NextEra Energy's Options: A Look at What the Big Money Is Thinking

NextEra Energy's Options: A Look at What the Big Money Is Thinking

Whales with a lot of money to spend have taken a noticeably bullish stance on NextEra Energy.

Looking at options history for NextEra Energy (NYSE:NEE) we detected 13 trades.

If we consider the specifics of each trade, it is accurate to state that 61% of the investors opened trades with bullish expectations and 38% with bearish.

From the overall spotted trades, 4 are puts, for a total amount of $176,267 and 9, calls, for a total amount of $442,807.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $70.0 to $82.5 for NextEra Energy over the last 3 months.

Analyzing Volume & Open Interest

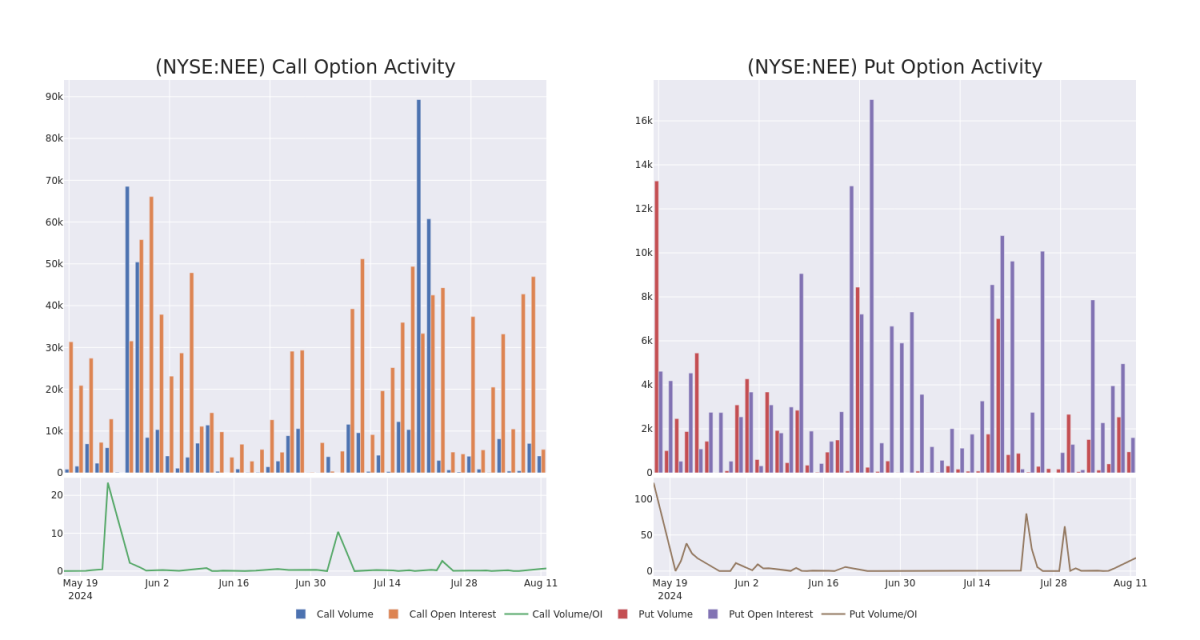

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for NextEra Energy's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of NextEra Energy's whale activity within a strike price range from $70.0 to $82.5 in the last 30 days.

NextEra Energy Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NEE | CALL | SWEEP | BULLISH | 10/18/24 | $8.95 | $8.85 | $8.95 | $70.00 | $87.7K | 1.2K | 99 |

| NEE | PUT | SWEEP | BEARISH | 10/18/24 | $3.8 | $3.75 | $3.8 | $77.50 | $66.8K | 1.5K | 309 |

| NEE | CALL | SWEEP | BULLISH | 10/18/24 | $3.75 | $3.65 | $3.7 | $77.50 | $59.9K | 2.7K | 1.0K |

| NEE | CALL | SWEEP | BULLISH | 10/18/24 | $3.75 | $3.65 | $3.75 | $77.50 | $58.1K | 2.7K | 907 |

| NEE | PUT | SWEEP | BEARISH | 03/21/25 | $7.9 | $7.8 | $7.9 | $80.00 | $55.3K | 13 | 70 |

About NextEra Energy

NextEra Energy's regulated utility, Florida Power & Light, is the largest rate-regulated utility in Florida. The utility distributes power to nearly 6 million customer accounts in Florida and owns 34 gigawatts of generation. FP&L contributes roughly 70% of NextEra's consolidated operating earnings. NextEra Energy Resources, the renewable energy segment, generates and sells power throughout the United States and Canada with more than 34 GW of generation capacity, including natural gas, nuclear, wind, and solar.

Where Is NextEra Energy Standing Right Now?

- With a trading volume of 1,483,077, the price of NEE is down by -0.23%, reaching $77.28.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 71 days from now.

Expert Opinions on NextEra Energy

A total of 3 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $84.0.

- Maintaining their stance, an analyst from BMO Capital continues to hold a Outperform rating for NextEra Energy, targeting a price of $83.

- An analyst from Barclays persists with their Equal-Weight rating on NextEra Energy, maintaining a target price of $75.

- An analyst from JP Morgan persists with their Overweight rating on NextEra Energy, maintaining a target price of $94.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest NextEra Energy options trades with real-time alerts from Benzinga Pro.