Guangdong Hybribio Biotech Co.,Ltd. (SZSE:300639) shareholders would be excited to see that the share price has had a great month, posting a 36% gain and recovering from prior weakness. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 34% over that time.

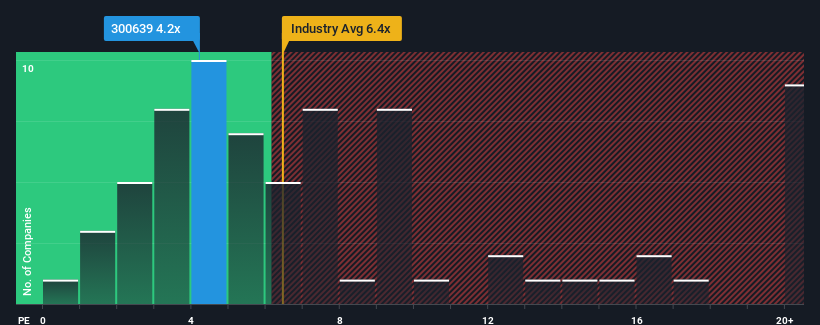

In spite of the firm bounce in price, Guangdong Hybribio BiotechLtd may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 4.2x, since almost half of all companies in the Biotechs industry in China have P/S ratios greater than 6.4x and even P/S higher than 10x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

How Guangdong Hybribio BiotechLtd Has Been Performing

For example, consider that Guangdong Hybribio BiotechLtd's financial performance has been poor lately as its revenue has been in decline. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Although there are no analyst estimates available for Guangdong Hybribio BiotechLtd, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Guangdong Hybribio BiotechLtd?

Guangdong Hybribio BiotechLtd's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered a frustrating 78% decrease to the company's top line. As a result, revenue from three years ago have also fallen 46% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 267% shows it's an unpleasant look.

With this information, we are not surprised that Guangdong Hybribio BiotechLtd is trading at a P/S lower than the industry. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

What We Can Learn From Guangdong Hybribio BiotechLtd's P/S?

Despite Guangdong Hybribio BiotechLtd's share price climbing recently, its P/S still lags most other companies. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Guangdong Hybribio BiotechLtd revealed its shrinking revenue over the medium-term is contributing to its low P/S, given the industry is set to grow. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises either. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

You should always think about risks. Case in point, we've spotted 4 warning signs for Guangdong Hybribio BiotechLtd you should be aware of.

If these risks are making you reconsider your opinion on Guangdong Hybribio BiotechLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.