Whales with a lot of money to spend have taken a noticeably bullish stance on Lululemon Athletica.

Looking at options history for Lululemon Athletica (NASDAQ:LULU) we detected 30 trades.

If we consider the specifics of each trade, it is accurate to state that 56% of the investors opened trades with bullish expectations and 26% with bearish.

From the overall spotted trades, 14 are puts, for a total amount of $970,307 and 16, calls, for a total amount of $1,042,698.

Projected Price Targets

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $200.0 to $470.0 for Lululemon Athletica over the last 3 months.

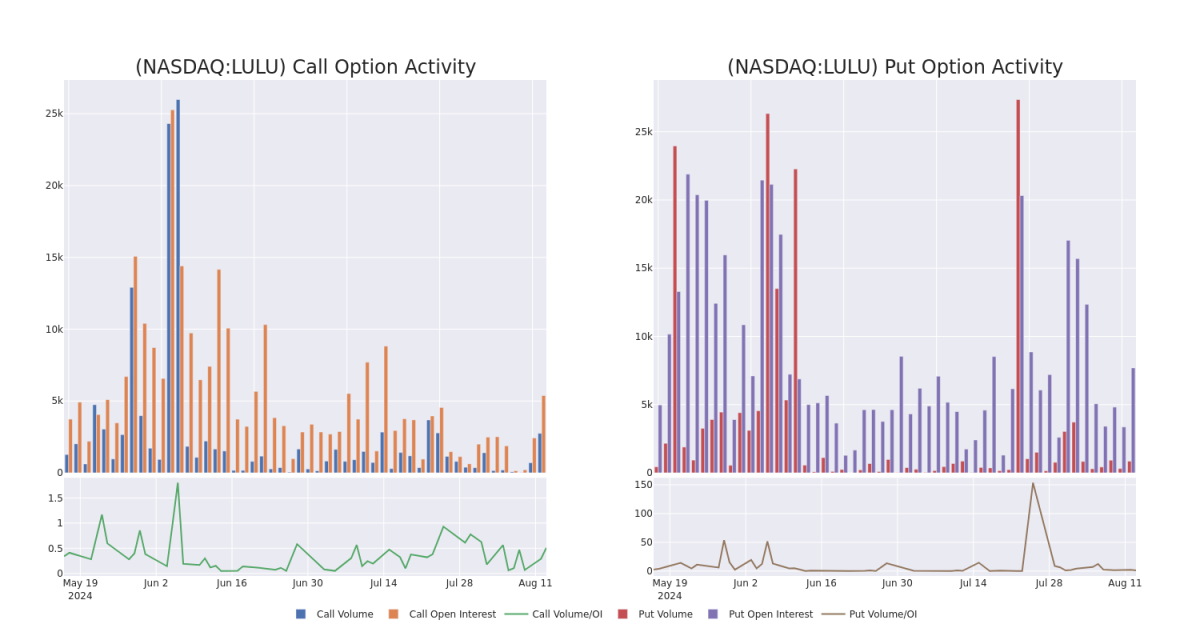

Volume & Open Interest Trends

In terms of liquidity and interest, the mean open interest for Lululemon Athletica options trades today is 568.09 with a total volume of 3,597.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Lululemon Athletica's big money trades within a strike price range of $200.0 to $470.0 over the last 30 days.

Lululemon Athletica Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LULU | PUT | SWEEP | BULLISH | 01/17/25 | $56.7 | $56.05 | $56.05 | $290.00 | $358.7K | 906 | 83 |

| LULU | CALL | SWEEP | BULLISH | 09/20/24 | $4.75 | $4.65 | $4.75 | $280.00 | $321.5K | 1.3K | 376 |

| LULU | PUT | SWEEP | BULLISH | 01/17/25 | $59.15 | $58.1 | $58.1 | $290.00 | $110.3K | 906 | 19 |

| LULU | CALL | SWEEP | BULLISH | 09/20/24 | $4.75 | $4.7 | $4.75 | $280.00 | $106.8K | 1.3K | 376 |

| LULU | PUT | TRADE | BULLISH | 01/17/25 | $32.1 | $32.0 | $32.0 | $250.00 | $96.0K | 2.2K | 32 |

About Lululemon Athletica

Lululemon Athletica designs, distributes, and markets athletic apparel, footwear, and accessories for women, men, and girls. Lululemon offers pants, shorts, tops, and jackets for both leisure and athletic activities such as yoga and running. The company also sells fitness accessories, such as bags, yoga mats, and equipment. Lululemon sells its products through more than 700 company-owned stores in about 20 countries, e-commerce, outlets, and wholesale accounts. The company was founded in 1998 and is based in Vancouver, Canada.

Following our analysis of the options activities associated with Lululemon Athletica, we pivot to a closer look at the company's own performance.

Current Position of Lululemon Athletica

- Currently trading with a volume of 1,853,386, the LULU's price is up by 0.94%, now at $241.95.

- RSI readings suggest the stock is currently may be approaching oversold.

- Anticipated earnings release is in 16 days.

What The Experts Say On Lululemon Athletica

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $365.2.

- An analyst from TD Cowen has decided to maintain their Buy rating on Lululemon Athletica, which currently sits at a price target of $420.

- Reflecting concerns, an analyst from Citigroup lowers its rating to Neutral with a new price target of $300.

- Maintaining their stance, an analyst from Baird continues to hold a Outperform rating for Lululemon Athletica, targeting a price of $350.

- An analyst from Baird persists with their Outperform rating on Lululemon Athletica, maintaining a target price of $470.

- Reflecting concerns, an analyst from Goldman Sachs lowers its rating to Neutral with a new price target of $286.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Lululemon Athletica options trades with real-time alerts from Benzinga Pro.