Track the latest trends of north-south directional funds.

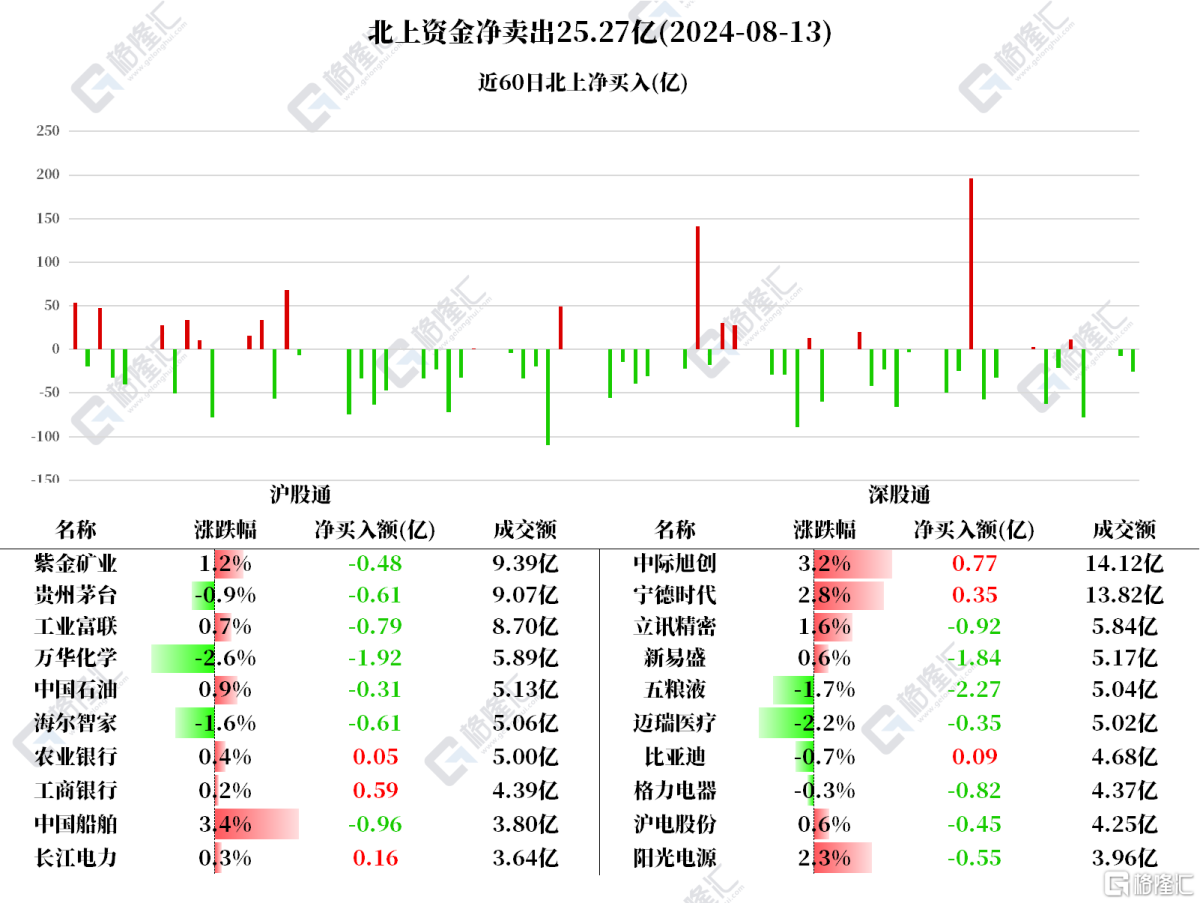

On August 13th, the northbound funds net sold A-shares for 2.527 billion yuan.

Wuliangye, Wanhua Chemical, and Eoptolink were net sold for 0.227 billion yuan, 0.192 billion yuan, and 0.184 billion yuan respectively. Zhongji Innolight had the highest net purchase amount, which was 0.077 billion yuan.

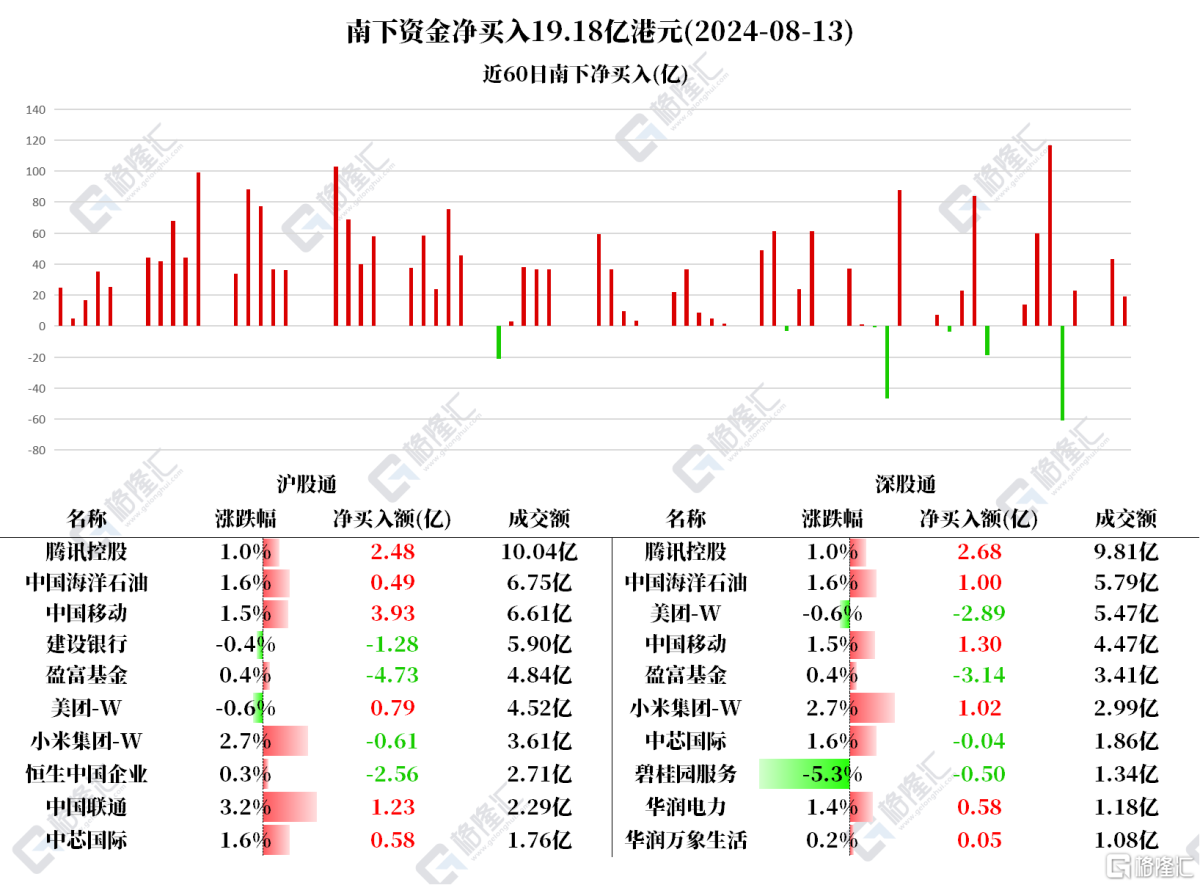

The southbound funds net bought Hong Kong stocks for 1.918 billion Hong Kong dollars.

The southbound funds net bought Hong Kong stocks for 1.918 billion Hong Kong dollars.

Net bought China Mobile for 0.523 billion, Tencent for 0.515 billion, CNOOC for 0.148 billion, and China Unicom for 0.122 billion; net sold Tracker Fund of Hong Kong for 0.787 billion, Hang Seng H-Share Index ETF for 0.256 billion, Meituan for 0.21 billion, and China Construction Bank Corporation for 0.127 billion.

According to statistics, the southbound funds have been continuously net buying Tencent for 14 days, totaling 10.3374 billion Hong Kong dollars; net buying Xiaomi for 13 consecutive days, totaling 2.08983 billion Hong Kong dollars; net buying CNOOC for 12 consecutive days, totaling 1.76065 billion Hong Kong dollars.

Individual Stocks Concerned: China Mobile: On the news front, Goldman Sachs issued a research report stating that the company's management maintained its expectations for stable growth in revenue and profit in 2024. Due to increased R&D and marketing expenses for enterprise business (cloud, artificial intelligence, industrial internet, etc.), EBITDA profit margin continued to show a downward trend, but the slowdown in depreciation costs helped support the trend of stable net profit margin. The management believes that the dividend payout ratio can be increased from 71% to the target of 75% in 2026. Goldman Sachs believes that stable business growth and steady capital expenditures should help China Mobile gradually increase its dividends. Chinahongqiao:

Wuliangye dropped 1.65% today. According to Tianyancha, Sichuan Wuzhe Liquor Sales Co., Ltd. was established recently with Xiao Xiangfa as the legal representative and a registered capital of 0.55 billion yuan. Its business scope includes liquor sales, import and export of goods, packaging services, food sales, domestic trade agency, etc. The full panorama of equity penetration chart shows that the company is wholly owned by Yibin Wuliangye Equity Investment Partnership Enterprise (Limited Partnership), which is jointly funded by Yibin Wuliangye Fund Management Co., Ltd. and others.

Wanhua Chemical fell 2.55% today. On the evening of August 12th, Wanhua Chemical announced that it achieved revenue of 97.067 billion yuan in the first half of 2024, a year-on-year increase of 10.77%; net profit was 8.174 billion yuan, a year-on-year decrease of 4.6%. Eoptolink was net sold for 0.227 billion yuan, Wanhua Chemical was net sold for 0.192 billion yuan, and Sichuan Wuzhe Liquor Sales Co., Ltd. was net sold for 0.184 billion yuan.

Zhongji Innolight rose 3.17% today. Zhongji Innolight recently stated in a conference call that some key customers have indeed increased their orders for 400G and 800G, and the demand is very strong. In addition, the company stated that it has received orders for the second half of this year, and has already negotiated supply and delivery plans with customers for next year, including prices, monthly shipments, etc.

Materials of the companies of North Water

China Mobile rose 1.48% today. China Mobile Communications Group Jiangsu Co., Ltd. Nantong Branch won the bid for Section 5 (secondary) of the Technical Defense Construction Project for Promoting the Construction of National Social Security Prevention and Control System Demonstration Cities in Nantong Economic and Technological Development Zone for 1.8 million yuan.

Tencent rose 0.96% today. The company will release its latest financial report on August 14th. The market generally predicts that Tencent's revenue will reach 160.554 billion yuan, a year-on-year increase of 7.6%; earnings per share will be 4.26 yuan, an increase of 58.15% year-on-year.

China Construction Bank Corporation fell 0.36% today. China Construction Bank announced that it has passed the resolution to issue non-capital bonds with a total loss absorption capacity of no more than 50 billion yuan at the first temporary general meeting of shareholders in 2024. Recently, non-capital bonds with a total loss absorption capacity of 2024 have been issued in the national interbank bond market and were successfully issued on August 12, 2024.

南下资金今日净买入港股19.18亿港元。

南下资金今日净买入港股19.18亿港元。