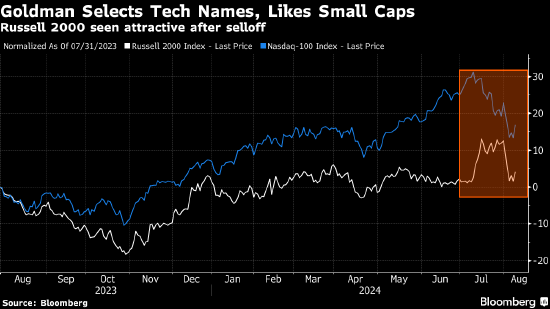

Luke Barrs, the global head of fundamental equity portfolio management at Goldman Sachs Asset Management, said that the collapse of the US stock market has eliminated the "massive bubbles" in the market, making some technology and small cap stocks attractive again. "What we are focusing on now is whether we can buy some selected technology and small cap stocks. We believe that normalizing interest rates should be helpful for this still undervalued asset class," Barrs said.

"We are now focusing on: can we buy some selected technology and small cap stocks? We believe that normalizing interest rates should be helpful for this still undervalued asset class," said Barrs.

Due to concerns about future economic recession, US stocks fell in the past month, with the S&P 500 index falling 4.6%. After the data showed a decrease in initial jobless claims, the index rebounded somewhat this week. Michael Hartnett, a strategist for Bank of America, said that market turbulence has not yet reached the level of suggesting concerns about a hard landing for the economy. Barrs said they are still cutting positions of large cloud computing service providers as their stock valuations are expensive and industry competition is intensifying.

He added that the company currently expects the Fed to cut interest rates three times before the end of the year.

He added that the company currently expects the Fed to cut interest rates three times before the end of the year.

Buy

Barrs表示,他们仍在削减大型云服务提供商的头寸,因为它们的股票估值昂贵且行业竞争加剧。

Barrs表示,他们仍在削减大型云服务提供商的头寸,因为它们的股票估值昂贵且行业竞争加剧。