Intel Unusual Options Activity For August 15

Intel Unusual Options Activity For August 15

Financial giants have made a conspicuous bearish move on Intel. Our analysis of options history for Intel (NASDAQ:INTC) revealed 14 unusual trades.

金融巨头们对英特尔做出了明显的看淡动作。我们对英特尔(纳斯达克股票:INTC)期权历史进行分析后发现,有14笔非常规的交易。

Delving into the details, we found 14% of traders were bullish, while 64% showed bearish tendencies. Out of all the trades we spotted, 6 were puts, with a value of $422,977, and 8 were calls, valued at $358,061.

深入了解后,我们发现有14%的交易者看好市场,而64%的交易者表现出看淡的倾向。我们发现的所有交易中,有6笔看跌期权交易,总价值为422,977美元,还有8笔看涨期权交易,总价值为358,061美元。

Predicted Price Range

预测价格区间

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $16.0 and $24.0 for Intel, spanning the last three months.

通过对成交量和持仓量的评估,我们可以看出主要市场操盘者都在关注英特尔的价格区间,该区间为16.0美元至24.0美元,时间为过去三个月。

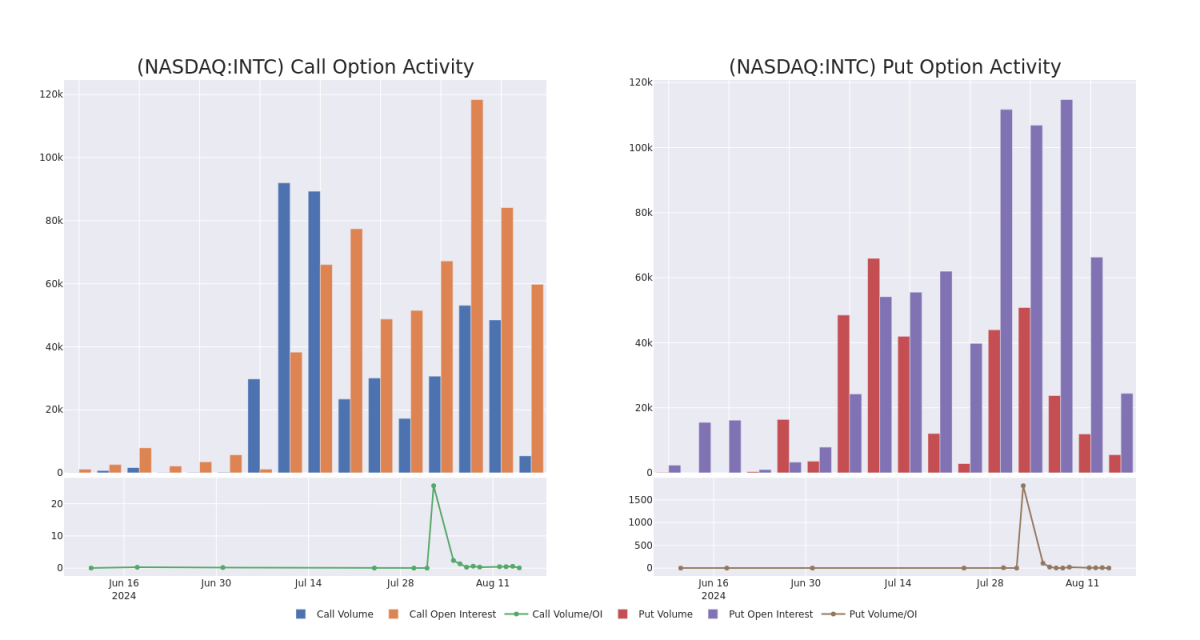

Volume & Open Interest Trends

成交量和未平仓量趋势

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

这些数据可以帮助您跟踪Coinbase Glb期权的流动性和利益,以给定的行权价格为基础。

This data can help you track the liquidity and interest for Intel's options for a given strike price.

这些数据可以帮助您跟踪给定行权价下的英特尔期权的流动性和利息。

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Intel's whale activity within a strike price range from $16.0 to $24.0 in the last 30 days.

下面我们可以看到,在过去30天内,在16.0美元至24.0美元的行权价格区间内,针对英特尔所有庞大的活动所进行的看涨和看跌期权的成交量和持仓量的变化。

Intel Option Activity Analysis: Last 30 Days

英特尔期权活动分析:过去30天

Largest Options Trades Observed:

观察到的最大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| INTC | PUT | SWEEP | BEARISH | 06/20/25 | $4.5 | $4.4 | $4.5 | $23.00 | $126.4K | 12.8K | 282 |

| INTC | PUT | SWEEP | NEUTRAL | 03/21/25 | $4.1 | $4.05 | $4.1 | $23.00 | $99.1K | 2.9K | 1.2K |

| INTC | CALL | SWEEP | BEARISH | 10/18/24 | $2.97 | $2.9 | $2.9 | $18.00 | $81.2K | 614 | 280 |

| INTC | PUT | SWEEP | BEARISH | 10/18/24 | $1.55 | $1.54 | $1.55 | $21.00 | $55.0K | 3.0K | 422 |

| INTC | PUT | SWEEP | BEARISH | 06/20/25 | $4.5 | $4.45 | $4.5 | $23.00 | $49.5K | 12.8K | 403 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 英特尔 | 看跌 | SWEEP | 看淡 | 06/20/25 | $4.5 | $4.4 | $4.5 | $23.00 | 126.4千美元 | 12.8K | 282 |

| 英特尔 | 看跌 | SWEEP | 中立 | 03/21/25 | $4.1 | $4.05 | $4.1 | $23.00 | $99.1K | 2.9K | 1.2K |

| 英特尔 | 看涨 | SWEEP | 看淡 | 10/18/24 | $2.97 | $2.9 | $2.9 | $18.00 | $81.2K | 614 | 280 |

| 英特尔 | 看跌 | SWEEP | 看淡 | 10/18/24 | $1.55 | $1.54 | $1.55 | 21.00美元 | $55.0K | 3.0K | 422 |

| 英特尔 | 看跌 | SWEEP | 看淡 | 06/20/25 | $4.5 | $4.45 | $4.5 | $23.00 | $49.5K | 12.8K | 403 |

About Intel

关于英特尔

Intel is a leading digital chipmaker, focused on the design and manufacturing of microprocessors for the global personal computer and data center markets. Intel pioneered the x86 architecture for microprocessors and was the prime proponent of Moore's law for advances in semiconductor manufacturing. Intel remains the market share leader in central processing units in both the PC and server end markets. Intel has also been expanding into new adjacencies, such as communications infrastructure, automotive, and the Internet of Things. Further, Intel expects to leverage its chip manufacturing capabilities into an outsourced foundry model where it constructs chips for others.

英特尔是一家领先的数字芯片制造商,专注于为全球个人电脑和数据中心市场设计和制造微处理器。英特尔率先提出了微处理器的x86架构,并是Moore's law在半导体制造方面的主要支持者。英特尔在PC和服务器终端市场的中央处理单元方面保持市场份额领先地位。英特尔还扩展到了新的附加领域,如通信基础设施、汽车和物联网。此外,英特尔希望利用其芯片制造能力进入外包晶圆厂模式,在此模式下为他人构建芯片。

Having examined the options trading patterns of Intel, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在研究了英特尔的期权交易模式之后,我们的注意力现在直接转向公司。这个转变让我们可以深入探讨它目前的市场地位和业绩。

Present Market Standing of Intel

英特尔现在的市场地位

- With a volume of 17,975,565, the price of INTC is up 2.33% at $20.39.

- RSI indicators hint that the underlying stock may be oversold.

- Next earnings are expected to be released in 70 days.

- 英特尔的成交量为17,975,565股,价格上涨了2.33%,报价为20.39美元。

- RSI指标表明该基础股票可能被超卖。

- 下一轮的财报预计将在70天内发布。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期权与仅交易股票相比是一种更具风险的资产,但它们具有更高的利润潜力。认真的期权交易者通过每日学习,进出交易,跟随多个指标并密切关注市场来管理这种风险。