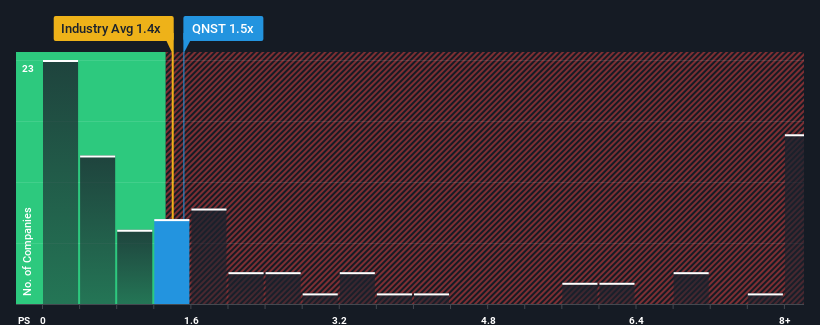

There wouldn't be many who think QuinStreet, Inc.'s (NASDAQ:QNST) price-to-sales (or "P/S") ratio of 1.5x is worth a mention when the median P/S for the Interactive Media and Services industry in the United States is similar at about 1.4x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

How Has QuinStreet Performed Recently?

Recent times haven't been great for QuinStreet as its revenue has been rising slower than most other companies. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think QuinStreet's future stacks up against the industry? In that case, our free report is a great place to start.How Is QuinStreet's Revenue Growth Trending?

In order to justify its P/S ratio, QuinStreet would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 5.7%. The latest three year period has also seen a 6.1% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Shifting to the future, estimates from the six analysts covering the company suggest revenue should grow by 18% per annum over the next three years. That's shaping up to be materially higher than the 12% per annum growth forecast for the broader industry.

With this information, we find it interesting that QuinStreet is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Bottom Line On QuinStreet's P/S

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that QuinStreet currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Plus, you should also learn about this 1 warning sign we've spotted with QuinStreet.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.