Financial giants have made a conspicuous bullish move on Wolfspeed. Our analysis of options history for Wolfspeed (NYSE:WOLF) revealed 9 unusual trades.

Delving into the details, we found 55% of traders were bullish, while 33% showed bearish tendencies. Out of all the trades we spotted, 4 were puts, with a value of $148,155, and 5 were calls, valued at $306,986.

Expected Price Movements

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $10.0 to $65.0 for Wolfspeed over the recent three months.

Analyzing Volume & Open Interest

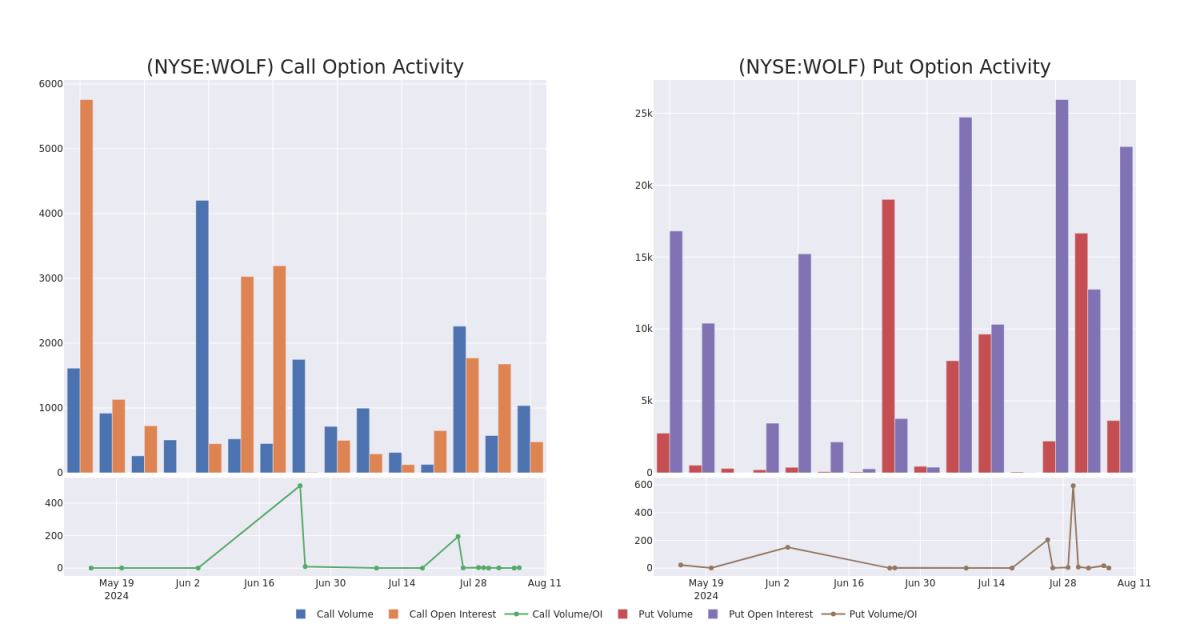

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Wolfspeed's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Wolfspeed's whale trades within a strike price range from $10.0 to $65.0 in the last 30 days.

Wolfspeed 30-Day Option Volume & Interest Snapshot

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| WOLF | CALL | SWEEP | BULLISH | 01/17/25 | $3.5 | $3.3 | $3.5 | $15.00 | $79.1K | 173 | 230 |

| WOLF | CALL | TRADE | BULLISH | 11/15/24 | $5.2 | $4.8 | $5.1 | $10.00 | $75.9K | 0 | 150 |

| WOLF | CALL | SWEEP | BULLISH | 01/17/25 | $2.5 | $2.4 | $2.5 | $19.00 | $63.9K | 2.1K | 258 |

| WOLF | CALL | SWEEP | BULLISH | 01/17/25 | $2.25 | $2.1 | $2.25 | $20.00 | $58.0K | 522 | 277 |

| WOLF | PUT | TRADE | BEARISH | 01/17/25 | $8.7 | $8.5 | $8.7 | $20.00 | $40.8K | 17.0K | 47 |

About Wolfspeed

Wolfspeed Inc is involved in the manufacturing of wide bandgap semiconductors. It is focused on silicon carbide and gallium nitride materials and devices for power and radio-frequency (RF) applications. The company serves applications such as transportation, power supplies, inverters, and wireless systems. Geographically, it derives a majority of revenue from Europe and also has a presence in the United States; China; Japan; South Korea, and other countries.

Having examined the options trading patterns of Wolfspeed, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Where Is Wolfspeed Standing Right Now?

- With a trading volume of 2,964,485, the price of WOLF is down by -8.6%, reaching $12.91.

- Current RSI values indicate that the stock is may be oversold.

- Next earnings report is scheduled for 12 days from now.

What The Experts Say On Wolfspeed

In the last month, 1 experts released ratings on this stock with an average target price of $18.0.

- In a cautious move, an analyst from New Street Research downgraded its rating to Neutral, setting a price target of $18.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Wolfspeed with Benzinga Pro for real-time alerts.