of 21.8% and a quarter-on-quarter increase of 8.6%.

The data not only greatly exceeded market expectations but also exceeded the company's own guidance of a quarter-on-quarter increase of 5% to 7% at the upper limit.

The net income for the same period was $0.165 billion, far exceeding analysts' expectations of $0.104 billion, a quarter-on-quarter increase of 129.2%.

The gross margin was as high as 13.9%, which also exceeded the previous guidance of 9%-11%. In the previous quarter, it was 13.7%, and last year's same period was 20.3%.

Looking ahead to Q3, SMIC expects revenue to increase by 13% to 15% on a quarterly basis, to between $2.148 billion and $2.186 billion, with a gross margin of 18%-20%.

At the same time, the other wafer foundry leader Hua Hong Semiconductor's performance showed signs of improvement on a quarter-on-quarter basis.

In Q2, Hua Hong Semiconductor's revenue was $0.4785 billion, down 24.22% year-on-year, and a quarter-on-quarter increase of 4.02%, in line with guidance.

The attributable net profit of the parent company was $6.7 million, a year-on-year decrease of 91.46% and a quarter-on-quarter decrease of 78.93%.

The gross margin was 10.5%, down from 27.7% in the same period last year and 6.4% in the first quarter, but better than guidance.

For the third quarter, Hua Hong Semiconductor expects its sales revenue to be around $0.5 billion to $0.52 billion, with a gross margin of around 10% to 12%.

Tang Junjun, President and Executive Director of Hua Hong Semiconductor, stated that the semiconductor market is experiencing a slow recovery from the bottom.

However, after the performance report was released, Morgan Stanley lowered Hua Hong Semiconductor's target price from HKD 28 to HKD 26.

Morgan Stanley believes that the company's previously announced second quarter net income was below analysts' average expectations, and lowered the target price to reflect a downward revision of earnings per share forecast for 2024-2026.