Track the latest trends of north-south directional funds.

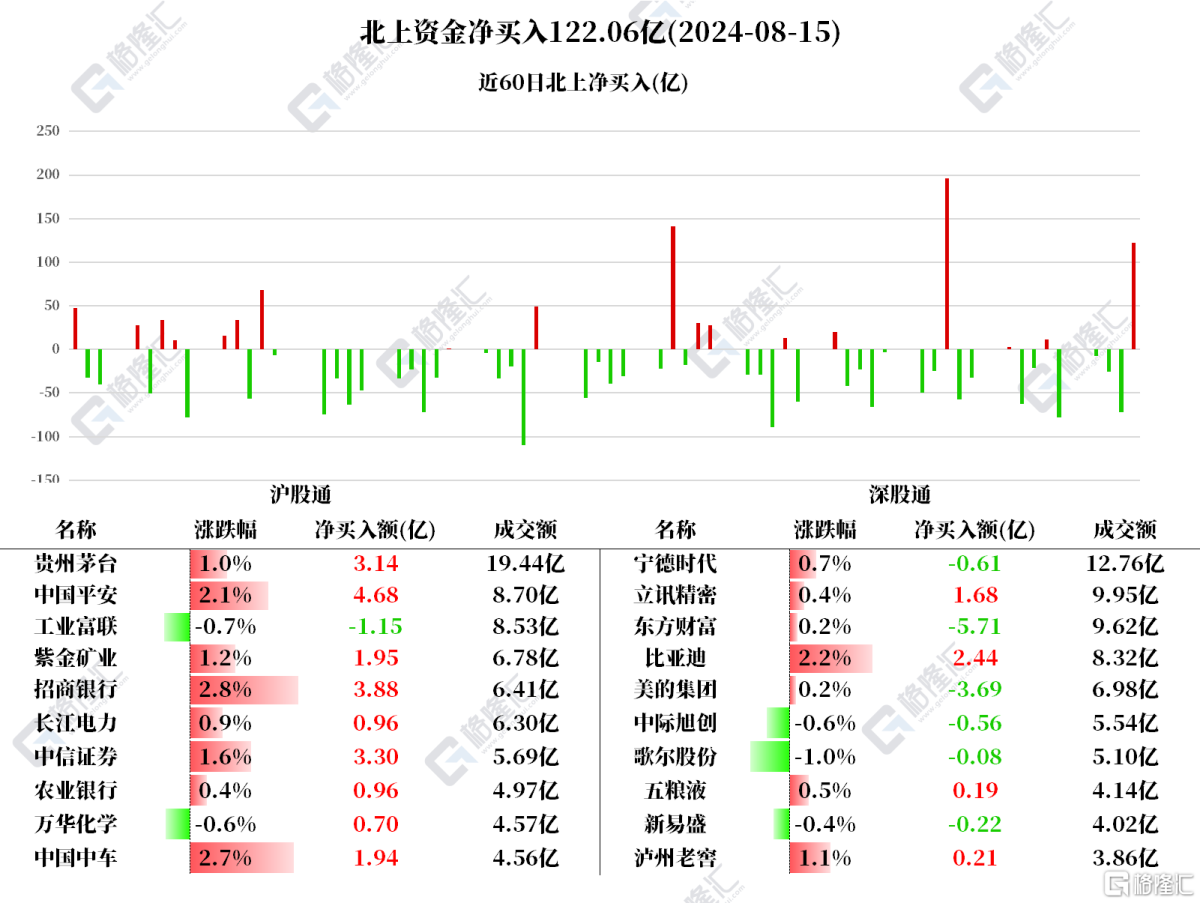

On August 15th, Northward funds net bought A shares of 12.206 billion yuan, the largest net purchase amount in a single day since July 31st.

Ping An Insurance, CM Bank, and Citic Securities received net purchases of 0.468 billion yuan, 0.388 billion yuan, and 0.33 billion yuan respectively, while East Money Information and Midea Group received net sales of 0.571 billion yuan and 0.369 billion yuan respectively.

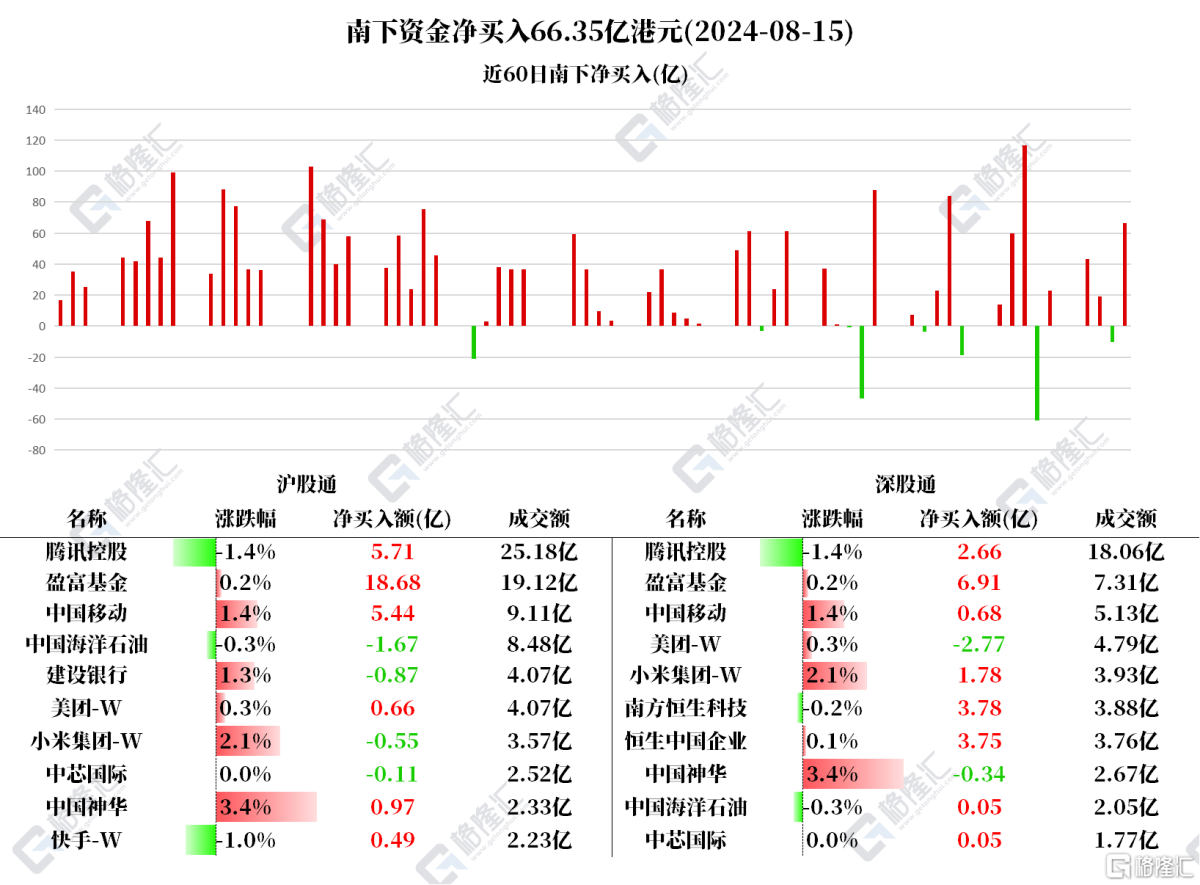

Southbound funds today net bought Hong Kong stocks of 6.635 billion Hong Kong dollars.

Southbound funds today net bought Hong Kong stocks of 6.635 billion Hong Kong dollars.

Net purchases of tracker fund of Hong Kong (Yield): 2.559 billion, Tencent: 0.837 billion, China Mobile: 0.612 billion, CSOP Hang Seng Tech Index ETF: 0.378 billion, Hang Seng H-Share Index ETF: 0.375 billion, Xiaomi: 0.122 billion; Net sales of Meituan: 0.21 billion, and CNOOC: 0.161 billion.

According to statistics, Southbound funds have been net buying Xiaomi for 15 consecutive days, with a total of 2.2721 billion Hong Kong dollars; and net buying China Mobile for 4 consecutive days, with a total of 1.78105 billion Hong Kong dollars.

Individual Stocks Concerned: China Mobile: On the news front, Goldman Sachs issued a research report stating that the company's management maintained its expectations for stable growth in revenue and profit in 2024. Due to increased R&D and marketing expenses for enterprise business (cloud, artificial intelligence, industrial internet, etc.), EBITDA profit margin continued to show a downward trend, but the slowdown in depreciation costs helped support the trend of stable net profit margin. The management believes that the dividend payout ratio can be increased from 71% to the target of 75% in 2026. Goldman Sachs believes that stable business growth and steady capital expenditures should help China Mobile gradually increase its dividends. Chinahongqiao:

CM Bank rose 2.81% today, leading the way in Mainland China banking. Securities research report by Cai Xing indicates that the current valuation of the banking sector is still at a low level. Against the background of the asset drought, high dividend absolute returns are still the long-term investment logic of the sector. As the dollar gradually enters a rate cut cycle and may increase its attractiveness to foreign capital, focus on core assets of the banks.

CITIC Securities rose 1.59% today. CITIC Securities announced that the board meeting will be held on Wednesday, August 28, 2024, to consider and approve the recommendation of the unaudited performance and interim dividend distribution of the company and its subsidiaries for the six months ended June 30, 2024.

Materials of the companies of North Water

Tencent fell 1.44% today. The company's Q2 results continued its high growth momentum, driven by new games and short video platform. UBS Group gave Tencent a "buy" rating with a target price of HKD 483.

Xiaomi rose 2.14% today. Xiaomi has recently issued a cadre appointment document internally, adjusting the personnel of the Xiaomi Group Brand Management Committee. Lu Weibing, the Group President, was appointed as the Chairman of the Committee and Zeng Xuezong, the Senior Vice President of the Group, Wang Xiaoyan and Xu Fei, the Vice Presidents of the Group, were appointed as Vice Chairmen of the Committee, responsible for major strategic discussions and decisions on the core brand architecture and brand assets of the Group.

Meituan rose 0.29% today. Recently, Midea Group and Meituan reached a strategic cooperation, and 25,000 home appliance specialty stores will settle in Meituan to promote the digitization of the full-link 'trade-in' of home appliances.

南下资金今日净买入港股66.35亿港元。

南下资金今日净买入港股66.35亿港元。