Macro Matters

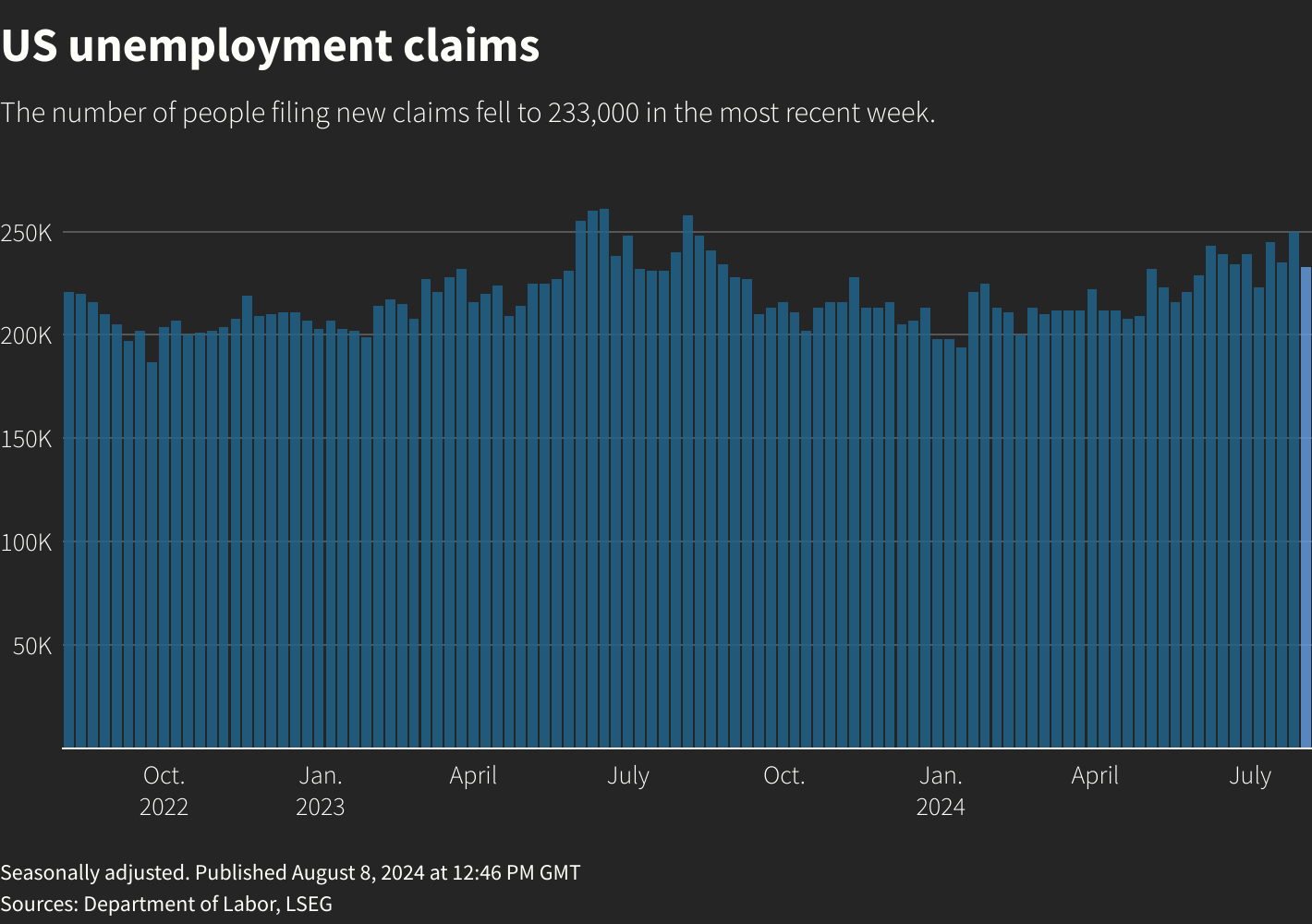

US weekly jobless claims drop calms market fears

Initial claims for state unemployment benefits fell 17,000 to a seasonally adjusted 233,000 for the week ended Aug. 3, the Labor Department said on Thursday, the largest drop in about 11 months. Economists polled by Reuters had forecast 240,000 claims for the latest week.

U.S. stocks gained following the release, while benchmark Treasury yields rose back above 4%. The U.S. dollar (.DXY), opens new tab also strengthened against a basket of currencies.

"The talk of an imminent recession seems wide of the mark," said Marc Chandler, chief market strategist at Bannockburn Global Forex.

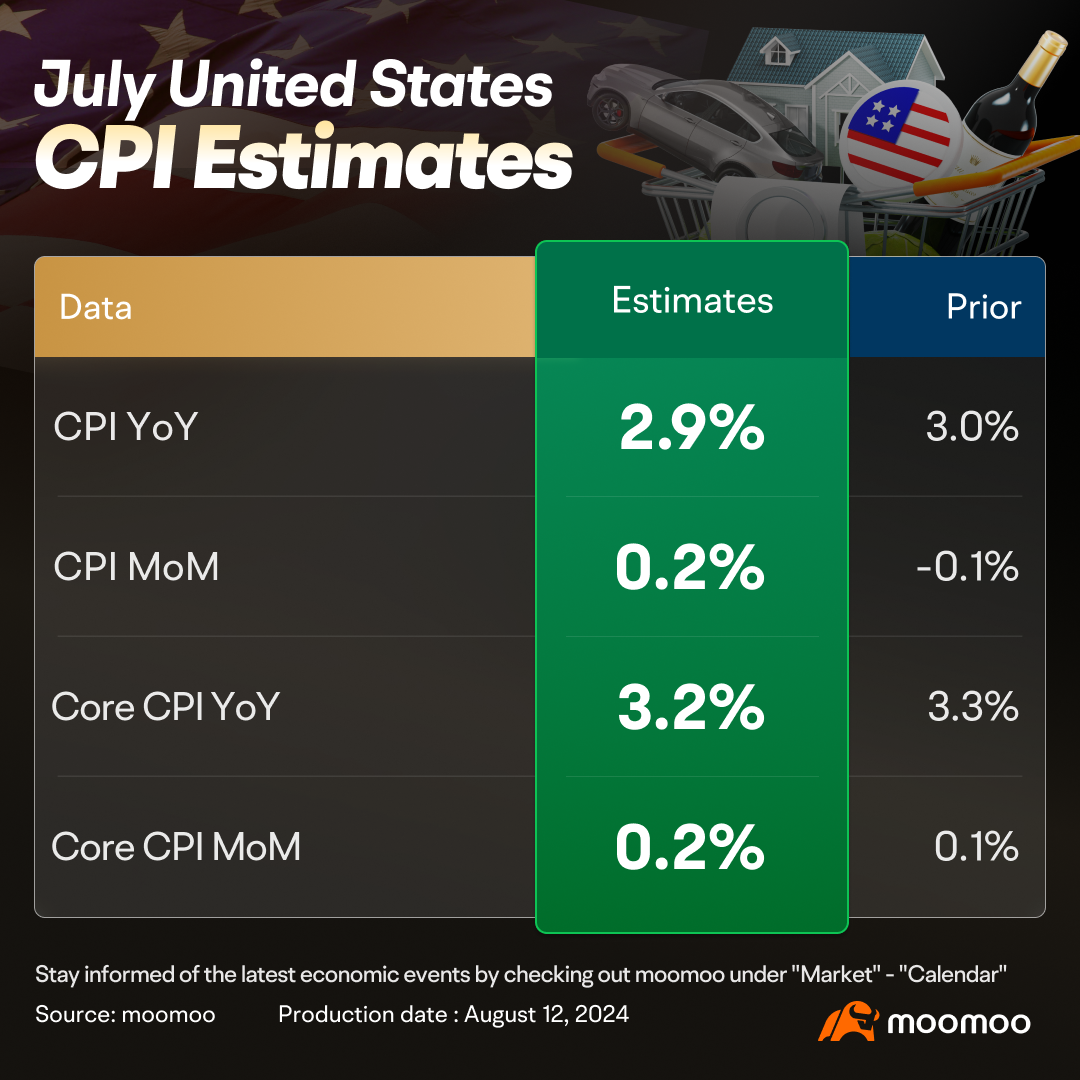

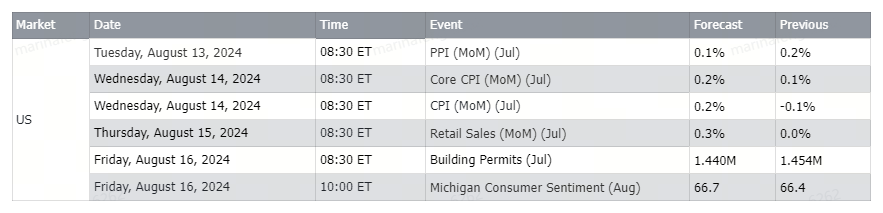

What To Expect From The Next CPI Inflation Report

The July CPI report is likely to further the case that inflation is quieting down even if it has not yet returned all the way back to the Fed's target. Economists look for headline CPI to have advanced 0.2% in July, which would make the year-over-year rate at more than a three-year low of 2.9%. The core CPI also looks set to advance 0.2% in July. The step-down in shelter inflation from the first six months of the year might be sustained. If realized, the 12-month change in the core CPI would fall to a fresh cycle low of 3.2%.

Labor costs are no longer a meaningful threat to the Fed's 2% inflation target, as growth in the labor force has coincided with fading demand for workers.

Smart Money Flow

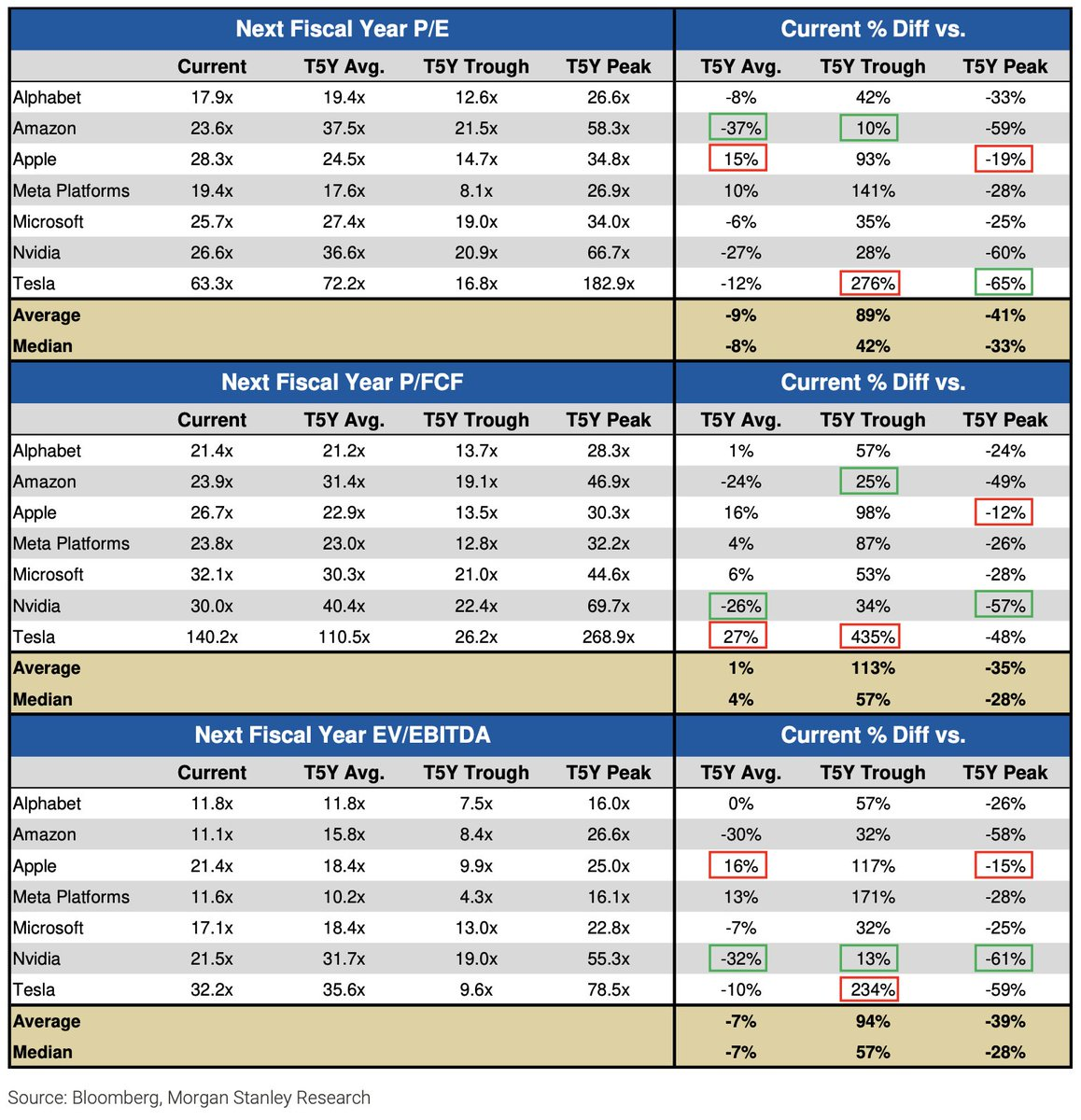

The median Mag 7 stock is trading about 8% below T5Y average P/E, about 40% above the T5Y trough, and about 30% below peak multiples.

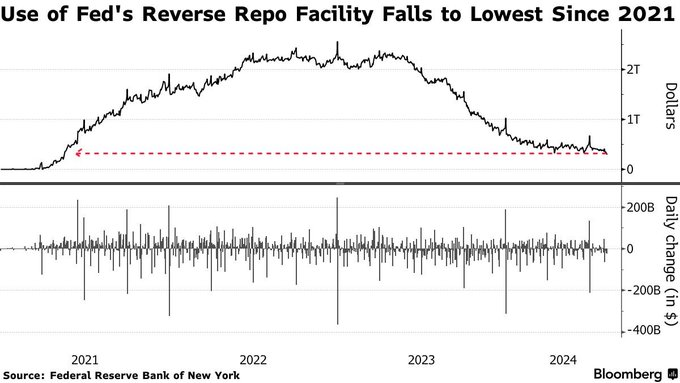

Some on Wall Street warn the draining facility is evidence that excess liquidity has been removed from the financial system and bank reserve balances are less abundant than policymakers believe.

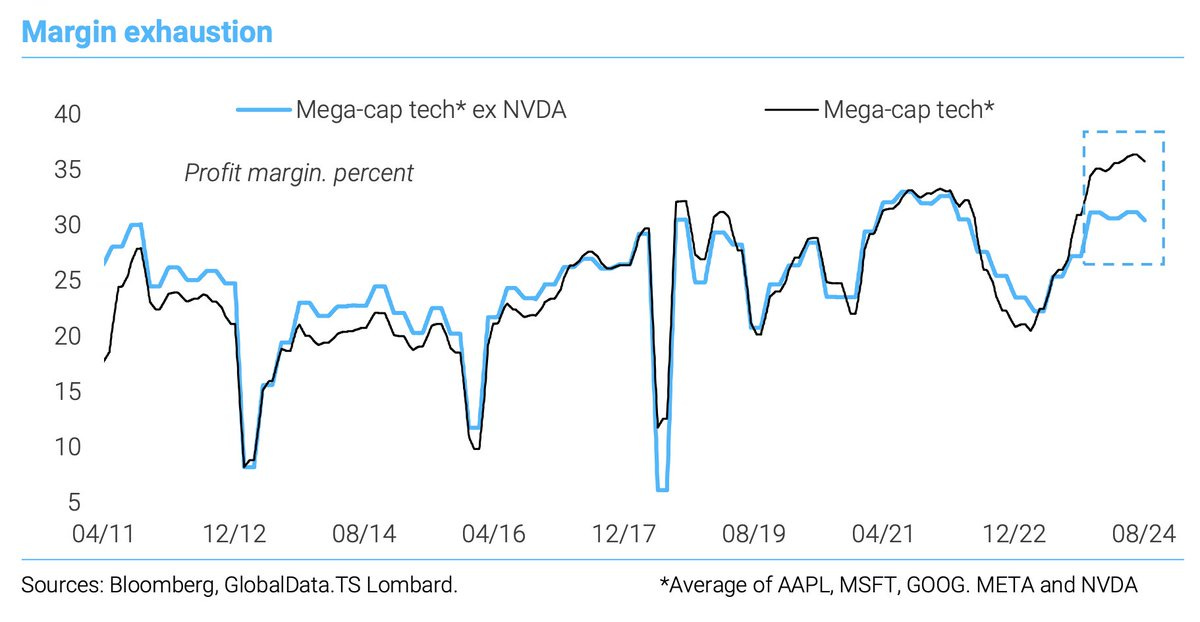

Signs of exhaustion in margin expansion are prompting investors to seek more clarity about the earnings impact from heavy capex on AI.

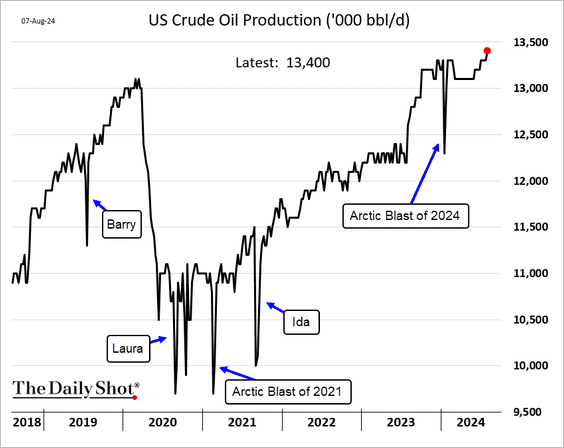

US crude oil production hit a record high.

Top Corporate News

Berkshire Hathaway Q2 Operating Profit Climbs Over 15%, Cash Hoard Swells To $277B As It Slashes Apple Stake by Nearly 50%

Warren Buffett-led Berkshire Hathaway, Inc. (NYSE:BRK) reported second-quarter net earnings on Saturday that fell year-over-year as a decline in investment gains more than offset an increase in operating earnings. The company's offloading of its stake in tech giant Apple, Inc. (NASDAQ:APPL) continued. Second-quarter net earnings fell 15.50% year-over-year from $35.91 billion to $30.35 billion. Operating earnings, which refer to income generated by its portfolio companies, climbed 15.48% to $11.60 billion. On the other hand, gains from its investment portfolio fell 27.52% to $18.75 billion. Berkshire's cash and cash-equivalents ballooned to $276.94 billion at the end of the second quarter, up from roughly $189 billion at the end of the first quarter.

Nvidia's New Blackwell GPU May Be Delayed

Tech news site The Information, citing a couple of industry sources, said volume shipments of the Blackwell B200 chip would be delayed some three months. Blackwell volumes were expected to begin in October 2024. Nvidia reports on a January fiscal year, so a delay would push revenue contributions from the B200 into the April 2025 quarter.

Lilly Reports Q2 2024 Financial Results, Raises Full-Year Revenue Guidance by $3 Billion

In Q2 2024, worldwide revenue was $11.30 billion, an increase of 36% compared with Q2 2023, driven by Mounjaro, Zepbound and Verzenio. Q2 2024 EPS increased 68% to $3.28 on a reported basis. 2024 full-year revenue guidance raised by $3 billion; reported EPS guidance raised $2.05 to the range of $15.10 to $15.60, and non-GAAP EPS guidance raised $2.60 to the range of $16.10 to $16.60.

Super Micro Computer Q4 Earnings: Revenue In Line, Strong Guidance, 10-For-1 Stock Split

Super Micro reported FY24Q4 revenue of $5.31 billion, in line with estimates. The company reported quarterly earnings of $6.25 per share, below analyst estimates of $8.10 per share. Super Micro said fiscal 2024 revenue was up 110% year-over-year, driven by record demand for new AI infrastructures. Gross margin was 11.2% in the fourth quarter. Super Micro's board also authorized a 10-for-1 forward split of its common stock. The company expects shares to begin trading on a split-adjusted basis on Oct. 1st. Super Micro expects first-quarter revenue to be in the range of $6 billion to $7 billion versus estimates of $5.3 billion. The company anticipates first-quarter adjusted earnings of $6.69 to $8.27 per share.

Upcoming Economic Data

Disclaimer: This presentation is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors’ financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information having regard to your relevant personal circumstances before making any investment decisions. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal.

Moomoo is a financial information and trading app offered by Moomoo Technologies Inc. In the U.S., investment products and services on Moomoo are offered by Moomoo Financial Inc., Member FINRA/SIPC.