The investment trend vane is here

Recently, Wall Street investment giants have successively submitted 13F forms to the US SEC.

Following BlackRock and J.P. Morgan Chase, investment institutions such as Berkshire, Bridgewater, and Gao Lin's HLR have also released their latest position reports.

Bridgewater Q2 “slashes” Apple, reduces Nvidia's position

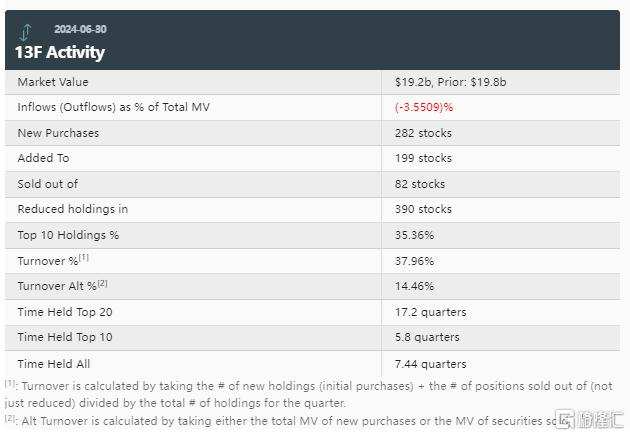

According to the 13F document, the market value of the world's largest hedge fund Qiaoshui's holdings in the second quarter was 19.2 billion US dollars, compared to 19.8 billion US dollars in the previous quarter, a decrease of 0.6 billion US dollars over the previous quarter.

According to the 13F document, the market value of the world's largest hedge fund Qiaoshui's holdings in the second quarter was 19.2 billion US dollars, compared to 19.8 billion US dollars in the previous quarter, a decrease of 0.6 billion US dollars over the previous quarter.

In the investment portfolio, Qiaoshui Q2 increased its holdings by 199, reduced its holdings by 390, added 282 new targets, and cleared 82 stocks.

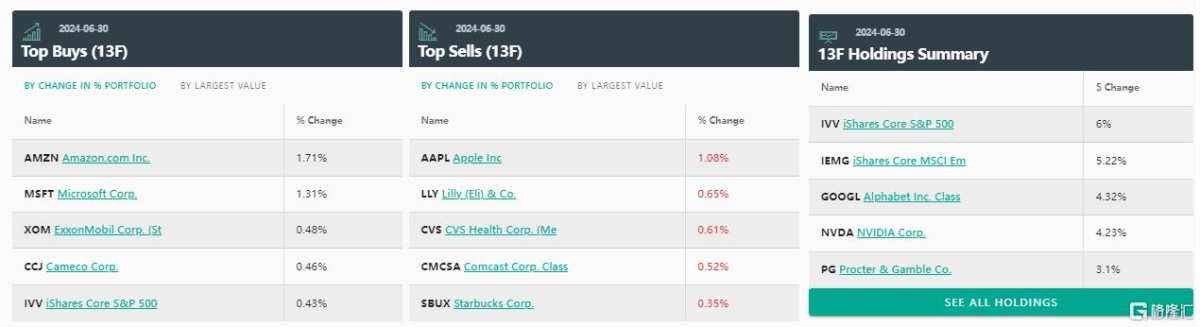

In the second quarter, Qiaoshui's top ten holdings accounted for 35.36% of the total market value, and the positions of US tech giants were drastically adjusted.

Among them, the iShares core S&P 500 ETF and the iShares core MSCI emerging market ETF are still in the top two, while Google, Nvidia, Procter & Gamble, Amazon, Microsoft, Meta, Johnson & Johnson, and Walmart rank in the top ten in that order.

Bridgewater Q2 significantly increased positions on Amazon and Microsoft. The holdings of Amazon increased by 1.59 million shares and Microsoft 0.51 million shares, by 152% and 88%, respectively.

Positions were opened with Constellation Energy (Constellation Energy), Chevron, and Uranium Energy (Uranium Energy), with positions opened at 0.194 million shares, 0.153 million shares, and 4.04 million shares, respectively.

The top five targets for reducing positions were Apple, Eli Lilly, CVS (CVS), Comcast, and Starbucks.

Among them, Apple's holdings decreased by more than 70% from 1.84 million shares to 0.469 million shares, and its share of the investment portfolio fell from 1.6% to 0.52%, ranking 38th.

Nvidia's holdings were reduced by 0.489 million shares, down nearly 7% month-on-month. Google's holdings of 0.828 million shares and Pinduoduo's 0.289 million shares were reduced, and Eli Lilly's holdings were also reduced from 0.28 million shares to 0.096 million shares.

Gao Lin HLR: Pinduoduo's top position, increased Nvidia holdings

According to the 13F report, the total market value of Gao Lin's HHLR holdings in the second quarter was about 4.054 billion US dollars, compared to 4.6 billion US dollars in the previous quarter.

In the investment portfolio, HHLR Q2 increased its holdings by 17, reduced its holdings by 17, added 24 new targets, and cleared 9 stocks.

The top ten holdings account for 85.4% of the total market capitalization, and Chinese securities dominate.

Among them, Pinduoduo is still the largest stock, with BaiGe Shenzhou and Alibaba ranking second and third respectively. Shell, Legendary Creatures, Vipshop, NetEase, ARRIVENT BIOPHARMA, Ctrip, and KINIKSA PHARMACEUTICALS ranked in the top ten in that order.

In the second quarter, HHLR increased its holdings of Alibaba by 5.24 million shares, making it the third-largest holding target, increasing its holdings of Vipshop by 14.61 million shares and increasing its holdings of securities such as NetEase and Ctrip.

The holdings of companies such as Pinduoduo, Amazon, Microsoft, Danaher, and Shell have been reduced. Among them, Pinduo's holdings were reduced by 2.9 million shares, but it was still the most important stock, reduced its holdings of Shell by more than 6 million, and also cleared Baidu.

In addition to China Securities, tech giants are also favorites of HHLR Advisors.

In terms of the top seven US technology companies, HHLR increased its holdings of Apple, Nvidia, Google, and META, and reduced its holdings of Amazon and Microsoft.