The 5i5j Holding Group Co., Ltd. (SZSE:000560) share price has done very well over the last month, posting an excellent gain of 29%. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 5.8% over the last year.

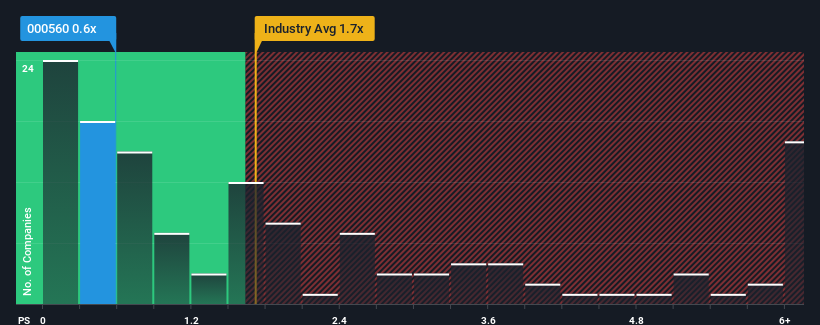

Although its price has surged higher, 5i5j Holding Group may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.6x, considering almost half of all companies in the Real Estate industry in China have P/S ratios greater than 1.7x and even P/S higher than 4x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

How 5i5j Holding Group Has Been Performing

Recent times haven't been great for 5i5j Holding Group as its revenue has been rising slower than most other companies. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on 5i5j Holding Group will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For 5i5j Holding Group?

In order to justify its P/S ratio, 5i5j Holding Group would need to produce sluggish growth that's trailing the industry.

In order to justify its P/S ratio, 5i5j Holding Group would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a decent 3.1% gain to the company's revenues. Although, the latest three year period in total hasn't been as good as it didn't manage to provide any growth at all. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 24% during the coming year according to the lone analyst following the company. With the industry only predicted to deliver 9.3%, the company is positioned for a stronger revenue result.

In light of this, it's peculiar that 5i5j Holding Group's P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What We Can Learn From 5i5j Holding Group's P/S?

The latest share price surge wasn't enough to lift 5i5j Holding Group's P/S close to the industry median. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

To us, it seems 5i5j Holding Group currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. There could be some major risk factors that are placing downward pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with 5i5j Holding Group (at least 1 which shouldn't be ignored), and understanding these should be part of your investment process.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.