Ideally, your overall portfolio should beat the market average. But in any portfolio, there will be mixed results between individual stocks. So we wouldn't blame long term Montage Technology Co., Ltd. (SHSE:688008) shareholders for doubting their decision to hold, with the stock down 29% over a half decade. More recently, the share price has dropped a further 15% in a month.

Now let's have a look at the company's fundamentals, and see if the long term shareholder return has matched the performance of the underlying business.

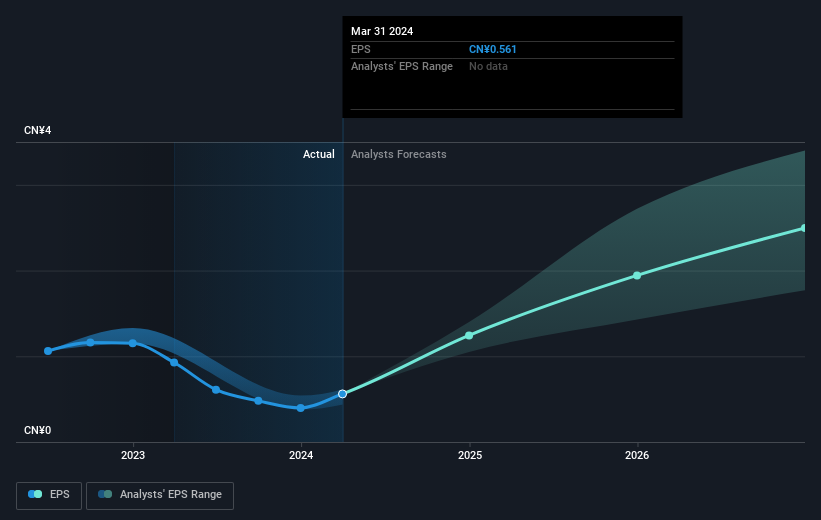

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Looking back five years, both Montage Technology's share price and EPS declined; the latter at a rate of 8.2% per year. This fall in the EPS is worse than the 7% compound annual share price fall. The relatively muted share price reaction might be because the market expects the business to turn around. The high P/E ratio of 92.94 suggests that shareholders believe earnings will grow in the years ahead.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

This free interactive report on Montage Technology's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's nice to see that Montage Technology shareholders have received a total shareholder return of 1.9% over the last year. Of course, that includes the dividend. That certainly beats the loss of about 5% per year over the last half decade. This makes us a little wary, but the business might have turned around its fortunes. Before deciding if you like the current share price, check how Montage Technology scores on these 3 valuation metrics.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.