Unpacking the Latest Options Trading Trends in Snap

Unpacking the Latest Options Trading Trends in Snap

Financial giants have made a conspicuous bullish move on Snap. Our analysis of options history for Snap (NYSE:SNAP) revealed 8 unusual trades.

金融巨头对Snap采取了明显的看涨举动。我们对Snap(纽约证券交易所代码:SNAP)期权历史的分析显示了8笔不寻常的交易。

Delving into the details, we found 75% of traders were bullish, while 25% showed bearish tendencies. Out of all the trades we spotted, 5 were puts, with a value of $335,198, and 3 were calls, valued at $277,717.

深入研究细节后,我们发现75%的交易者看涨,而25%的交易者表现出看跌趋势。在我们发现的所有交易中,有5笔是看跌期权,价值335,198美元,3笔是看涨期权,价值277,717美元。

What's The Price Target?

目标价格是多少?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $8.0 to $15.0 for Snap over the recent three months.

根据交易活动,看来重要投资者的目标是在最近三个月中将Snap的价格范围从8.0美元扩大到15.0美元。

Analyzing Volume & Open Interest

分析交易量和未平仓合约

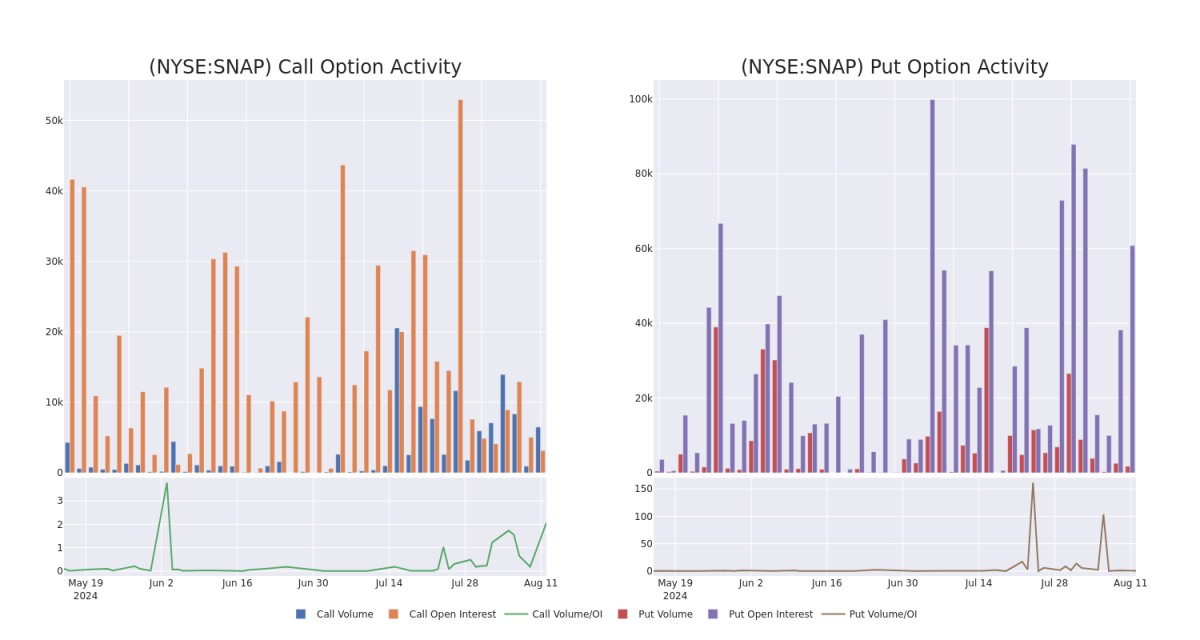

In terms of liquidity and interest, the mean open interest for Snap options trades today is 7995.75 with a total volume of 8,243.00.

就流动性和利息而言,当今Snap期权交易的平均未平仓合约为7995.75,总交易量为8,243.00。

In the following chart, we are able to follow the development of volume and open interest of call and put options for Snap's big money trades within a strike price range of $8.0 to $15.0 over the last 30 days.

在下图中,我们可以跟踪过去30天在8.0美元至15.0美元行使价区间内的Snap大额资金交易的看涨和看跌期权交易量和未平仓合约的变化。

Snap 30-Day Option Volume & Interest Snapshot

Snap 30 天期权交易量和利息快照

Noteworthy Options Activity:

值得注意的期权活动:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SNAP | CALL | SWEEP | BEARISH | 12/20/24 | $0.81 | $0.78 | $0.78 | $11.00 | $204.6K | 209 | 5.5K |

| SNAP | PUT | SWEEP | BULLISH | 01/17/25 | $0.86 | $0.84 | $0.84 | $8.00 | $84.1K | 29.8K | 1.0K |

| SNAP | PUT | SWEEP | BULLISH | 12/20/24 | $3.25 | $3.2 | $3.2 | $12.00 | $80.6K | 526 | 252 |

| SNAP | PUT | SWEEP | BULLISH | 06/20/25 | $3.9 | $3.8 | $3.8 | $12.00 | $79.0K | 5.5K | 209 |

| SNAP | PUT | TRADE | BULLISH | 01/16/26 | $6.7 | $6.6 | $6.64 | $15.00 | $57.7K | 20.5K | 87 |

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 问 | 出价 | 价格 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 拍下 | 打电话 | 扫 | 粗鲁的 | 12/20/24 | 0.81 美元 | 0.78 美元 | 0.78 美元 | 11.00 美元 | 204.6 万美元 | 209 | 5.5K |

| 拍下 | 放 | 扫 | 看涨 | 01/17/25 | 0.86 美元 | 0.84 美元 | 0.84 美元 | 8.00 美元 | 84.1 万美元 | 29.8K | 1.0K |

| 拍下 | 放 | 扫 | 看涨 | 12/20/24 | 3.25 | 3.2 美元 | 3.2 美元 | 12.00 美元 | 80.6 万美元 | 526 | 252 |

| 拍下 | 放 | 扫 | 看涨 | 06/20/25 | 3.9 美元 | 3.8 美元 | 3.8 美元 | 12.00 美元 | 79.0 万美元 | 5.5K | 209 |

| 拍下 | 放 | 贸易 | 看涨 | 01/16/26 | 6.7 美元 | 6.6 美元 | 6.64 美元 | 15.00 美元 | 57.7 万美元 | 20.5K | 87 |

About Snap

关于 Snap

Snap owns one of the most popular social networking apps, Snapchat, claiming more than 400 million daily active users as of the end of 2023. Snap generates nearly all its revenue from advertising. While only about one quarter of users are in North America, the region accounts for about 65% of sales.

Snap拥有最受欢迎的社交网络应用程序之一Snapchat,截至2023年底,其每日活跃用户超过4亿。Snap 几乎所有的收入都来自广告。虽然只有大约四分之一的用户在北美,但该地区约占销售额的65%。

Following our analysis of the options activities associated with Snap, we pivot to a closer look at the company's own performance.

在分析了与Snap相关的期权活动之后,我们开始仔细研究公司自身的业绩。

Present Market Standing of Snap

Snap 目前的市场地位

- Currently trading with a volume of 15,188,019, the SNAP's price is down by 0.0%, now at $9.05.

- RSI readings suggest the stock is currently may be oversold.

- Anticipated earnings release is in 71 days.

- SNAP目前的交易量为15,188,019美元,价格下跌了0.0%,目前为9.05美元。

- RSI读数表明该股目前可能已超卖。

- 预计收益将在71天后发布。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

与仅交易股票相比,期权是一种风险更高的资产,但它们具有更高的获利潜力。严肃的期权交易者通过每天自我教育、扩大交易规模、关注多个指标以及密切关注市场来管理这种风险。