This Is What Whales Are Betting On Micron Technology

This Is What Whales Are Betting On Micron Technology

Deep-pocketed investors have adopted a bearish approach towards Micron Technology (NASDAQ:MU), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in MU usually suggests something big is about to happen.

富有的投资者对美光科技(纳斯达克:MU)采取了看淡的态度,这是市场参与者不应忽视的。我们在Benzinga对公共期权记录进行追踪,今天揭示了这个重大举动。这些投资者的身份不详,但在MU上这样巨大的举动通常意味着即将发生一些重大的事情。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 113 extraordinary options activities for Micron Technology. This level of activity is out of the ordinary.

我们从今天Benzinga的期权扫描器突出显示的113个非同寻常的美光科技期权交易中获得了这个信息。这种活跃度是非同寻常的。

The general mood among these heavyweight investors is divided, with 41% leaning bullish and 44% bearish. Among these notable options, 31 are puts, totaling $2,739,052, and 82 are calls, amounting to $8,134,916.

这些重量级投资者的情绪一直是分裂的,41%看好,44%看淡。在这些显著的期权中,有31个看跌期权,总额为2,739,052美元,82个看涨期权,总额为8,134,916美元。

Expected Price Movements

预期价格波动

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $40.0 to $220.0 for Micron Technology during the past quarter.

分析这些合同的成交量和未平仓合约,似乎大户在过去一个季度里一直在关注美光科技在40.0美元到220.0美元的价格区间。

Analyzing Volume & Open Interest

分析成交量和未平仓合约

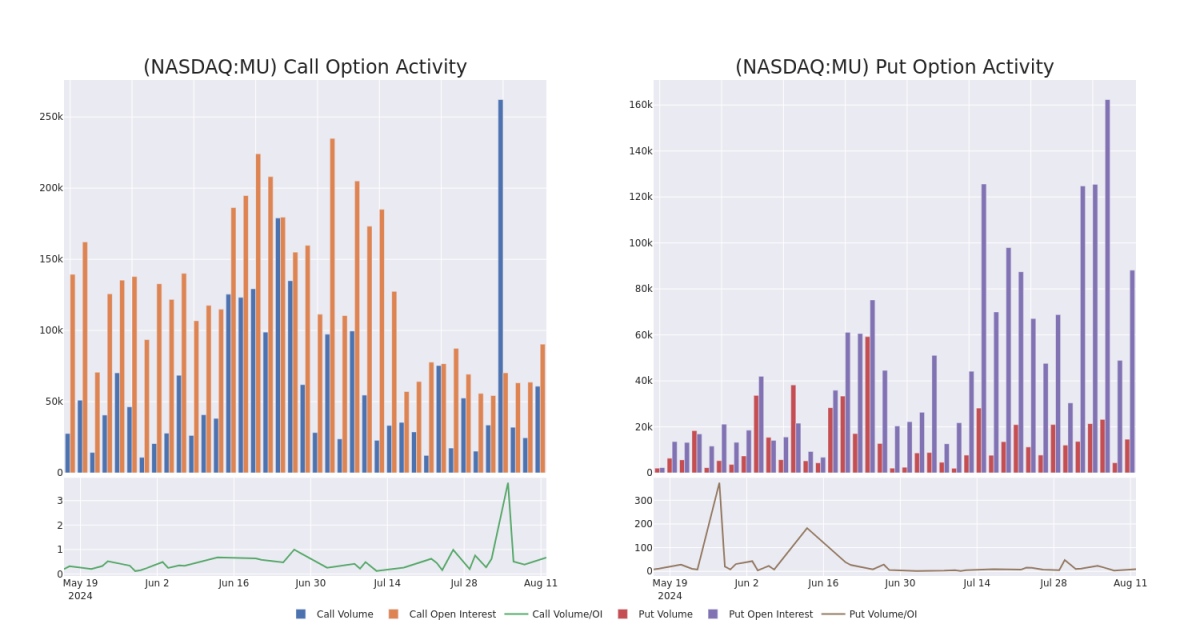

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Micron Technology's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Micron Technology's whale trades within a strike price range from $40.0 to $220.0 in the last 30 days.

在交易期权时查看成交量和未平仓合约是一种强有力的策略。这些数据可以帮助您追踪给定执行价格下美光科技期权的流动性和兴趣。下面,我们可以观察到过去30天所有美光科技鲸鱼交易在40.0美元到220.0美元行权价格区间内看涨期权和看跌期权的成交量和未平仓合约的演变。

Micron Technology Option Volume And Open Interest Over Last 30 Days

Micron Technology过去30天的期权成交量和未平仓合约

Biggest Options Spotted:

最大的期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MU | CALL | SWEEP | BULLISH | 02/21/25 | $13.55 | $13.3 | $13.55 | $100.00 | $406.5K | 223 | 14 |

| MU | PUT | TRADE | BEARISH | 12/20/24 | $18.15 | $17.75 | $18.15 | $110.00 | $196.0K | 3.7K | 112 |

| MU | PUT | SWEEP | BULLISH | 01/17/25 | $16.1 | $16.0 | $16.03 | $105.00 | $160.0K | 5.9K | 601 |

| MU | PUT | TRADE | BULLISH | 01/17/25 | $16.05 | $16.0 | $16.0 | $105.00 | $160.0K | 5.9K | 361 |

| MU | PUT | TRADE | BEARISH | 01/17/25 | $15.95 | $15.95 | $15.95 | $105.00 | $159.5K | 5.9K | 261 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 美光 | 看涨 | SWEEP | 看好 | 02/21/25 | $13.55 | $13.3 | $13.55 | $100.00。 | $406.5K | 223 | 14 |

| 美光 | 看跌 | 交易 | 看淡 | 12/20/24 | $18.15 | $17.75 | $18.15 | $110.00 | $196.0K | 3.7K | 112 |

| 美光 | 看跌 | SWEEP | 看好 | 01/17/25 | $16.1 | $16.0 | $16.03 | $105.00 | $160.0K | 5.9K | 601 |

| 美光 | 看跌 | 交易 | 看好 | 01/17/25 | $16.05 | $16.0 | $16.0 | $105.00 | $160.0K | 5.9K | 361 |

| 美光 | 看跌 | 交易 | 看淡 | 01/17/25 | $15.95 | $15.95 | $15.95 | $105.00 | $159.5K | 5.9K | 261 |

About Micron Technology

关于美光科技

Micron is one of the largest semiconductor companies in the world, specializing in memory and storage chips. Its primary revenue stream comes from dynamic random access memory, or DRAM, and it also has minority exposure to not-and or NAND, flash chips. Micron serves a global customer base, selling chips into data centers, mobile phones, consumer electronics, and industrial and automotive applications. The firm is vertically integrated.

美光科技是世界上最大的半导体公司之一,专门从事存储芯片。其主要营业收入来自动态随机存取存储器(DRAM),它还少量接触与或非(NAND)闪存芯片。美光科技服务于全球用户,将芯片销售到数据中心、移动电话、消费电子、工业和汽车应用中。该公司具有垂直一体化优势。

Following our analysis of the options activities associated with Micron Technology, we pivot to a closer look at the company's own performance.

在我们对美光科技期权活动的分析之后,我们转而更近距离地关注该公司的表现。

Present Market Standing of Micron Technology

美光科技的目前市场地位

- Trading volume stands at 23,367,983, with MU's price up by 2.92%, positioned at $97.4.

- RSI indicators show the stock to be may be approaching oversold.

- Earnings announcement expected in 43 days.

- 交易量为23,367,983,MU价格上涨2.92%,位于97.4美元。

- RSI指标显示该股票可能正接近超卖。

- 预计会有一次收益公告,还有43天。

Professional Analyst Ratings for Micron Technology

美光科技的专业分析师评级

1 market experts have recently issued ratings for this stock, with a consensus target price of $145.0.

1位市场专家最近为该股发出了评级,一致的目标价为145.0美元。

- An analyst from Keybanc persists with their Overweight rating on Micron Technology, maintaining a target price of $145.

- KeyBanc的分析师坚持对美光科技的超重评级,维持目标价145美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Micron Technology options trades with real-time alerts from Benzinga Pro.

期权交易存在更高的风险和潜在收益。 精明的交易者通过不断学习,调整策略,监控多个因子并密切关注市场动向来管理这些风险。 通过Benzinga Pro的实时警报了解最新的Micron Technology期权交易情况。