Financial giants have made a conspicuous bearish move on Walt Disney. Our analysis of options history for Walt Disney (NYSE:DIS) revealed 12 unusual trades.

Delving into the details, we found 25% of traders were bullish, while 58% showed bearish tendencies. Out of all the trades we spotted, 5 were puts, with a value of $200,515, and 7 were calls, valued at $368,284.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $84.0 to $100.0 for Walt Disney over the recent three months.

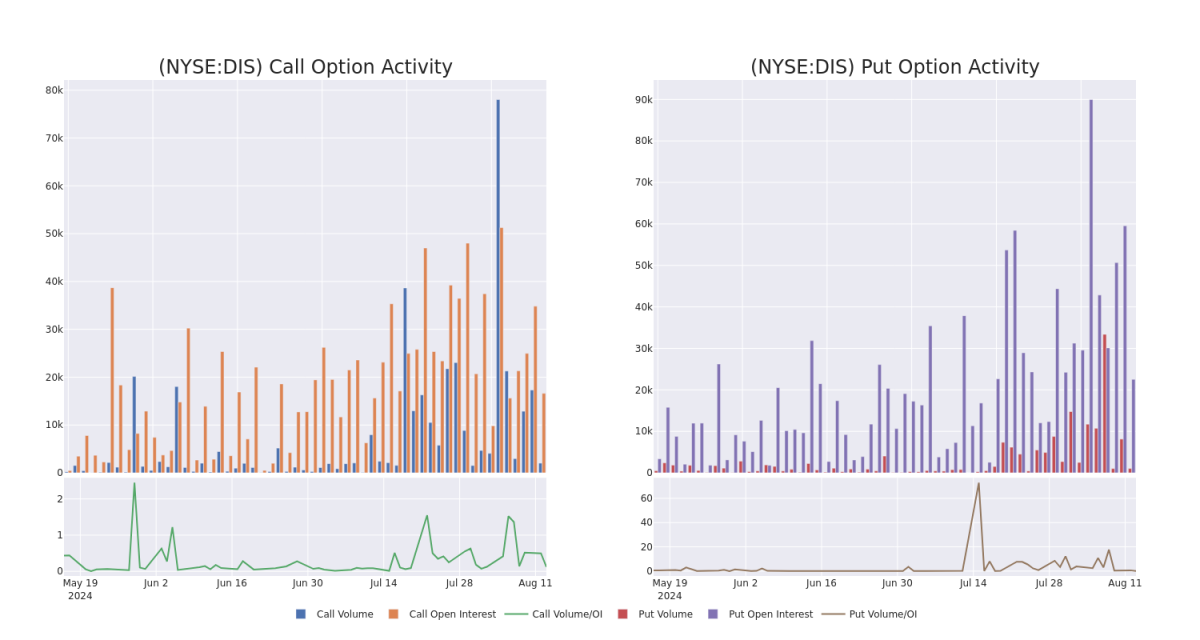

Volume & Open Interest Trends

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Walt Disney's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Walt Disney's whale trades within a strike price range from $84.0 to $100.0 in the last 30 days.

Walt Disney 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DIS | CALL | SWEEP | NEUTRAL | 12/18/26 | $11.75 | $11.3 | $11.75 | $100.00 | $117.5K | 844 | 46 |

| DIS | CALL | TRADE | BEARISH | 12/18/26 | $12.0 | $11.75 | $11.75 | $100.00 | $49.3K | 844 | 42 |

| DIS | CALL | TRADE | BEARISH | 09/20/24 | $3.3 | $3.25 | $3.25 | $85.00 | $48.7K | 2.7K | 192 |

| DIS | PUT | SWEEP | NEUTRAL | 09/20/24 | $9.7 | $9.5 | $9.6 | $95.00 | $48.0K | 8.5K | 297 |

| DIS | PUT | TRADE | BEARISH | 09/20/24 | $9.5 | $9.25 | $9.5 | $95.00 | $47.5K | 8.5K | 152 |

About Walt Disney

Disney operates in three global business segments: entertainment, sports, and experiences. Entertainment and experiences both benefit from franchises and characters the firm has created over the course of a century. Entertainment includes the ABC broadcast network, several cable television networks, and the Disney+ and Hulu streaming services. Within the segment, Disney also engages in movie and television production and distribution, with content licensed to movie theaters, other content providers, or, increasingly, kept in-house for use on Disney's own streaming platform and television networks. The sports segment houses ESPN and the ESPN+ streaming service. Experiences contains Disney's theme parks and vacation destinations, and also benefits from merchandise licensing.

After a thorough review of the options trading surrounding Walt Disney, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of Walt Disney

- With a trading volume of 1,627,179, the price of DIS is down by -0.56%, reaching $85.47.

- Current RSI values indicate that the stock is may be oversold.

- Next earnings report is scheduled for 85 days from now.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Walt Disney options trades with real-time alerts from Benzinga Pro.