Why Singapore Rents Are Falling

Why Singapore Rents Are Falling

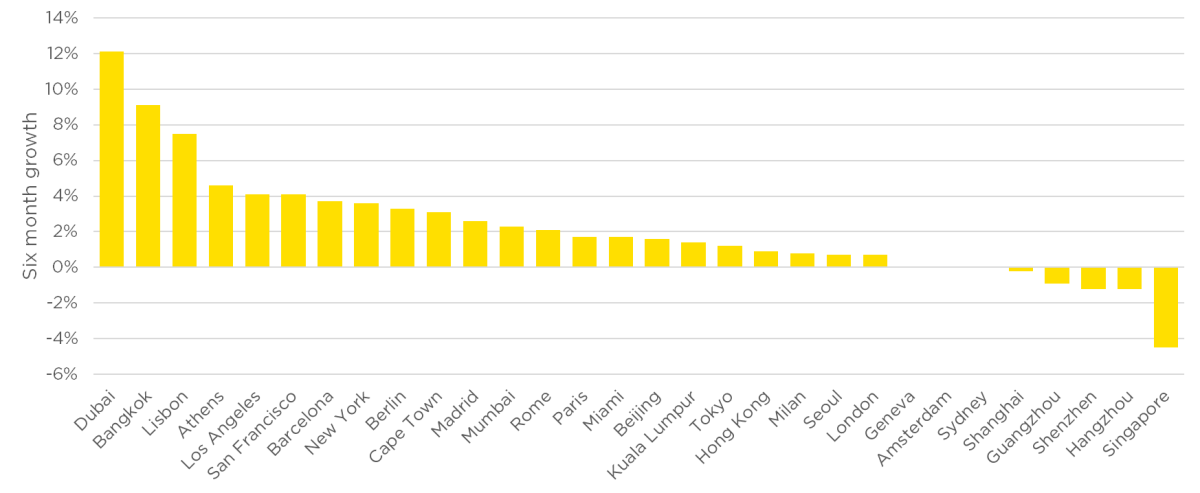

In H1 2024, rents fell by 4.5% HoH and 5.6% YoY.

2024年上半年,租金环比下降4.5%,同比下降5.6%。

Singapore has fallen to the bottom of the rankings of cities with the biggest prime rental value changes, and experts attribute this to rents in Singapore being "out of sync with global trends."

新加坡房地产最高租金价值变化排名垫底,专家认为这是因为新加坡的租金“与全球趋势不符”。

"Starting in 2022, when markets around the world saw rents continue to decline, Singapore experienced a very sharp run-up in prices. In 2024, rents are now correcting in an orderly fashion as more supply comes online," said Alan Cheong, executive director of Research & Consultancy at Savills Singapore.

Savills Singapore的Research & Consultancy执行董事Alan Cheong表示:“从2022年开始,当全球市场继续看到租金下降时,新加坡经历了非常剧烈的价格上涨。2024年,随着更多的供应投放市场,租金正在有序地纠正。”

According to Savills Prime Residential Index: World Cities – Rents and Yields, Singapore's rents have fallen by 4.5% HoH and 5.6% YoY, placing it at the lowest position in the index.

根据Savills Prime Residential Index:World Cities – Rents and Yields指数,新加坡的租金环比下降4.5%,同比下降5.6%,位列该指数最低水平。

Savills

Savills

The report also attributed the decline to the slowdown in leasing demand in the prime districts and a moderation in economic growth and employment expansion.

报告还将此次下降归因于主要地段租赁需求的减缓,以及经济增长和就业扩张的适度放缓。

Cheong believes that Singapore "may see the rental market starting to stabilise by the end of the year as the quarter-on-quarter rental decline appears to be slowing."

Cheong认为,随着季环比租金下降趋缓,新加坡"可能会在年底前看到租赁市场开始稳定。"

Globally, the cities which recorded the biggest prime rental value changes were Dubai (12.1%), Bangkok (9%) and Lisbon (7.5%).

在全球范围内,记录最大高端租赁价值变化的城市分别是迪拜(12.1%),曼谷(9%)和里斯本(7.5%)。

In a separate report, Savills revealed that Singapore has fallen in the rankings of cities with the biggest capital value growth for residential properties.

在另一份报告中,Savills透露,新加坡在住宅物业最大资本价值增长城市排名中下降了。

Savills, however, underscored that Singaproe's decline is negligible, as prices have remained largely unchanged.

然而,Savills强调,新加坡的下降微不足道,因为价格基本保持不变。