Key Insights

- Bright Smart Securities & Commodities Group will host its Annual General Meeting on 19th of August

- Total pay for CEO Edmond Hui includes HK$3.01m salary

- The overall pay is comparable to the industry average

- Bright Smart Securities & Commodities Group's total shareholder return over the past three years was 148% while its EPS was down 7.4% over the past three years

The share price of Bright Smart Securities & Commodities Group Limited (HKG:1428) has increased significantly over the past few years. However, the earnings growth has not kept up with the share price momentum, suggesting that some other factors may be driving the price direction. The upcoming AGM on 19th of August may be an opportunity for shareholders to bring up any concerns they may have for the board's attention. They will be able to influence managerial decisions through the exercise of their voting power on resolutions, such as CEO remuneration and other matters, which may influence future company prospects. In our analysis below, we show why shareholders may consider holding off a raise for the CEO's compensation until company performance improves.

Comparing Bright Smart Securities & Commodities Group Limited's CEO Compensation With The Industry

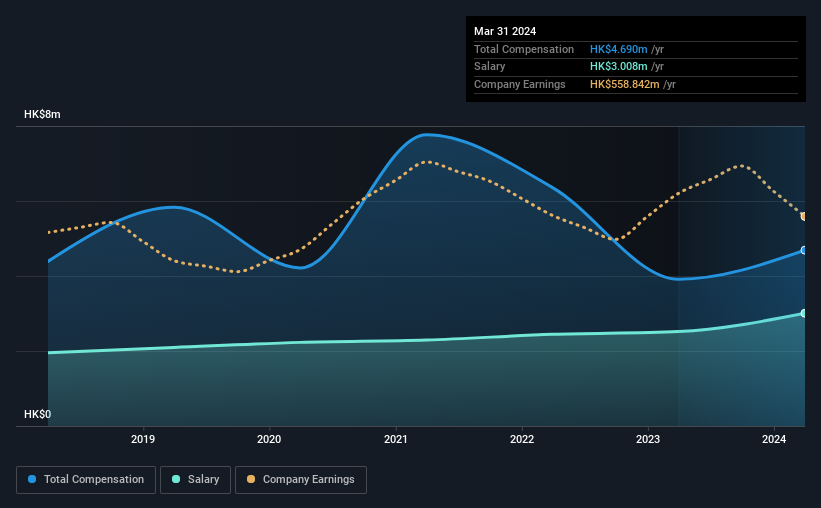

Our data indicates that Bright Smart Securities & Commodities Group Limited has a market capitalization of HK$3.2b, and total annual CEO compensation was reported as HK$4.7m for the year to March 2024. That's a notable increase of 20% on last year. In particular, the salary of HK$3.01m, makes up a huge portion of the total compensation being paid to the CEO.

On comparing similar companies from the Hong Kong Capital Markets industry with market caps ranging from HK$1.6b to HK$6.2b, we found that the median CEO total compensation was HK$3.7m. This suggests that Bright Smart Securities & Commodities Group remunerates its CEO largely in line with the industry average. Moreover, Edmond Hui also holds HK$1.1m worth of Bright Smart Securities & Commodities Group stock directly under their own name.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | HK$3.0m | HK$2.5m | 64% |

| Other | HK$1.7m | HK$1.4m | 36% |

| Total Compensation | HK$4.7m | HK$3.9m | 100% |

On an industry level, around 84% of total compensation represents salary and 16% is other remuneration. Bright Smart Securities & Commodities Group pays a modest slice of remuneration through salary, as compared to the broader industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

On an industry level, around 84% of total compensation represents salary and 16% is other remuneration. Bright Smart Securities & Commodities Group pays a modest slice of remuneration through salary, as compared to the broader industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Bright Smart Securities & Commodities Group Limited's Growth Numbers

Over the last three years, Bright Smart Securities & Commodities Group Limited has shrunk its earnings per share by 7.4% per year. In the last year, its revenue is down 9.8%.

The decline in EPS is a bit concerning. And the fact that revenue is down year on year arguably paints an ugly picture. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Bright Smart Securities & Commodities Group Limited Been A Good Investment?

Most shareholders would probably be pleased with Bright Smart Securities & Commodities Group Limited for providing a total return of 148% over three years. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

To Conclude...

Although shareholders would be quite happy with the returns they have earned on their initial investment, earnings have failed to grow and this could mean returns may be hard to keep up. The upcoming AGM will provide shareholders the opportunity to revisit the company's remuneration policies and evaluate if the board's judgement and decision-making is aligned with that of the company's shareholders.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. We did our research and spotted 3 warning signs for Bright Smart Securities & Commodities Group that investors should look into moving forward.

Important note: Bright Smart Securities & Commodities Group is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.