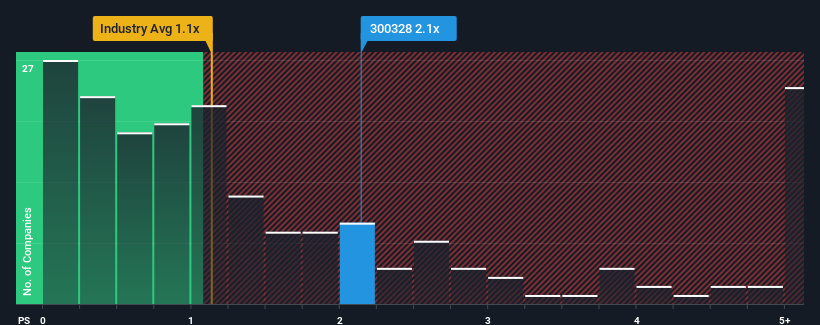

Dongguan Eontec Co., Ltd.'s (SZSE:300328) price-to-sales (or "P/S") ratio of 2.1x may not look like an appealing investment opportunity when you consider close to half the companies in the Metals and Mining industry in China have P/S ratios below 1.1x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

What Does Dongguan Eontec's P/S Mean For Shareholders?

It looks like revenue growth has deserted Dongguan Eontec recently, which is not something to boast about. Perhaps the market believes that revenue growth will improve markedly over current levels, inflating the P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

Although there are no analyst estimates available for Dongguan Eontec, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Dongguan Eontec?

The only time you'd be truly comfortable seeing a P/S as high as Dongguan Eontec's is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. However, a few strong years before that means that it was still able to grow revenue by an impressive 80% in total over the last three years. Accordingly, shareholders will be pleased, but also have some questions to ponder about the last 12 months.

This is in contrast to the rest of the industry, which is expected to grow by 13% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we can see why Dongguan Eontec is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Bottom Line On Dongguan Eontec's P/S

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

It's no surprise that Dongguan Eontec can support its high P/S given the strong revenue growth its experienced over the last three-year is superior to the current industry outlook. Right now shareholders are comfortable with the P/S as they are quite confident revenue aren't under threat. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

You should always think about risks. Case in point, we've spotted 3 warning signs for Dongguan Eontec you should be aware of, and 1 of them can't be ignored.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.