Mercury Systems, Inc. (NASDAQ:MRCY) is expected to release earnings results for its fourth quarter, after the closing bell on Tuesday, Aug. 13.

Analysts expect the Andover, Massachusetts-based company to report quarterly earnings at 2 cent per share, versus a year-ago profit of 11 cents per share. Mercury Systems is projected to report quarterly revenue of $230.69 million, compared to $253.24 million a year earlier, according to data from Benzinga Pro.

On June 18, Mercury named Tod Brindlinger as Senior Vice President of Operations.

Mercury Systems shares gained 2.7% to close at $35.60 on Friday.

Mercury Systems shares gained 2.7% to close at $35.60 on Friday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

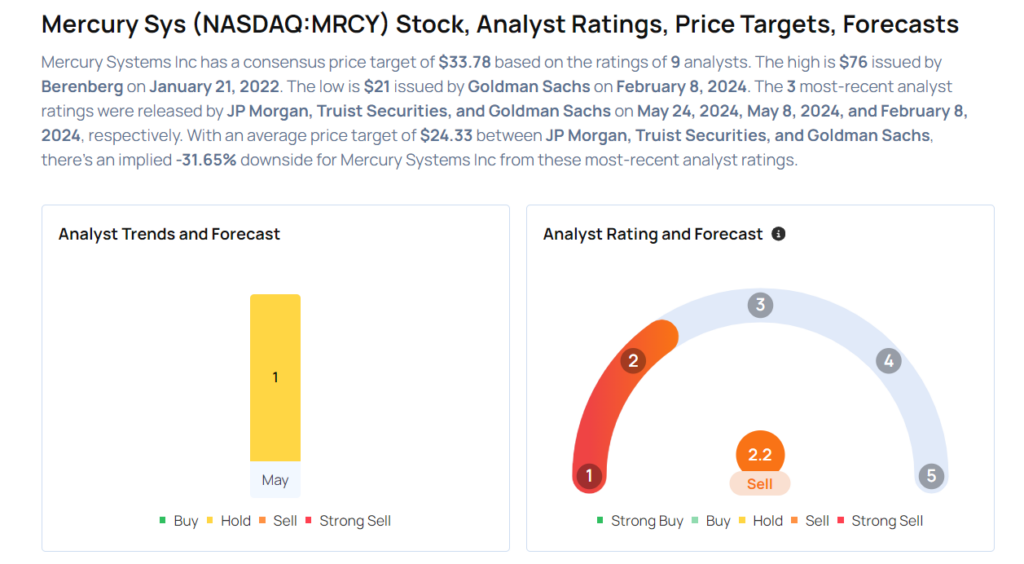

- JP Morgan analyst Seth Seifman maintained a Neutral rating and raised the price target from $24 to $26 on May 24. This analyst has an accuracy rate of 83%.

- Truist Securities analyst Michael Ciarmoli maintained a Hold rating and cut the price target from $28 to $26 on May 8. This analyst has an accuracy rate of 77%.

- Goldman Sachs analyst Noah Poponak maintained a Sell rating and decreased the price target from $24 to $21 on Feb. 8. This analyst has an accuracy rate of 61%.

- RBC Capital analyst Ken Herbert maintained a Sector Perform rating and cut the price target from $35 to $30 on Feb. 7. This analyst has an accuracy rate of 64%.

- Jefferies analyst Sheila Kahyaoglu downgraded the stock from Hold to Underperform and cut the price target from $35 to $30 on Jan. 3. This analyst has an accuracy rate of 70%.

Considering buying MRCY stock? Here's what analysts think:

Read This Next:

- Wall Street's Most Accurate Analysts Give Their Take On 3 Defensive Stocks Delivering High-Dividend Yields