During the European session on Thursday, the USD/JPY V-shaped reversed after touching a low of 147.049 and was reported at 147.359 with a gain of 0.02%.

Historical trends suggest weak US economic data.

After being dominated by the latest inflation data earlier this week, today's focus returned to US economic activity. Specifically, retail sales and weekly jobless claims for July. Economists expect that the control group retail sales will rise by 0.1%, and the claimants will slightly increase to 0.235 million people.

Look at the number of people who applied for jobless claims in the past month. It's like a yo-yo, dramatically moving from one week to the next. If this pattern continues, we may see another significant increase today.

Moderate growth of control group retail sales (directly calculated into US GDP) is by no means inevitable, as we have seen three months of unprecedented growth since 2018, indicating that we may see negative growth later today.

If these patterns continue (the key is "if"), then temporarily alleviated recession concerns may re-emerge, leading to a resurgence of risk assets. While inferring data trends to form a specific view of the economy is dangerous, this is what the market has done in August, combined with low trading volume, resulting in extreme fluctuations.

Weak data may lead to a retest of recent lows for US two-year Treasury yields.

If we see jobless claims and retail sales both cause new economic concerns, the market may begin to digest the risk of a 50 basis point rate cut by the Federal Reserve in September, resulting in the risk of the two-year US Treasury yield falling back to last week's low during the market panic.

As widely reported in recent weeks, when concerns about the US economy caused US Treasury yields to fall sharply, USD/JPY often moved in the same direction.

The USD/JPY appears to be heavy.

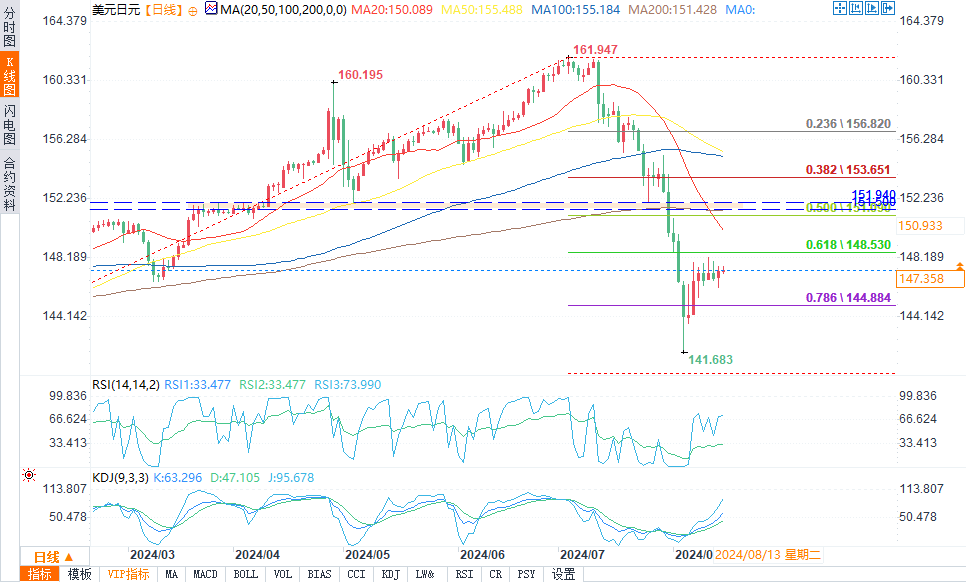

(USD/JPY daily chart source: Etna Communications)

Although it has rebounded somewhat in the past week, it is worth noting that the USD/JPY has been unable to regain its upward trend since early 2023, attracting buying prices below 146.50 but failing to push it above 148.00. Visually, this appears to be heavy, and if we see US Treasury yields fall again, who knows if arbitrage trading may start to unwind again? If this happens, it's easy to see last week's low point re-emerging.

Of course, such a result may require weak US data to occur first. If not, this ticket is basically invalid. This is an important moment that could either allay fears of an economic recession or greatly exacerbate those fears.

At 18:00 Beijing time, the USD/JPY was reported at 147.372/386, up 0.03%.