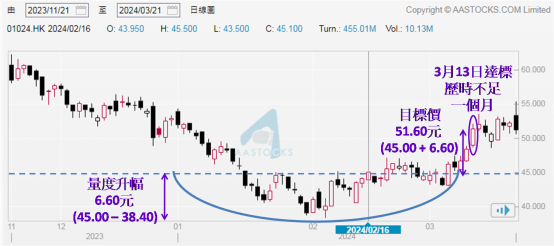

Jinwu Financial News | The “chart pattern” studied last time is a “round bottom/disc bottom”. It is one of the favorable reversal patterns. Typically, a stock index or individual stock falls for a period of time (usually not less than two weeks) and then consolidates at a low level, and the buyer wins in the fight between buyers and sellers. Immediately after that, the stock index or individual stock rebounded, creating an upward wave. Refer to the Kuaishou-W (01024) case. The high price was 62.25 yuan on November 21, 2023, the highest since October 18 of the same year. The stock price declined thereafter, closing at 43.10 yuan on January 17, 2024, falling below 45.00 yuan. This was the first time since November 11, 2022. It happened for the first time since November 11, 2022. Starting at 62.25 yuan, although it took less than two months, the decline was over 30%.

Over the same period, the Hang Seng Index had a cumulative decline of nearly 2,800 points (18,057 → 15,276 points), and the decline was 15.40%. More than 10% showed that the overall investment sentiment in Hong Kong stocks was very poor. The sharp decline in Kuaishou mentioned above was due to market performance, and the correlation with fundamental quality is low. In fact, after closing on November 21, 2023, Kuaishou announced its results for the third quarter of 2023. The profit attributable to shareholders as of the end of September 2023 was about 2.181 billion yuan (RMB, same below), compared with a loss of about 2.713 billion yuan over the same period in 2022, reversing losses for two consecutive quarters (2023 is also the first year since the Group was founded). The performance is encouraging. On the same day, however, the stock price showed a single-day shift, from rise to fall. The same was true of the trend of the Hang Seng Index on the same day, so Kuaishou's stock price performance was dragged down by the market, and it can be traced.

Source: Asdaq Financial Network

The closing report of 44.95 yuan on the morning of February 16, 2024 was higher than the highest closing report of 44.65 yuan since January 17 (see January 24). The increase in the afternoon was further expanded. It had already risen to 45.50 yuan in about 1.5 hours, and there was a “sharp rise in price” from February 14 to 16, confirming that there was a “round bottom/disc bottom” at the time, which was a positive market signal. If the 45.00 yuan level is used as the starting point for this pattern, it is 38.40 yuan lower than February 5, and the distance is 6.60 yuan. Using this as a reference for potential increases, the target price is 51.60 yuan. Judging from the past performance of the stock price, the target price is at the beginning of January 2024. The stock price was rampant from December 22, 2023 to January 4, 2024, which can be understood as the current resistance level.

Therefore, the target price of $51.60 is not simply a calculation result; it is a reference basis for the previous stock price resistance level. If investors enter the market at the level of 45.00 yuan, the potential increase is close to 15.00%. As the Hang Seng Index trend gradually recovers in late January 2024, the investment climate in Hong Kong stocks gradually improves, and Kuaishou is expected to reach the target price within a month, proving that it was appropriate to enter the market at the time. That is, the “plate handle” appeared soon after, and the buyer and seller argued lightly. As long as they did not collect less than 42.75 yuan for two consecutive days (that is, 45.00 yuan was reduced by 5.00%), they can still maintain the “round bottom/disc-shaped bottom” conclusion that they are optimistic about the future market; otherwise, the increase was destroyed. Generally speaking, the current explanation pattern often takes a long time to form. The trend takes a month or more, which is a reliable reference for favorable patterns.

Therefore, the target price of $51.60 is not simply a calculation result; it is a reference basis for the previous stock price resistance level. If investors enter the market at the level of 45.00 yuan, the potential increase is close to 15.00%. As the Hang Seng Index trend gradually recovers in late January 2024, the investment climate in Hong Kong stocks gradually improves, and Kuaishou is expected to reach the target price within a month, proving that it was appropriate to enter the market at the time. That is, the “plate handle” appeared soon after, and the buyer and seller argued lightly. As long as they did not collect less than 42.75 yuan for two consecutive days (that is, 45.00 yuan was reduced by 5.00%), they can still maintain the “round bottom/disc-shaped bottom” conclusion that they are optimistic about the future market; otherwise, the increase was destroyed. Generally speaking, the current explanation pattern often takes a long time to form. The trend takes a month or more, which is a reliable reference for favorable patterns.

[Author Profile] Nie Zhenbang (Nie Sir)

Graduated from the Department of Financial Services, Hong Kong Polytechnic University,

Over 17 years of experience in the financial industry and investment teaching,

Author of four investment and financial management books.

Hong Kong Securities Regulatory Commission licensees

[Statement] The author confirms that neither I nor my contacts have experienced the following two situations. One is that I traded the above analyzed stocks within 30 days before writing; the second is that I traded the above stocks within 3 business days after the publication of the article.

Furthermore, the author does not currently hold the above shares. The above is solely personal research and sharing. It does not represent the position of any third party agency, nor is it any investment advice or inducement. Readers are encouraged to use their own independent thinking skills to make their own investment decisions.

故此目标价51.60元并非单纯的运算结果,是有昔日股价阻力位的参考依据,而投资者若于45.00元水平进场,潜在升幅接近15.00%,配合2024年1月下旬起恒指走势渐见回顺,港股投资气氛逐渐改善,快手有望在一个月内便到达目标价,证明当时进场合适。即或后来不久出现“碟柄”,买卖双方又见好淡争持,只要不是连续两天收低于42.75元 (就是45.00元回调5.00%),仍能维持“圆形底 / 碟形底”出现看好后市的结论;否则才看升幅已被破坏。一般来说,今次解说形态往往要较长时间才会形成,倾向历时一个月或以上,是较可靠的利好形态参考。

故此目标价51.60元并非单纯的运算结果,是有昔日股价阻力位的参考依据,而投资者若于45.00元水平进场,潜在升幅接近15.00%,配合2024年1月下旬起恒指走势渐见回顺,港股投资气氛逐渐改善,快手有望在一个月内便到达目标价,证明当时进场合适。即或后来不久出现“碟柄”,买卖双方又见好淡争持,只要不是连续两天收低于42.75元 (就是45.00元回调5.00%),仍能维持“圆形底 / 碟形底”出现看好后市的结论;否则才看升幅已被破坏。一般来说,今次解说形态往往要较长时间才会形成,倾向历时一个月或以上,是较可靠的利好形态参考。