Due to the strong Japanese yen, a Morgan Stanley strategist has joined UBS team to lower the year-end target for major Japanese stock indices.

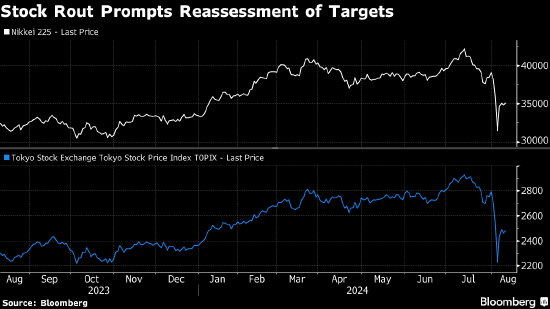

Morgan Stanley's Japanese securities strategist, Rie Nishihara, and others predict that the TOPIX index will rise to 2,700-2,800 points, down from the previous forecast of 2,950 points. They expect the Nikkei 225 index, which is dominated by technology stocks, to reach around 39,000-40,000 points by the end of the year, lower than the previous forecast of 42,000 points. Both indices rose above the previous expected levels and reached their peak in early July before falling sharply into bear market.

In a Friday report, Morgan Stanley mentioned concerns about the strength of the Japanese yen and the impact of rising risks of a US economic recession, echoing the currency risk raised by UBS strategists Nozomi Moriya and others.

"As market volatility may remain at relatively high levels for the time being, we will continue to evaluate what we believe is an appropriate level for the Japanese market while assessing the risks of a US economic recession and US market sentiment," wrote Nishihara.

Morgan Stanley has lowered its EPS growth expectations for Japanese stocks from around 8% to around 4%. Morgan Stanley and UBS both recommend sectors related to domestic demand.