Peak season is approaching.

With the opening of the peak season in the second half of the year, the supply and demand situation of the photovoltaic industry under supply contraction may be better than that in the first half of the year. Recently, the photovoltaic sector has started to rebound significantly. The monthly increase in stocks such as Sungrow Power Supply, DeYe Shares, and Hangzhou First Applied Material has exceeded 20%. Product structure, 10-30 billion yuan products operating income of 401/1288/60 million yuan respectively.

Although the competition pattern of the main links is still fierce, some auxiliary material links are still very stable under the control of industry oligarchs. With the expectation of early stocking of the peak season, the product prices of these links have the opportunity to recover and balance.

Although the competition pattern of the main links is still fierce, some auxiliary material links are still very stable under the control of industry oligarchs. With the expectation of early stocking of the peak season, the product prices of these links have the opportunity to recover and balance.

01

Photovoltaic transformation

As mentioned before, when will the photovoltaic sector bottom out? This is related to the regulation of industry overcapacity adjustment, the repair of corporate balance sheets, and there will certainly be some backward companies weeded out, and even leading companies may not be able to support it.

At the previously held high-level meetings, it was repeatedly emphasized to "strengthen industry self-discipline and prevent 'internal competition'".

Fortunately, in the short term, cash flow is all the enterprise can rely on to support it. It can no longer support significant expansion in production capacity.

According to an incomplete statistics from Century New Energy Network, compared with the same period in 2023, there has been a significant decrease in the number of expansion projects and the investment scale of projects. In the first half of this year, the signing, expansion, and commencement projects of the photovoltaic industry were about 102, with a total investment of only half of the same period last year.

Last year, there were 46 investment projects of more than 10 billion yuan, and this year there are only about 18. N-type replacing P-type has been clear trend since last year. Advanced capacity is given priority, indicating that the capacity cut is mostly P-type.

By the end of this year, the P-type market share may be below 10%, and it will become a niche product.

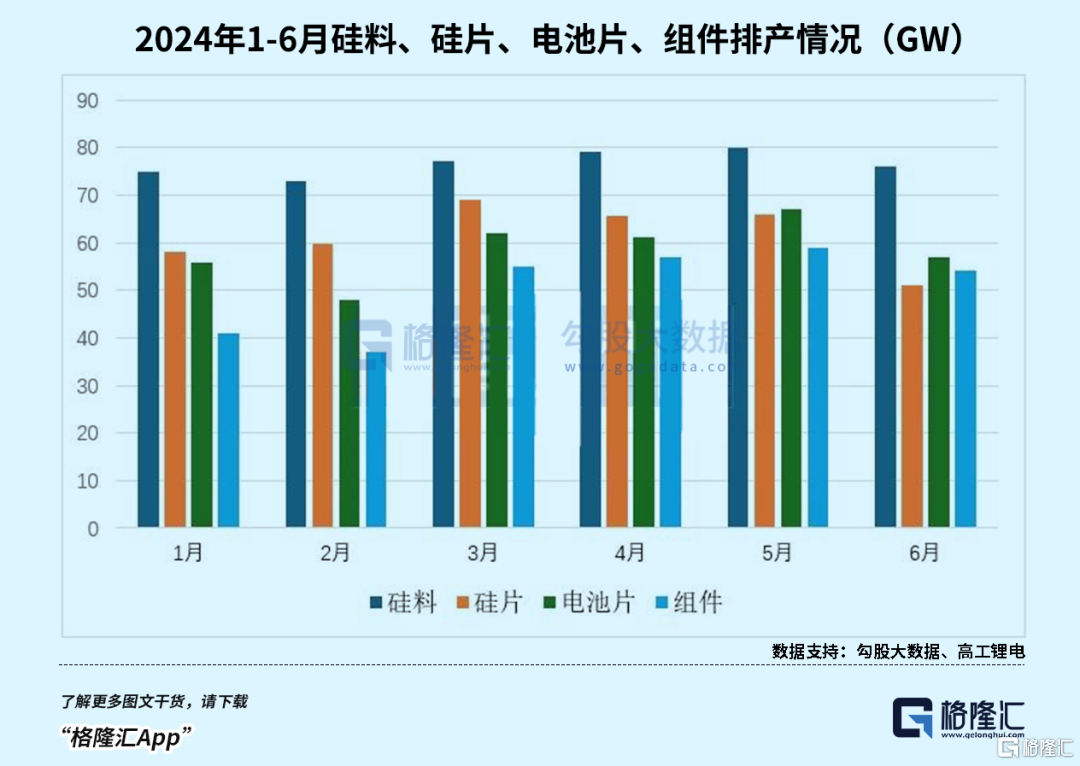

Many companies are holding onto the lifesaving straw of P-to-N, but unfortunately, the price has spread too quickly. After the four links of the main chain fell sharply last year, they continued to decline this year. According to GGII, the average decline in the first half of the year was 40%, 41%, 24%, and 16% respectively for silicon material/silicon wafer/solar cell/module, respectively. To reduce inventory, most companies have significantly lowered their production plans.

Now, except for the start-up rate of Zhonghuan, which is less than 60%, and even more seriously, Lingda, Zhongli and nearly 10 photovoltaic listed companies have been ST or even delisted, and several photovoltaic companies' IPOs have been delayed or withdrawn.

The brutal industry consolidation is only truly experienced by the insiders.

Taking components as an example, the top five global component shipments in the first half of the year were: Jinko, JA Solar, Trina, Longi, and Tongwei. Jinko successfully defended its position based on TOPCon, while "No.1" Longi slipped to fourth place.

Another major issue that all component players cannot ignore is the increased risk of overseas shipments.

Although the demand growth rate in the domestic market in the first half of the year was stable (102.48 GW, +30.7%), due to changes in tariffs, geopolitics, and inventory accumulation, the proportion of overseas shipments of the top 10 has fallen from 65% in the first half of 2022 to 44% this year, continuing a downward trend for three consecutive years.

The ranking of the battery link is even more intense. Zhongrun Energy this time climbed to the first place, up from the third place last year. Jinko, one of the earliest companies to benefit from TOPCon, has already launched its products in overseas markets, pushing it up to second place this time. Tongwei Co., LTD, which has been the world's largest out-of-the-box shipment for seven consecutive years, has fallen to the third in the industry.

Overall, the Top 5 battery shipments have declined, ending the trend of rapid growth in the past few years. Moreover, the price of battery has been falling in the first half of the year, indicating fierce competition among them!

However, there are also some bullish signals. With the deepening of trade barriers in Europe and the United States, and the initiation of double-reverse investigations in Southeast Asia, Jinko, Zhonghuan, Sungrow Power Supply and other companies have successively announced that they will go to the Middle East to invest in establishing factories. Especially Saudi Arabia has a very high demand for clean energy, and only Chinese photovoltaic companies have the strength to eat this fat.

In addition, following the arrival of the third quarter peak season, the prices of the industrial chain have not only stabilized but also shown a slight upward trend.

According to the quotation of the Shanghai Nonferrous Metals Network on August 5th:

The average price of polycrystalline silicon dense material is 36.5 yuan/kg, up 2.82%; the average price of polycrystalline silicon recycled material is 38.5 yuan/kg, up 2.67%; the average price of N-type polycrystalline silicon material is 40.5 yuan/kg, up 3.85%; the price of granular silicon is 33 yuan/kg, up 3.13%; the average price of N-type granular silicon is 36.5 yuan/kg, up 2.82%.

The overall transaction price of silicon wafers has also risen from the lowest 1.1 yuan/piece in June to 1.2 yuan/piece, showing signs of recovery. The main reason is still the contraction of the supply side, with production decreasing for several months in a row compared to the previous month, leading to a rapid destocking pace, which has led to a short-term uptrend.

Especially in the silicon material link, the inventory has dropped to just over 0.2 million tons at the beginning of August, down 0.1 million tons from May, dropping to less than two months of production capacity. However, the following third quarter is a traditional peak season for installation. If production only increases slightly and prices continue to rebound, the sector's leading companies will have some positive news on the improvement of both volume and price.

The same logic applies to auxiliary materials. With the surge in downstream installation demand and the arrival of the module sales season, glass inventories for module manufacturers are expected to increase. The photovoltaic glass supply and demand will be in a phase of temporary balance, leading to price increases.

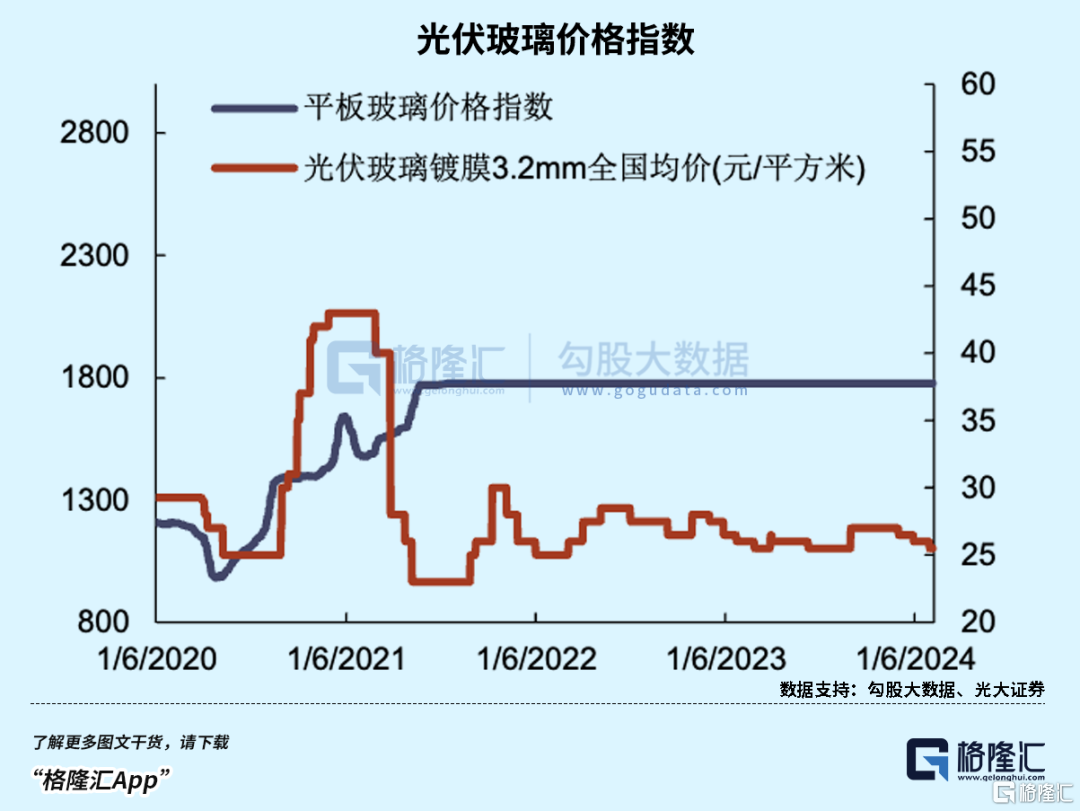

After the Spring Festival, Flat Glass Group experienced a small rebound, which can be seen from the price of photovoltaic glass.

From March to April, the average spot price of photovoltaic glass increased slightly compared to the lowest point in March. Because the production intention of glass companies in the off-season period recovered slowly, the production capacity needed time to climb, and according to PVinfolink, the main industry chain in March was much higher than expected during the Spring Festival off-season, driving up the demand for photovoltaic glass inventory.

02

The reform of the supply side of photovoltaic glass has begun.

Photovoltaic glass is located in the middle of the photovoltaic industry chain. It is the main consumable material for module encapsulation, which plays a role in protecting cells from water vapor corrosion, blocking oxygen to prevent oxidation, and has good insulation and aging resistance. Its strength and light transmittance directly determine the service life and power generation efficiency of photovoltaic modules and is an essential material for the production of crystalline silicon photovoltaic modules.

Previously, the solar panel used a single panel to absorb sunlight for power generation. The thickness of a single glass panel was 3.2mm. With the development of crystalline silicon solar technology, the back side can also generate a "photovoltaic effect" to produce current. The crystalline silicon solar cell module encapsulated with front and back glass panels is usually called a "double-glass module", and the thickness of the cover plate and back plate of the double-glass module is reduced to 2mm.

Currently, with the trend of component lightweighting and efficiency requirements, component glass will develop towards double glass and thinning.

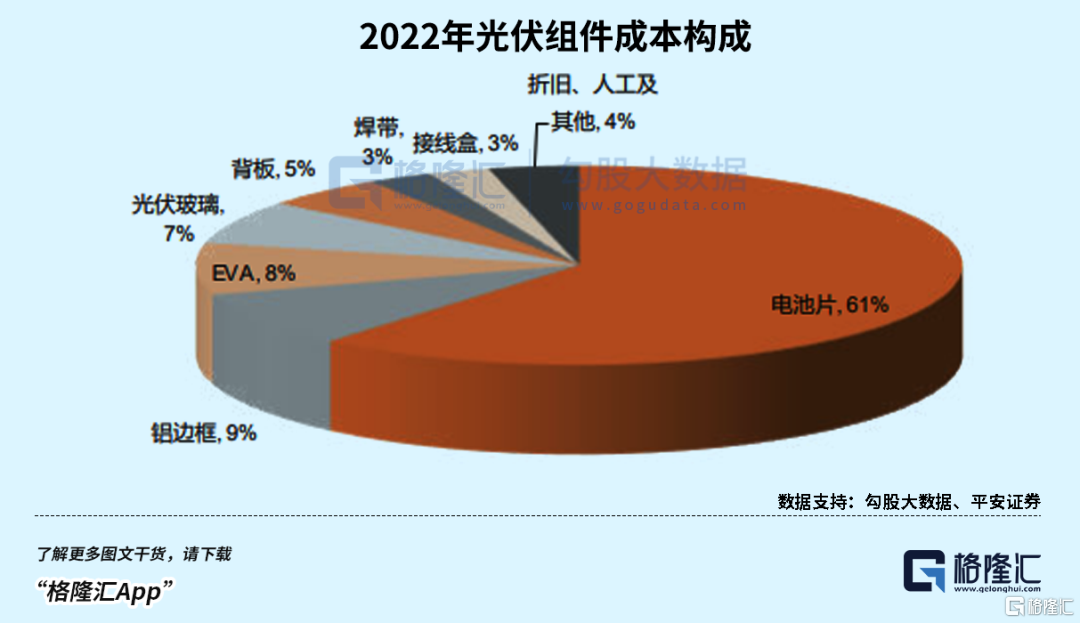

According to OFweek Industry Research Institute, in 2022 photovoltaic glass accounts for about 7% of the cost of photovoltaic components and is second only to aluminum frames and EVA photovoltaic films in auxiliary materials. Considering the continuous increase in the penetration rate of double glass modules in recent years and the downward trend of silicon material costs, the current share of photovoltaic glass in components is expected to be even higher.

As with general glass production, the photovoltaic glass is also a typical heavy asset industry, with an investment of about 1 billion yuan for a daily melting furnace with a daily production capacity of 1200 tons. The construction period is about 1.5 years, and it takes 6 months after completion to achieve production. However, the production cost is higher than that of ordinary glass, mainly because an AR coating process is added to increase light transmittance.

Production has continuous and uninterruptible characteristics. Once stopped casually, the cost of restarting is high. The production line generally needs to go through 8-10 years of cooling and maintenance, playing a certain role in production capacity regulation. Therefore, the newly ignited production capacity is the most stable core supply in the industry.

The price of photovoltaic glass is jointly determined by downstream module installation demand, production pace and inventory level. It has seasonal tendencies. When downstream installation demand surges and the module sales season is approaching, module manufacturers' glass inventory expectations strengthen, leading to destocking price increases. When demand enters the off-season and glass production capacity cannot be shut down, it will lead to a rise in inventory and a drop in prices.

Unlike other links, the supply of photovoltaic glass industry is greatly affected by policy cycles, leading to a more obvious trend of slow growth in production capacity compared to other links.

In 2018, the Ministry of Industry and Information Technology issued the "Notice on Printing and Distributing the Implementation Measures for Capacity Replacement in the Steel, Cement, Glass and Other Industries", which included photovoltaic rolled glass in the capacity replacement policy. However, the revision in 2021 cancelled the requirement for replacement and required a hearing by the relevant provincial regulatory authorities and the establishment of a capacity risk warning mechanism. In fact, it has relaxed the conditions for expansion and opened a three-year period of expansion of production capacity, further causing an imbalance between supply and demand.

At the end of 2020 and the beginning of 2021, due to the sharp expansion of market demand, the price of photovoltaic glass had a small peak.

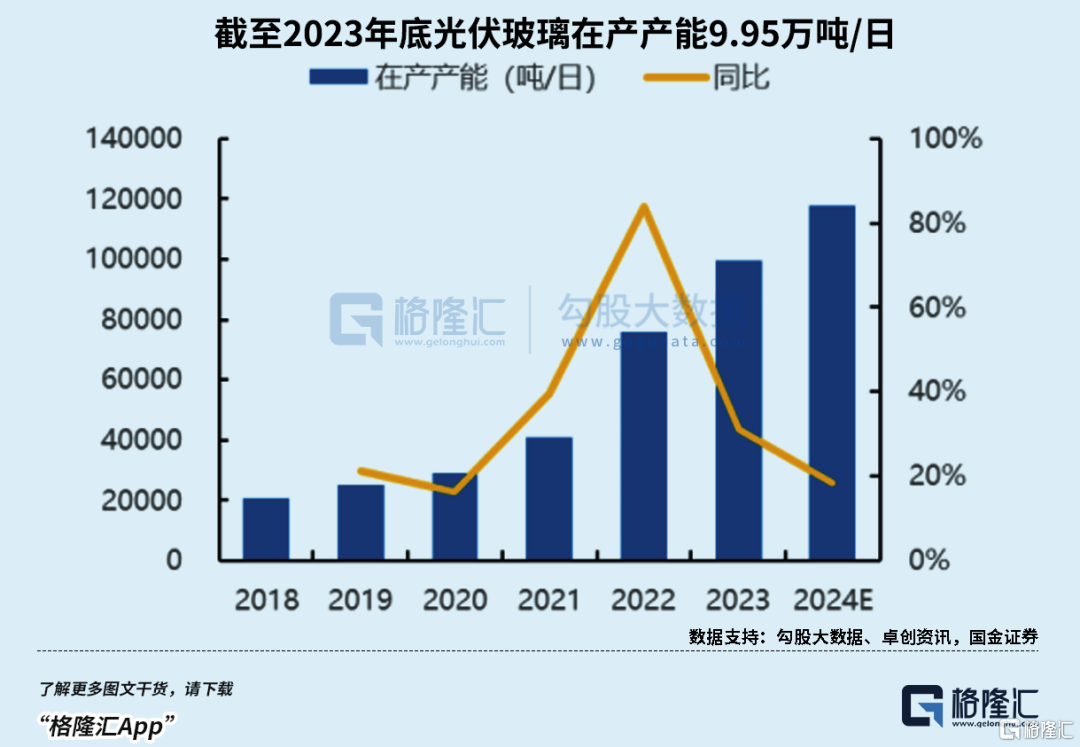

According to Zhuochuang News statistics, the domestic photovoltaic glass production capacity from 2020 to the end of 2023 will be 2.95, 0.0413, 0.0759, and 0.0995 million tons/day respectively, and the production capacity will more than triple in four years. As for the product structure, 100-300 billion yuan of product revenue was 401/1288/60 million yuan respectively.

A large amount of production capacity planning indicates the risk of oversupply, so policies are tightening again.

Since the hearing in 2023 became stricter, the overall progress of the photovoltaic glass industry's production has been delayed to a certain extent.

In May of last year, the Ministry of Industry and Information Technology and the National Development and Reform Commission issued the "Notice on Further Enhancing the Risk Warning of Photovoltaic Rolled Glass Capacity",which requires further implementation of capacity risk mechanisms. Projects with substantial workload should complete the capacity replacement procedures before the cold repair period. Projects with no substantial workload need to carry out risk warning opinions, and the opinions should be issued by the Ministry of Industry and Information Technology and the National Development and Reform Commission. This further increases the uncertainty of project commissioning time. At the same time, in June of this year, the expression "no need for capacity replacement" has been deleted on the basis of the revision in 2021, which also indicates that the expansion of the industry needs to be further tightened on the margin.

At the same time, in June of this year, the expression "no need for capacity replacement" has been deleted on the basis of the revision in 2021, which also indicates that the expansion of the industry needs to be further tightened on the margin.

How effective is it?

From the projects reported to the hearing, the actual production capacity from 2021 to 2023 accounted for only 93%, 54%, and 15% of the planned production capacity, and the completion rate decreased sharply year by year. As of now, the project that requires risk warning has a production capacity of about 0.0348 million tons/day, accounting for 41%. The pass rate of second- and third-tier enterprises with fewer planned production lines and smaller production scales is far lower than that of leading players.

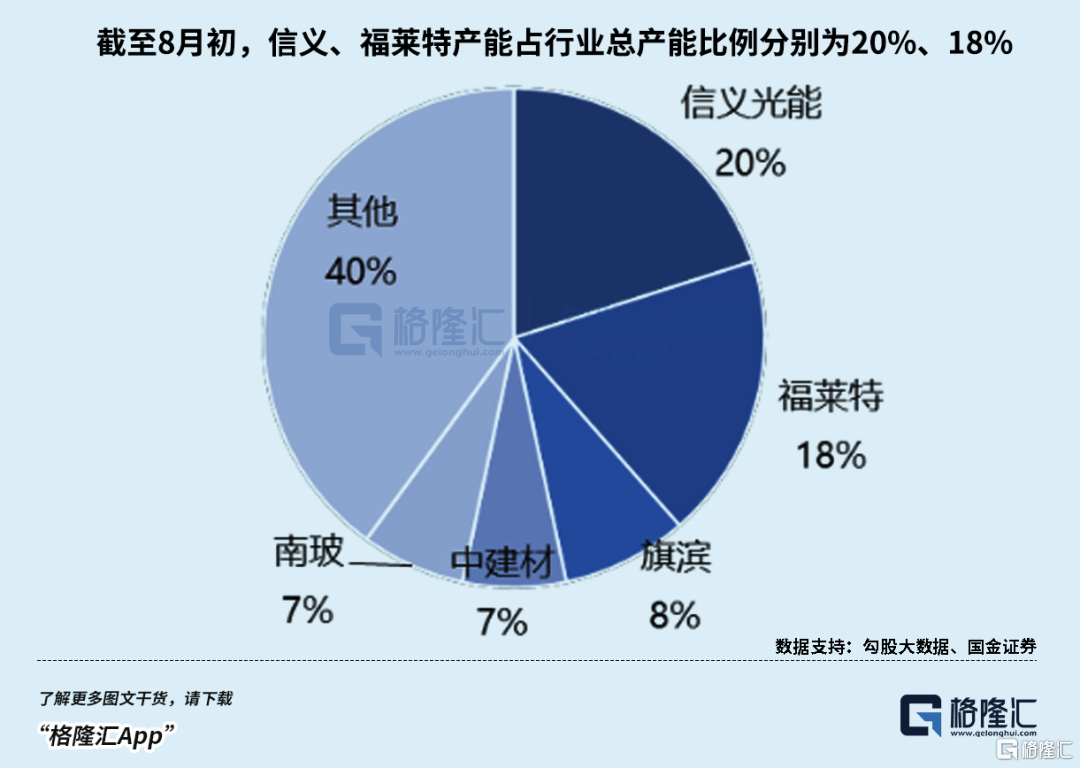

As of early August, Xinyi Solar and Flat Glass Group's in-production production capacity was 0.0232 and 0.0214 million tons/day respectively, accounting for 38% of the in-production production capacity of the photovoltaic glass industry (including overseas production capacity). The market share of other companies was less than 10%.

Take Flat Glass Group as an example. The actual ignition time of Fengyang Phase IV, which was originally planned to be put into operation in 2023, is the end of March 2024. From the perspective of the projects that have been put into production, the phenomenon of project ignition time delays is more common. Moreover, the cost disadvantage of second- and third-tier enterprises relative to leading enterprises, as well as their limited new production capacity strength and challenges to the company's capital scale and management capabilities, pose huge challenges.

In the future, the phenomenon of the strong becoming stronger in the industry will become more prominent.

03

Leading enterprises will benefit first.

According to institutions, the total newly added production capacity in China this year is about 0.02 million tons/day, and the total production capacity at the end of the year will exceed 0.12 million tons/day, a year-on-year increase of over 20%. From 2024 to 2025, the demand for photovoltaic glass in the market will be 33.26 million tons and 39.53 million tons respectively, corresponding to nominal production capacity demand of 0.101 million tons/day and 0.12 tons/day. Therefore, the oversupply situation is not so serious, and the main reason is that the pace of capacity release is well controlled.

As the leader of photovoltaic glass, Xinyi Solar plans to add 6 production lines in 2024, and Flat Glass Group plans to add 8 production lines in 2024.

As the size of photovoltaic glass kilns gradually increases and the investment per ton increases rapidly, according to Flat Glass Group's expansion plan and company announcements, the initial investment for kilns of 600td, 1200t/d, and 1600t/d is expected to be 0.4 billion yuan, 0.88 billion yuan, and 1.04 billion yuan respectively. Under the trend of expanding large-size kilns, funding and technological barriers in the photovoltaic glass process will be further increased.

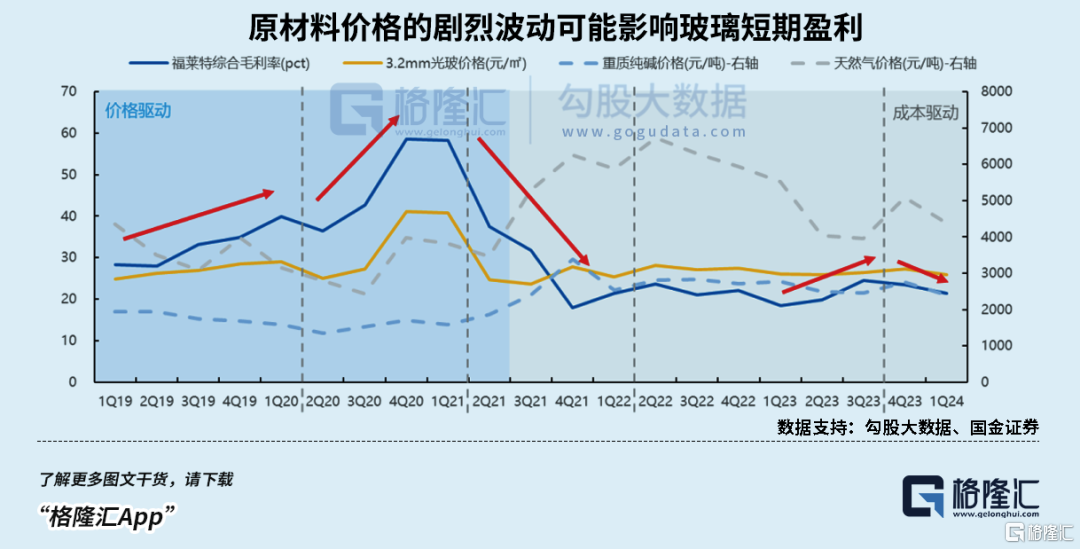

The advantage of leading enterprises over second- and third-tier enterprises is also reflected in cost control. Direct materials consumed by photovoltaic glass account for about 40% of the cost, and energy costs account for 35-40%. Among them, soda ash and natural gas account for 27% and 10%, respectively, and the gross profit margin of enterprises has fluctuated with the price changes of the two in the past. Now, the surplus of soda ash is affected by the downturn in the real estate industry, while the price of natural gas has become stable as the European energy crisis eases. Short-term profits have the hope of improving from the cost side.

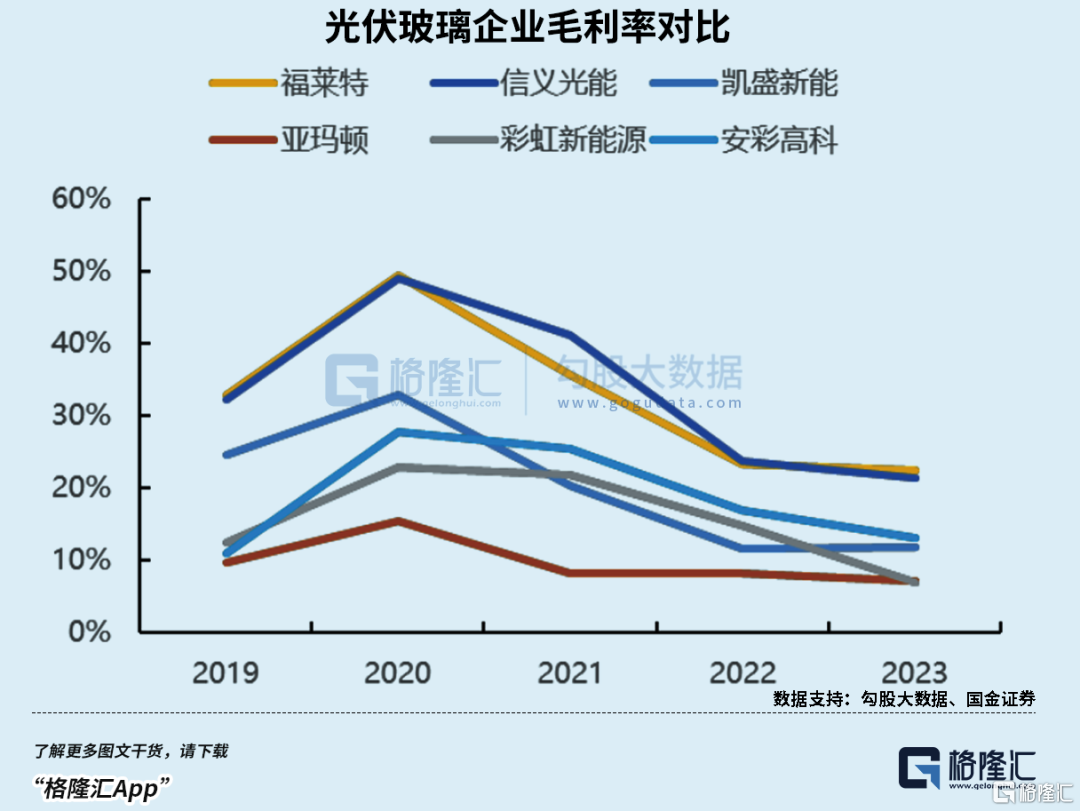

Compared with small kilns, large kilns not only have lower investment per ton, but also have more stable internal fuel and stability, requiring less raw materials and energy consumption. Since 2017, Flat Glass Group has been investing in kilns with a capacity of thousands of tons to consolidate its cost advantage. From the difference in gross profit margin, its leading advantage over second- and third-tier enterprises remains above 10 points. As the scale gradually increases to more than 1600t/d, the cost difference is expected to continue to widen.

From the planned production capacity, combined with the hearing announcement, the scale of Flat Glass Group's projects put into production after 2024 has reached 0.0456 million tons/day, including 3200 tons/day overseas, and the reserve project scale is the largest in the industry. If all of them are landed, they can open up the gap with the current leader Xinyi Solar.

Since April, photovoltaic glass stocks have been accumulating due to the rapid increase in daily melting, and downstream demand in Southeast Asia has plummeted due to anti-dumping investigations, reflecting price pressure. The latest policy opinions in June indicated that capacity will become strictly managed. The industry's pullback after April roughly reflected the negative factors in the first half of the year and returned to the low point of February. If there are no major bearish factors, the valuation at this level is cost-effective.

04

Epilogue

Of course, we should not be overly optimistic. Although there will be a proper price recovery even during the past two years of downturn, the industry's overcapacity has not been completely cleared after all, and the price rebound can only be seen for a quarter, let alone a reversal.

In this photovoltaic supply-side reform, the increase in market share of industry leaders is a long-term story. For the photovoltaic glass sector, which has a stable competitive landscape, low probability of technological disruption, and a more cautious release of supply, industry leaders are expected to improve their market share during this downturn period and emerge from the industry's inefficient competition and resume growth. (End of text)

虽然主要环节的竞争格局仍然激烈,但有一些辅材环节在行业寡头把控下没有再出现激进式扩产,格局还是十分稳定的。如今旺季来临提前囤货的预期已经出现,这些环节的产品价格迎来了恢复平衡的契机。

虽然主要环节的竞争格局仍然激烈,但有一些辅材环节在行业寡头把控下没有再出现激进式扩产,格局还是十分稳定的。如今旺季来临提前囤货的预期已经出现,这些环节的产品价格迎来了恢复平衡的契机。