Top 3 Consumer Stocks That Could Blast Off This Month

Top 3 Consumer Stocks That Could Blast Off This Month

本月有望暴漲的三隻消費股

The most oversold stocks in the consumer discretionary sector presents an opportunity to buy into undervalued companies.

消費不可或缺板塊中最被低估的公司股票出現了買入機會。

The RSI is a momentum indicator, which compares a stock's strength on days when prices go up to its strength on days when prices go down. When compared to a stock's price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

RSI指標是一種動量指標,它比較了股票在價格上漲時的強度與在價格下跌時的強度。與股票的價格走勢進行比較,可以給交易者更好的了解股票短期內表現的良好程度。當RSI低於30時,資產通常被認爲是超賣的,根據Benzinga Pro的數據。

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

以下是本行業板塊最近的主要超賣股票列表,RSI接近或低於30。

ODP Corp (NASDAQ:ODP)

ODP corp(納斯達克:ODP)

- On Aug. 7, ODP reported worse-than-expected second-quarter financial results and cut its FY24 guidance. "While we are pacing below our prior expectations for the year, we are not standing still. We're taking actions to improve our top-line trajectory and we remain focused on capturing the long-term opportunities derived by our strong value proposition, solid balance sheet, and flexible foundation," said Gerry Smith, chief executive officer of ODP. The company's stock fell around 33% over the past five days and has a 52-week low of $23.69.

- RSI Value: 21.13

- ODP Price Action: Shares of ODP fell 2.5% to close at $25.52 on Friday.

- Benzinga Pro's real-time newsfeed alerted to latest ODP news.

- 8月7日,ODP發佈了比預期更糟糕的第二季度財務報表,並下調了其FY24指引。「雖然我們的表現略低於今年之前的預期,但我們並沒有袖手旁觀。我們正在採取措施改善我們的 top-line trajectory,並繼續專注於維護由我們強大的價值主張,堅實的資產負債表和靈活的基礎帶來的長期機會,」ODP首席執行官Gerry Smith說。該公司股票在過去五天中下跌約33%,52周最低價爲23.69美元。

- RSI值:21.13

- ODP價格變動:ODP股票週五下跌2.5%,收於25.52美元。

- Benzinga Pro的實時新聞提醒了最新的ODP新聞。

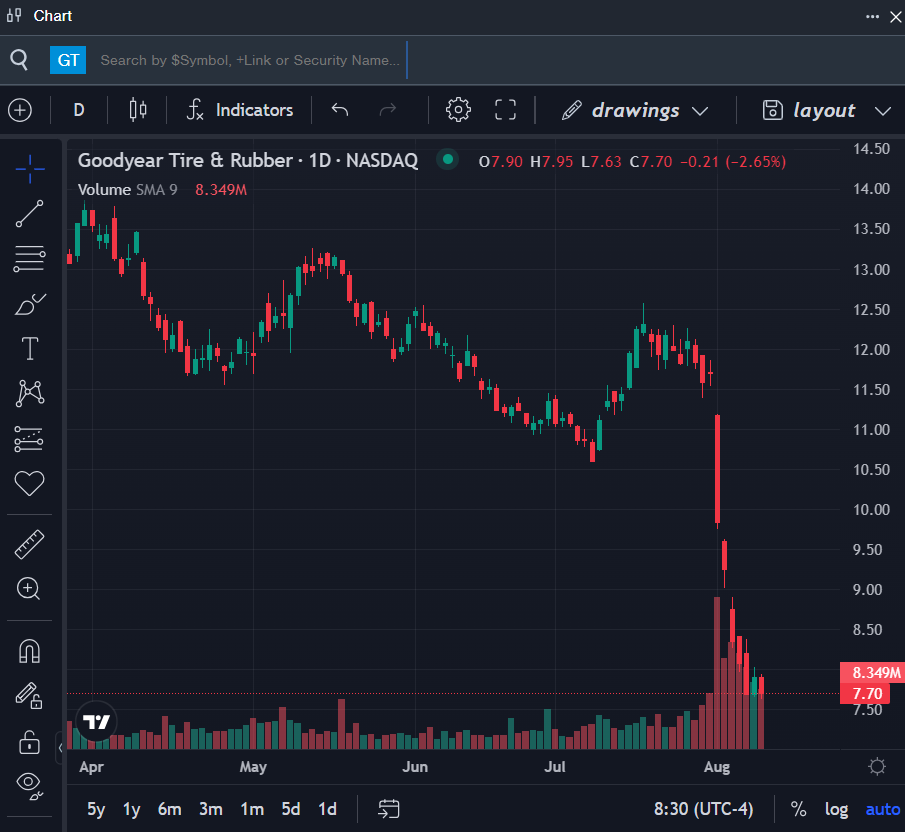

Goodyear Tire & Rubber Co (NASDAQ:GT)

固特異輪胎和橡膠公司(納斯達克:GT)

- On July 31, Goodyear Tire & Rubber reported mixed quarterly financial results. "We demonstrated clear progress on our Goodyear Forward plan in the second quarter, achieving significant margin expansion and securing a definitive agreement to sell our Off-the-Road business," said Chief Executive Officer and President Mark Stewart. The company's stock fell around 32% over the past month. It has a 52-week low of $7.63.

- RSI Value: 22.49

- GT Price Action: Shares of Goodyear Tire fell 2.7% to close at $7.70 on Friday.

- Benzinga Pro's charting tool helped identify the trend in GT stock.

- 7月31日,固特異輪胎和橡膠公司發佈了混合季度財務報告。「我們在第二季度展示了我們的Goodyear Forward計劃的明顯進展,實現了顯著的利潤率擴張,並獲得了出售我們的Off-the-Road業務的明確協議,」首席執行官兼總裁Mark Stewart說。該公司股票在過去一個月中下跌約32%,52周最低價爲7.63美元。

- RSI值:22.49

- GT價格行動:固特異輪胎的股票週五下跌2.7%,收於7.70美元。

- Benzinga Pro的圖表工具有助於確定Gt股票的趨勢。

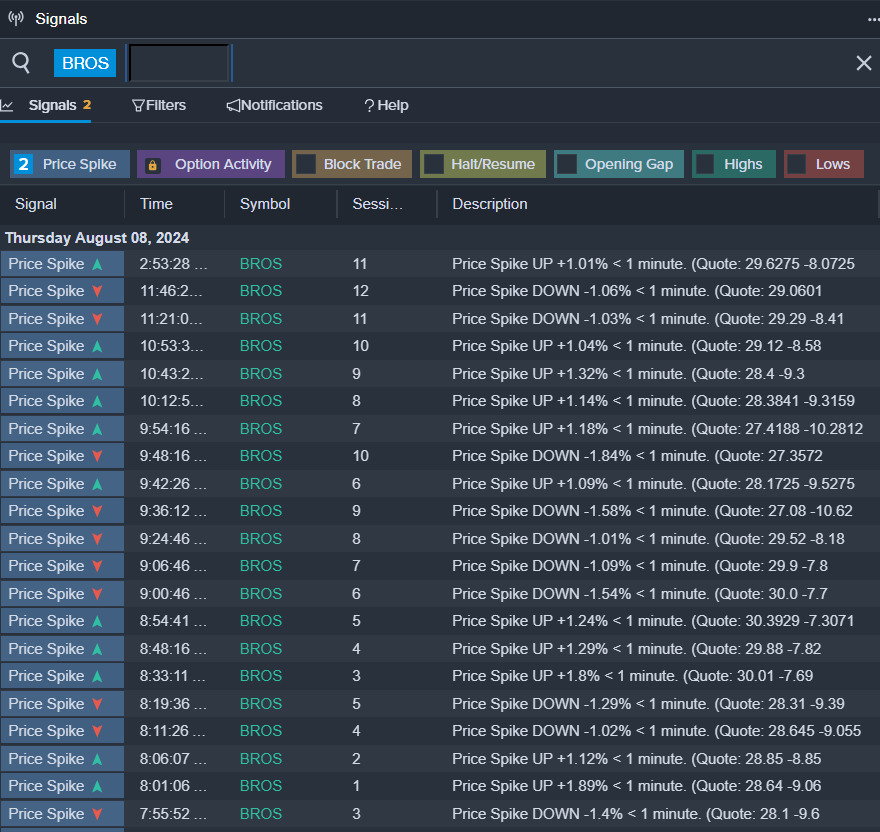

Dutch Bros Inc (NYSE:BROS)

Dutch Bros股份公司(紐交所:BROS)

- On Aug. 7, Dutch Bros reported quarterly earnings of 19 cents per share which beat the analyst consensus estimate of 13 cents by 46.15%. "Our quarterly performance demonstrates the long runway ahead for Dutch Bros as we once again delivered strong top-line and profitability growth. Revenue rose 30%, including a 4.1% increase in system same-shop sales, and was underpinned by excellent margin flow through. With strong results 2024 to date despite the volatile consumer backdrop and expectations for a robust second half to the year, we are pleased to be raising our annual guidance," said Christine Barone, CEO of Dutch Bros. The company's shares fell around 28% over the past month and has a 52-week low of $22.66.

- RSI Value: 25.27

- BROS Price Action: Shares of Dutch Bros fell 2.4% to close at $29.49 on Friday.

- Benzinga Pro's signals feature notified of a potential breakout in BROS shares.

- 8月7日,Dutch Bros報告每股收益爲19美分,超出分析師共識預期13美分的46.15%。「我們的季度業績展示了Dutch Bros的長期增長空間,我們再次實現了強勁的top-line和盈利能力增長。收入增長了30%,包括系統同店銷售增長了4.1%,優秀的毛利率流量支撐了我們的業績表現。儘管消費者市場環境動盪,但2024年至今的業績強勁,並預計今年下半年也會表現強勁,我們非常高興地提高了我們的年度指引,」Dutch Bros首席執行官Christine Barone說。該公司股票在過去一個月中下跌約28%,52周最低價爲22.66美元。

- RSI值:25.27

- BROS價格行動:Dutch Bros的股票在週五下跌2.4%,收於29.49美元。

- Benzinga Pro的信號功能通知了BROS股票潛在的突破。

- Dow Settles Higher But Records Weekly Loss: Greed Index Remains In 'Extreme Fear' Zone

- 道瓊斯收漲,但本週下跌:貪婪指數仍處於「極度恐懼」區域。