Top 3 Energy Stocks That May Rocket Higher This Quarter

Top 3 Energy Stocks That May Rocket Higher This Quarter

可能在本季度大涨的前3个能源股

The most oversold stocks in the energy sector presents an opportunity to buy into undervalued companies.

能源板块中超卖的股票为买入低估公司提供了机会。

The RSI is a momentum indicator, which compares a stock's strength on days when prices go up to its strength on days when prices go down. When compared to a stock's price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

RSI指标是一种动量指标,它比较了股票在价格上涨时的强度与在价格下跌时的强度。与股票的价格走势进行比较,可以给交易者更好的了解股票短期内表现的良好程度。当RSI低于30时,资产通常被认为是超卖的,根据Benzinga Pro的数据。

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

以下是本行业板块最近的主要超卖股票列表,RSI接近或低于30。

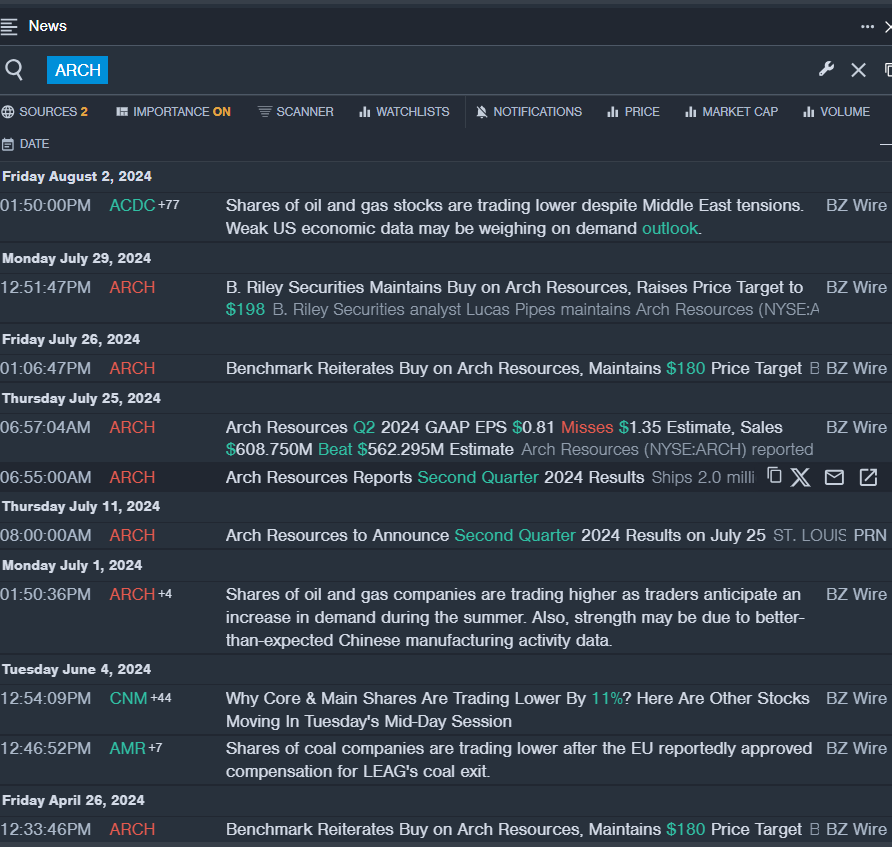

Arch Resources Inc (NYSE:ARCH)

arch resources公司(纽交所:ARCH)

- On July 25, Arch Resources posted weaker-than-expected quarterly earnings. "During the quarter, the Arch team moved quickly and nimbly in the wake of the tragic bridge collapse in Baltimore, taking steps to facilitate the continuing flow of our coking coal products to steelmakers and redirecting volumes to our 35-percent-owned DTA facility," said Paul A. Lang, Arch's CEO. "Through these efforts, the metallurgical segment – in collaboration with our railroad and terminal partners – succeeded in shipping more than two million tons of coking coal even as Baltimore's deepwater channel remained closed throughout the first 70 days of the quarter before all restrictions were lifted on the shipping channel on June 10." The company's stock fell around 21% over the past month and has a 52-week low of $125.90.

- RSI Value: 28.15

- ARCH Price Action: Shares of Arch Resources fell 0.7% to close at $128.53 on Tuesday.

- Benzinga Pro's real-time newsfeed alerted to latest ARCH news.

- 2021年7月25日,Arch Resources发布了低于预期的季度收益报告。Arch的CEO保罗·朗表示:“在季度中,Arch团队在一桥铁路事故的影响下迅速采取行动,采取措施促进我们焦煤产品的持续流向钢铁制造商,并将一部分产能重定向到我们拥有35%股权的DTA设施。” “在我们与铁路和终端合作伙伴的合作下,冶金部门成功装运了超过200万吨的焦煤,即使在季度的前70天里,巴尔的摩的深水航道仍然关闭,在6月10日取消限制之前。”公司的股价在过去一个月下跌了约21%,并且创下了52周的最低点125.90美元。

- RSI数值:28.15

- ARCH股票价格表现:周二Arch Resources的股票下跌了0.7%,收于128.53美元。

- Benzinga Pro的实时资讯提醒了最新的ARCH资讯。

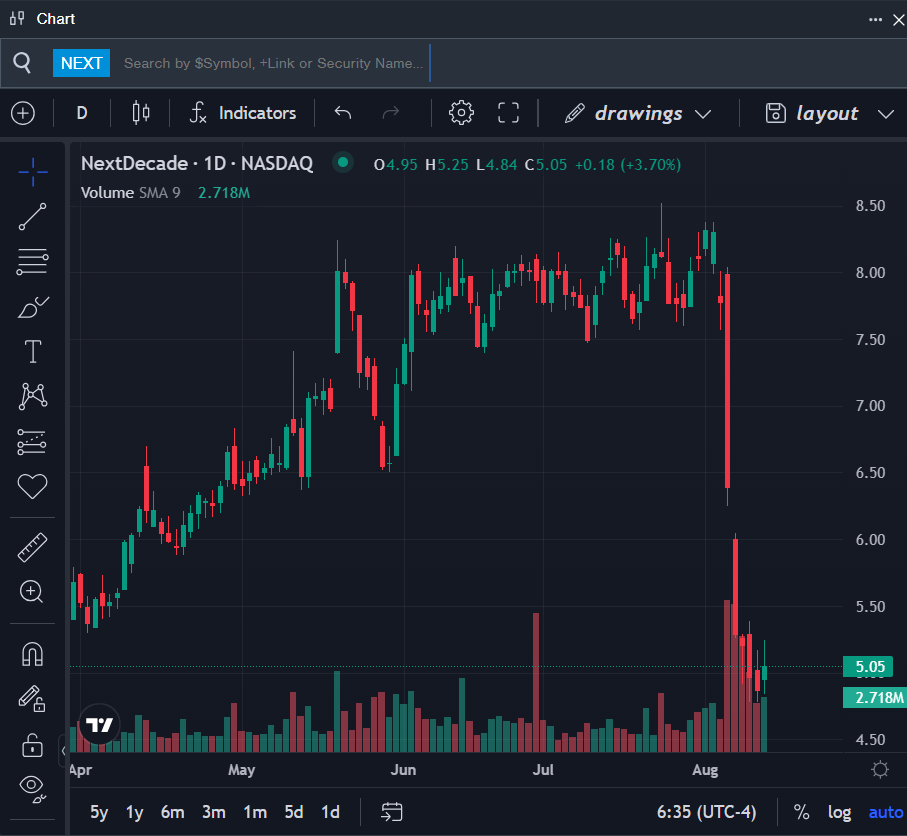

Nextdecade Corp (NASDAQ:NEXT)

nextdecade公司(纳斯达克:NEXT)

- On Aug. 6, NextDecade said the U.S. Court of Appeals issued an order to revoke the company's authorization to operate its Rio Grand LNG Facility. The company's stock fell around 38% over the past month. It has a 52-week low of $4.03.

- RSI Value: 23.51

- NEXT Price Action: Shares of Nextdecade gained 3.7% to close at $5.05 on Tuesday.

- Benzinga Pro's charting tool helped identify the trend in NEXT stock.

- 2021年8月6日,NextDecade表示,美国上诉法院发出了一项命令,撤销了该公司运营里约格兰LNG设施的授权。该公司的股价在过去一个月下跌了约38%,并且创下了52周的最低点4.03美元。

- RSI数值:23.51

- NEXT股票价格表现:周二NEXT的股票上涨了3.7%,收于5.05美元。

- Benzinga Pro的图表工具帮助识别了NEXt股票的趋势。

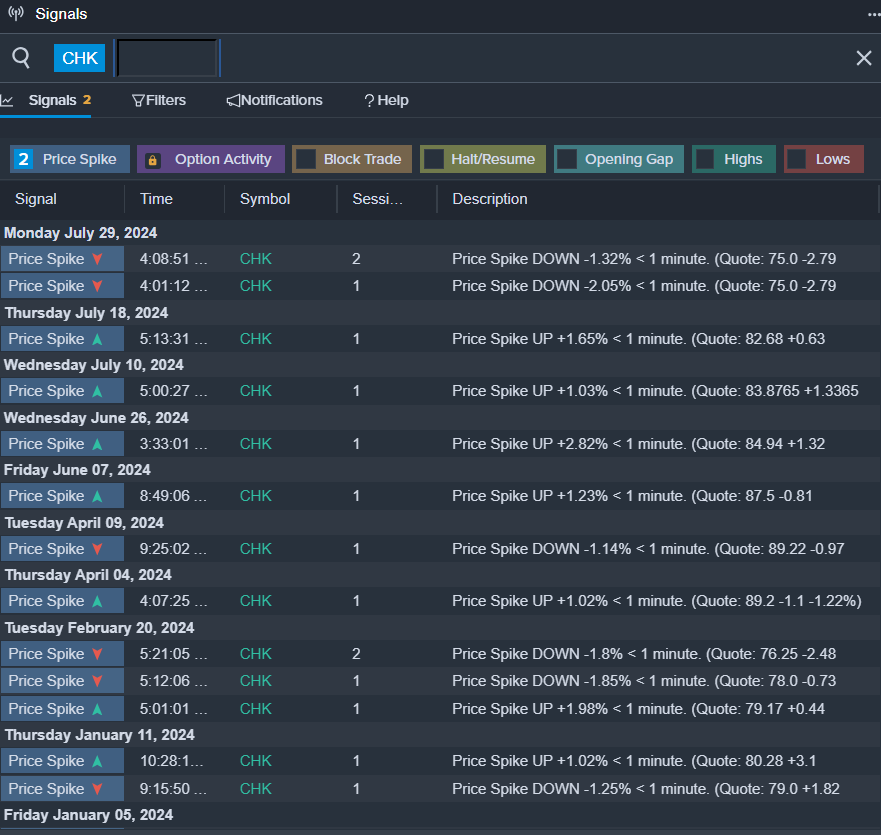

Chesapeake Energy Corp (NASDAQ:CHK)

Chesapeake Energy公司(纳斯达克:CHK)

- On July 29, Chesapeake Energy reported quarterly earnings of 1 cent per share, a 98.44% decrease from earnings of 64 cents per share from the same period last year. The company reported quarterly sales of $505 million, missing the analyst consensus estimate of $787.14 million by 35.84%. "We continue to execute our business as we prudently manage current market conditions and prepare for our pending combination with Southwestern. We remain focused on operational improvements and enhancing capital efficiency. The efforts of our team have positioned us to lower our 2024 capital and production expense guidance by $50 million and approximately 8%, respectively," said Nick Dell'Osso, Chesapeake's CEO. The company's shares fell around 14% over the past month and has a 52-week low of $69.42.

- RSI Value: 29.44

- CHK Price Action: Shares of Chesapeake Energy fell 1.5% to close at $72.25 on Tuesday.

- Benzinga Pro's signals feature notified of a potential breakout in CHK shares.

- 2021年7月29日,Chesapeake Energy报告了每股收益为1美分的季度收益,与去年同期的每股收益64美分相比下降了98.44%。公司季度销售额为5.05亿美元,较分析师一致预期的7.8714亿美元下降了35.84%。Chesapeake的CEO尼克·戴尔奥索表示:“我们继续执行我们的业务,慎重地管理当前的市场状况,并为我们与西南榴园的合并做好准备。我们继续专注于运营改善和提高资本效率。我们团队的努力使我们将2024年的资本和生产费用指南降低了5000万美元和约8%。” 公司的股价在过去一个月下跌了约14%,并且创下了52周的最低点69.42美元。

- RSI数值:29.44

- CHK股票价格表现:周二Chesapeake Energy的股票下跌了1.5%,收于72.25美元。

- Benzinga Pro的信号功能提醒了CHk股票的潜在突破。

- Nasdaq, Dow Jones Jump Over 400 Points Following PPI Report: Investor Sentiment Improves But Greed Index Remains In 'Extreme Fear' Zone

- 纳斯达克、道琼斯指数因PPI报告暴涨400点:投资者情绪改善,但贪婪指数仍处于‘极度恐惧’区域。