Sunwoda Electronic Co.,Ltd (SZSE:300207) shareholders should be happy to see the share price up 12% in the last month. But that is small recompense for the exasperating returns over three years. Indeed, the share price is down a tragic 62% in the last three years. So it is really good to see an improvement. After all, could be that the fall was overdone.

With the stock having lost 3.5% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Although the share price is down over three years, Sunwoda ElectronicLtd actually managed to grow EPS by 8.9% per year in that time. This is quite a puzzle, and suggests there might be something temporarily buoying the share price. Or else the company was over-hyped in the past, and so its growth has disappointed.

Although the share price is down over three years, Sunwoda ElectronicLtd actually managed to grow EPS by 8.9% per year in that time. This is quite a puzzle, and suggests there might be something temporarily buoying the share price. Or else the company was over-hyped in the past, and so its growth has disappointed.

It's worth taking a look at other metrics, because the EPS growth doesn't seem to match with the falling share price.

The modest 0.8% dividend yield is unlikely to be guiding the market view of the stock. Revenue is actually up 15% over the three years, so the share price drop doesn't seem to hinge on revenue, either. It's probably worth investigating Sunwoda ElectronicLtd further; while we may be missing something on this analysis, there might also be an opportunity.

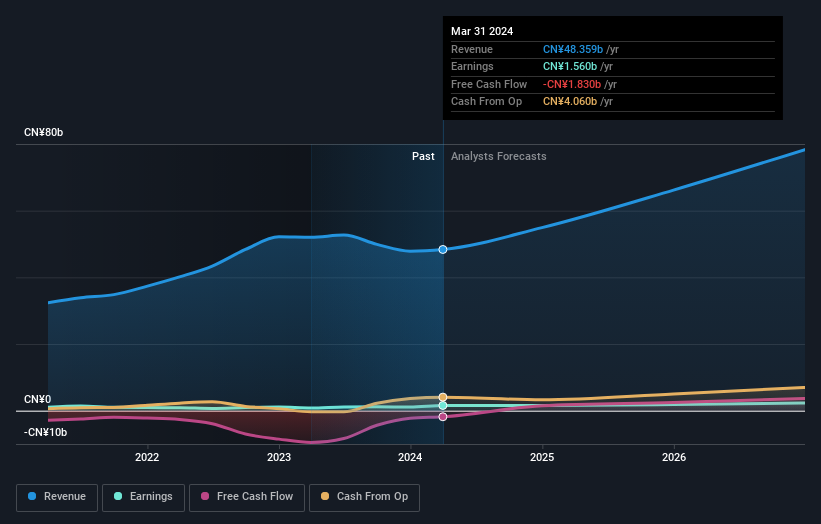

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We know that Sunwoda ElectronicLtd has improved its bottom line lately, but what does the future have in store? You can see what analysts are predicting for Sunwoda ElectronicLtd in this interactive graph of future profit estimates.

A Different Perspective

We're pleased to report that Sunwoda ElectronicLtd shareholders have received a total shareholder return of 2.3% over one year. And that does include the dividend. Having said that, the five-year TSR of 4% a year, is even better. The pessimistic view would be that be that the stock has its best days behind it, but on the other hand the price might simply be moderating while the business itself continues to execute. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 2 warning signs for Sunwoda ElectronicLtd that you should be aware of.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.