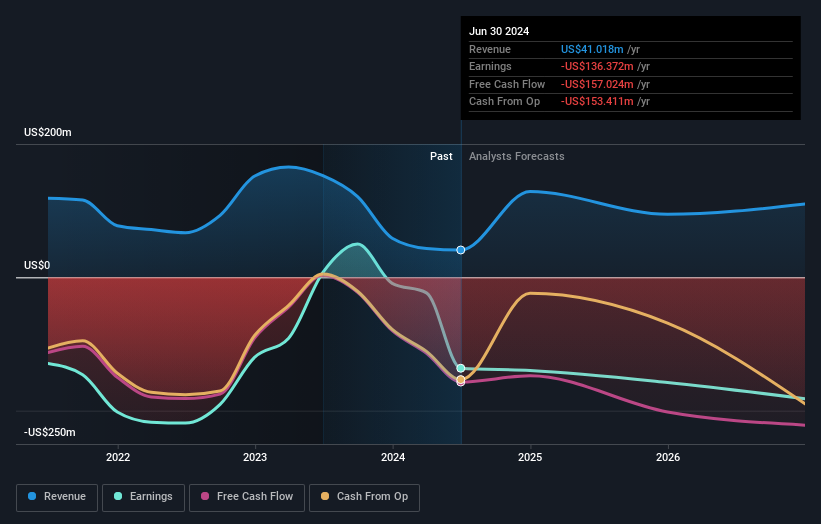

As you might know, MacroGenics, Inc. (NASDAQ:MGNX) last week released its latest second-quarter, and things did not turn out so great for shareholders. It was not a great statutory result, with revenues coming in 48% lower than the analysts predicted. Unsurprisingly, earnings also fell seriously short of forecasts, turning into a per-share loss of US$0.89. Following the result, the analysts have updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. We've gathered the most recent statutory forecasts to see whether the analysts have changed their earnings models, following these results.

Taking into account the latest results, the most recent consensus for MacroGenics from ten analysts is for revenues of US$128.6m in 2024. If met, it would imply a substantial 214% increase on its revenue over the past 12 months. Per-share losses are predicted to creep up to US$2.37. Before this latest report, the consensus had been expecting revenues of US$117.3m and US$2.00 per share in losses. While this year's revenue estimates increased, there was also a noticeable increase in loss per share expectations, suggesting the consensus has a bit of a mixed view on the stock.

It will come as no surprise that expanding losses caused the consensus price target to fall 6.3% to US$7.50with the analysts implicitly ranking ongoing losses as a greater concern than growing revenues. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. Currently, the most bullish analyst values MacroGenics at US$16.00 per share, while the most bearish prices it at US$4.00. As you can see the range of estimates is wide, with the lowest valuation coming in at less than half the most bullish estimate, suggesting there are some strongly diverging views on how analysts think this business will perform. With this in mind, we wouldn't rely too heavily the consensus price target, as it is just an average and analysts clearly have some deeply divergent views on the business.

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. It's clear from the latest estimates that MacroGenics' rate of growth is expected to accelerate meaningfully, with the forecast 9x annualised revenue growth to the end of 2024 noticeably faster than its historical growth of 5.5% p.a. over the past five years. Compare this with other companies in the same industry, which are forecast to grow their revenue 23% annually. It seems obvious that, while the growth outlook is brighter than the recent past, the analysts also expect MacroGenics to grow faster than the wider industry.

The Bottom Line

The most important thing to take away is that the analysts increased their loss per share estimates for next year. Pleasantly, they also upgraded their revenue estimates, and their forecasts suggest the business is expected to grow faster than the wider industry. Furthermore, the analysts also cut their price targets, suggesting that the latest news has led to greater pessimism about the intrinsic value of the business.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. We have estimates - from multiple MacroGenics analysts - going out to 2026, and you can see them free on our platform here.

That said, it's still necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with MacroGenics (at least 3 which shouldn't be ignored) , and understanding these should be part of your investment process.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.