The Bausch Health Companies Inc. (NYSE:BHC) share price has fared very poorly over the last month, falling by a substantial 26%. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 36% share price drop.

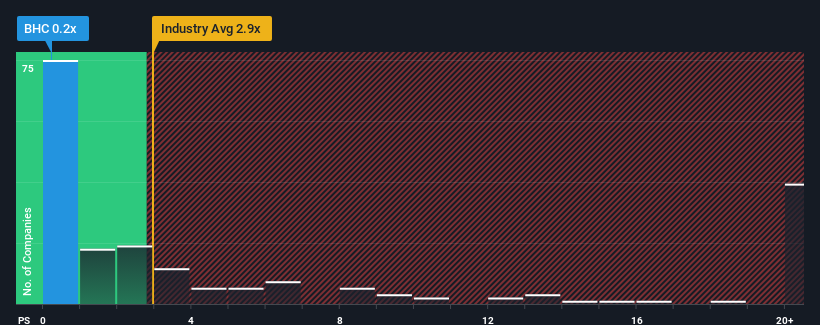

Since its price has dipped substantially, Bausch Health Companies' price-to-sales (or "P/S") ratio of 0.2x might make it look like a strong buy right now compared to the wider Pharmaceuticals industry in the United States, where around half of the companies have P/S ratios above 2.9x and even P/S above 11x are quite common. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

What Does Bausch Health Companies' Recent Performance Look Like?

With revenue growth that's inferior to most other companies of late, Bausch Health Companies has been relatively sluggish. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Bausch Health Companies will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Bausch Health Companies' to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 10% last year. Revenue has also lifted 8.5% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 3.8% each year during the coming three years according to the eight analysts following the company. That's shaping up to be materially lower than the 18% per annum growth forecast for the broader industry.

In light of this, it's understandable that Bausch Health Companies' P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What Does Bausch Health Companies' P/S Mean For Investors?

Having almost fallen off a cliff, Bausch Health Companies' share price has pulled its P/S way down as well. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Bausch Health Companies' analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. It's hard to see the share price rising strongly in the near future under these circumstances.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Bausch Health Companies that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.