Financial giants have made a conspicuous bullish move on Adobe. Our analysis of options history for Adobe (NASDAQ:ADBE) revealed 32 unusual trades.

Delving into the details, we found 46% of traders were bullish, while 25% showed bearish tendencies. Out of all the trades we spotted, 19 were puts, with a value of $1,758,928, and 13 were calls, valued at $594,077.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $420.0 to $600.0 for Adobe over the recent three months.

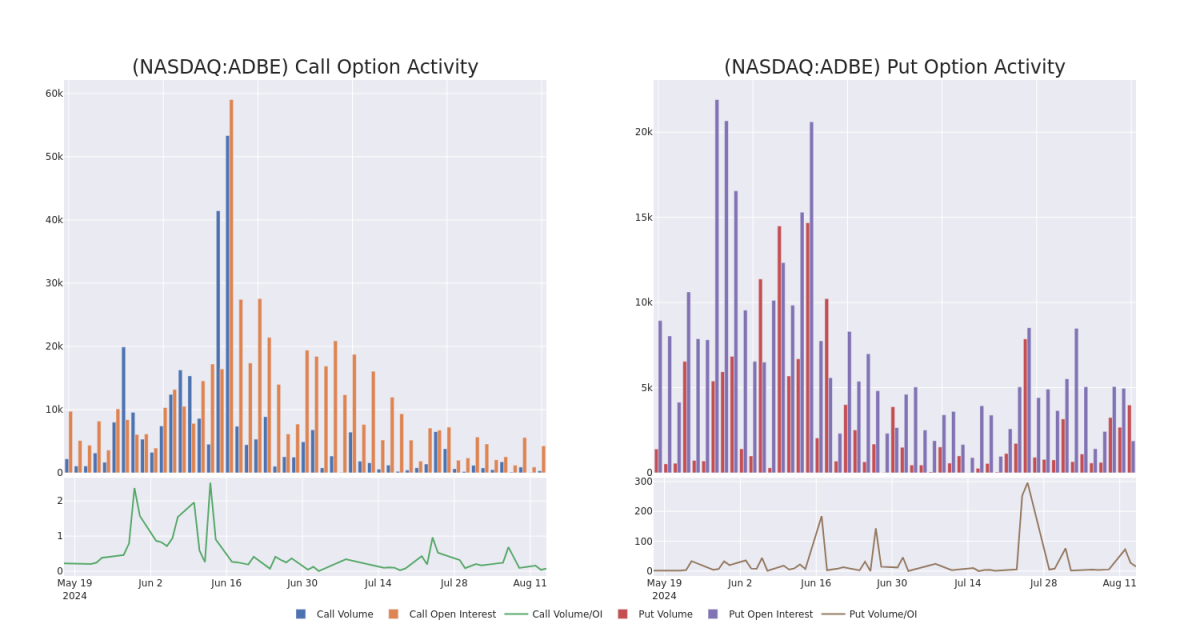

Analyzing Volume & Open Interest

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Adobe's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Adobe's significant trades, within a strike price range of $420.0 to $600.0, over the past month.

Adobe Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ADBE | PUT | SWEEP | BULLISH | 12/20/24 | $29.05 | $29.0 | $29.0 | $510.00 | $498.8K | 279 | 173 |

| ADBE | PUT | SWEEP | BULLISH | 06/20/25 | $57.65 | $56.15 | $56.15 | $540.00 | $353.8K | 329 | 63 |

| ADBE | CALL | TRADE | BEARISH | 09/20/24 | $93.65 | $90.3 | $91.55 | $450.00 | $183.1K | 154 | 20 |

| ADBE | PUT | SWEEP | BEARISH | 11/15/24 | $38.65 | $38.05 | $38.2 | $545.00 | $95.4K | 251 | 95 |

| ADBE | PUT | TRADE | BEARISH | 11/15/24 | $38.25 | $38.1 | $38.25 | $545.00 | $68.8K | 251 | 442 |

About Adobe

Adobe provides content creation, document management, and digital marketing and advertising software and services to creative professionals and marketers for creating, managing, delivering, measuring, optimizing,g and engaging with compelling content multiple operating systems, devices, and media. The company operates with three segments: digital media content creation, digital experience for marketing solutions, and publishing for legacy products (less than 5% of revenue).

Adobe's Current Market Status

- Currently trading with a volume of 1,906,510, the ADBE's price is up by 0.85%, now at $539.79.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 29 days.

Professional Analyst Ratings for Adobe

Over the past month, 1 industry analysts have shared their insights on this stock, proposing an average target price of $600.0.

- Reflecting concerns, an analyst from RBC Capital lowers its rating to Outperform with a new price target of $600.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Adobe options trades with real-time alerts from Benzinga Pro.