Michael Burry's investment company, Scion Asset Management, reported that the company increased its holdings of 0.03 million shares of Alibaba stocks in the second quarter, and the holding value increased from 9 million US dollars in the first quarter to 11.2 million US dollars. In the second quarter, Scion also increased its holdings of over 0.03 million shares of Baidu stocks, with a holding value of 6.5 million US dollars at the end of June. After clearing out popular US stocks in the first quarter, the company significantly reduced its US stock holdings in the second quarter.

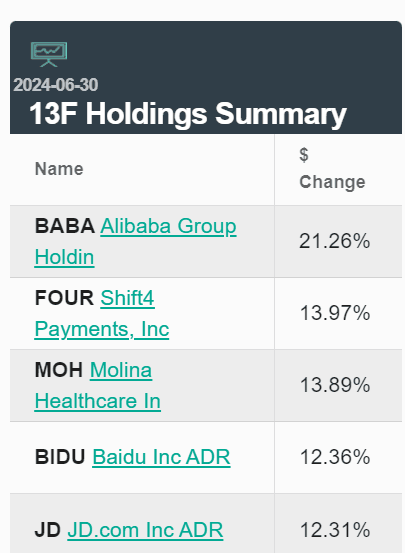

Michael Burry, the "big short" who made money during the subprime crisis, made big moves in the second quarter of this year. In Q2, he further increased his shareholdings in Alibaba and Baidu, with Alibaba surpassing JD.com to become his largest holding as of June 30. At the same time, the "big short" slashed his entire stock portfolio in half.

Burry became famous during the 2007 subprime crisis, and his reputation in the international capital circle soared by shorting stocks. His story was adapted into the movie "The Big Short".

According to Scion's latest 13F filed with the US SEC on Wednesday, Burry's investment company Scion Asset Management increased its stake in Alibaba by 0.03 million shares in Q2, with the value of its holding increasing from $9 million in the first quarter to $11.2 million, making it Scion's largest holding.

According to Scion's latest 13F filed with the US SEC on Wednesday, Burry's investment company Scion Asset Management increased its stake in Alibaba by 0.03 million shares in Q2, with the value of its holding increasing from $9 million in the first quarter to $11.2 million, making it Scion's largest holding.

In Q2, Scion also increased its stake in Baidu by more than 0.03 million shares, worth $2 million. As of June 30, it held 0.075 million shares of Baidu, valued at $6.5 million.

Last quarter, Scion reduced its holdings in JD.com. In Q2, the reduction was 0.11 million shares, worth slightly over $3 million, but JD.com remains one of Scion's largest holdings in its portfolio.

In Q1, Scion massively increased its investment in Chinese internet giants, including increased holdings in JD.com and Alibaba, as well as opening a position in Baidu. As of the end of Q1 this year, JD.com and Alibaba were its largest holdings, with a 80% and 66.67% increase in holdings respectively.

In fact, Alibaba and JD.com have been in Scion's portfolio since Q4 2022, but the decisive buying occurred in Q1 this year.

Payment technology provider Shift4 Payments is Scion's second largest holding, with a total net value of approximately $7.3 million. In Q2, Scion established a new position in Shift4 and purchased 0.1 million shares.

In Q2, Scion established new positions in multiple industries including financial services, healthcare and commercial real estate. In addition to the aforementioned Shift4 Payments, Scion also holds new positions in Molina Healthcare and real estate investment trust company Hudson Pacific Properties, each with individual stock holdings valued at over $5.5 million.

Scion also increased its holdings in beauty company Olaplex and biotechnology company BioAtla during the reporting period.

In Q2, Scion reduced its holdings in luxury consignment retailer RealReal.

During the quarter, Scion exited positions in multiple targets, including HCA Healthcare, Citigroup, payment service provider Block, healthcare company Cigna Group and automotive parts retailer Advance Auto Parts.

As of Q2, Scion holds a total of 10 stocks with a total value of over $52 million, a size that has decreased by a staggering nearly 50% compared to the previous quarter.

Michael Burry's name once made Wall Street tremble, attracting market attention with his long and short positions. While massively adding Chinese concept stocks, his remaining positions, he has done this before this year. Scion's 13F as of the end of Q1 this year showed that while going long on Chinese concept stocks, Burry liquidated positions in Google and Amazon, two of the "seven sisters" of the US stock market.

"The big short"'s bearish sentiment on the US market has been "intensifying" since 2019, constantly warning of the high risks of US stocks through social media. He posted in 2022, "That familiar stupidity hasn't disappeared yet."

This year, the "big short"'s operations have been quite targeted. What has he sniffed out this time?

根据Scion公司周三提交给美国SEC的最新13F文件,Burry旗下的投资公司Scion资产管理公司报告称,该公司在二季度增持了3万股阿里巴巴股票,

根据Scion公司周三提交给美国SEC的最新13F文件,Burry旗下的投资公司Scion资产管理公司报告称,该公司在二季度增持了3万股阿里巴巴股票,