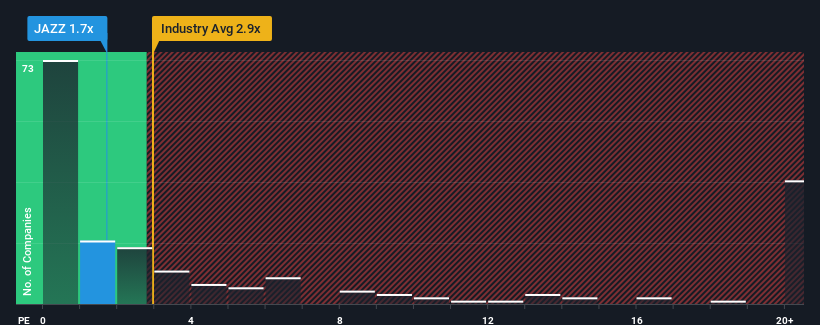

You may think that with a price-to-sales (or "P/S") ratio of 1.7x Jazz Pharmaceuticals plc (NASDAQ:JAZZ) is a stock worth checking out, seeing as almost half of all the Pharmaceuticals companies in the United States have P/S ratios greater than 2.9x and even P/S higher than 11x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

How Has Jazz Pharmaceuticals Performed Recently?

Recent times haven't been great for Jazz Pharmaceuticals as its revenue has been rising slower than most other companies. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Jazz Pharmaceuticals will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

Jazz Pharmaceuticals' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 3.9% last year. This was backed up an excellent period prior to see revenue up by 49% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenues over that time.

Taking a look back first, we see that the company managed to grow revenues by a handy 3.9% last year. This was backed up an excellent period prior to see revenue up by 49% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenues over that time.

Looking ahead now, revenue is anticipated to climb by 5.9% per year during the coming three years according to the analysts following the company. That's shaping up to be materially lower than the 18% each year growth forecast for the broader industry.

In light of this, it's understandable that Jazz Pharmaceuticals' P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What Does Jazz Pharmaceuticals' P/S Mean For Investors?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Jazz Pharmaceuticals maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. The company will need a change of fortune to justify the P/S rising higher in the future.

Plus, you should also learn about these 2 warning signs we've spotted with Jazz Pharmaceuticals (including 1 which doesn't sit too well with us).

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.