Whales with a lot of money to spend have taken a noticeably bullish stance on ARM Holdings.

Looking at options history for ARM Holdings (NASDAQ:ARM) we detected 16 trades.

If we consider the specifics of each trade, it is accurate to state that 62% of the investors opened trades with bullish expectations and 31% with bearish.

From the overall spotted trades, 2 are puts, for a total amount of $106,380 and 14, calls, for a total amount of $11,835,615.

From the overall spotted trades, 2 are puts, for a total amount of $106,380 and 14, calls, for a total amount of $11,835,615.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $75.0 to $150.0 for ARM Holdings during the past quarter.

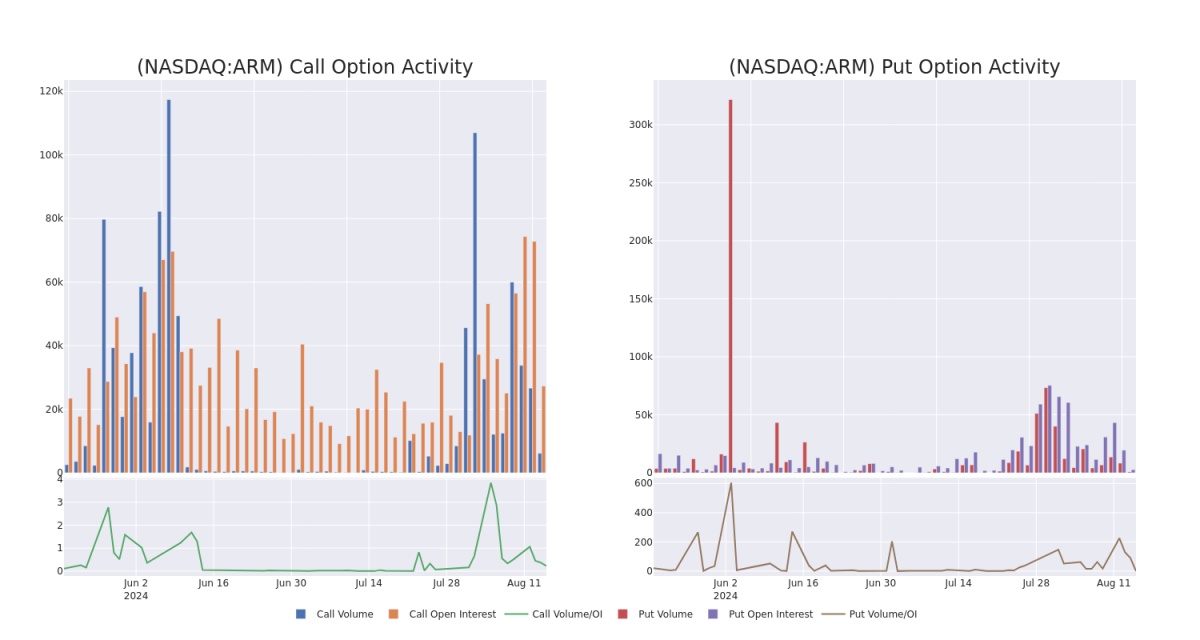

Volume & Open Interest Trends

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for ARM Holdings's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of ARM Holdings's whale trades within a strike price range from $75.0 to $150.0 in the last 30 days.

ARM Holdings Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ARM | CALL | TRADE | BULLISH | 12/18/26 | $58.85 | $56.25 | $58.35 | $130.00 | $10.9M | 2.0K | 1.8K |

| ARM | CALL | SWEEP | BEARISH | 12/18/26 | $61.95 | $60.45 | $60.45 | $120.00 | $272.2K | 6.1K | 146 |

| ARM | CALL | TRADE | BULLISH | 06/20/25 | $63.0 | $62.0 | $63.0 | $75.00 | $94.5K | 47 | 15 |

| ARM | CALL | TRADE | BULLISH | 01/16/26 | $44.45 | $41.85 | $43.5 | $130.00 | $87.0K | 5.6K | 20 |

| ARM | PUT | SWEEP | BULLISH | 08/30/24 | $7.9 | $7.8 | $7.8 | $133.00 | $77.2K | 9 | 0 |

About ARM Holdings

Arm Holdings is the IP owner and developer of the ARM architecture (ARM stands for Acorn RISC Machine), which is used in 99% of the world's smartphone CPU cores, and it also has high market share in other battery-powered devices like wearables, tablets, or sensors. Arm licenses its architecture for a fee, offering different types of licenses depending on the flexibility the customer needs. Customers like Apple or Qualcomm buy architectural licenses, which allows them to modify the architecture and add or delete instructions to tailor the chips to their specific needs. Other clients directly buy off-the-shelf designs from Arm. Off-the-shelf and architectural customers pay a royalty fee per chip shipped.

Having examined the options trading patterns of ARM Holdings, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

ARM Holdings's Current Market Status

- With a volume of 1,098,866, the price of ARM is up 2.44% at $128.99.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 92 days.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for ARM Holdings with Benzinga Pro for real-time alerts.