A Closer Look at Celestica's Options Market Dynamics

A Closer Look at Celestica's Options Market Dynamics

High-rolling investors have positioned themselves bearish on Celestica (NYSE:CLS), and it's important for retail traders to take note.\This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in CLS often signals that someone has privileged information.

Celestica (NYSE: CLS)的高管投資者看淡該股,散戶應該注意。這種活動是通過Benzinga追蹤公開期權數據發現的。這些投資者的身份尚不確定,但CLS股票的如此重大變動通常意味着某人掌握了內部信息。

Today, Benzinga's options scanner spotted 8 options trades for Celestica. This is not a typical pattern.

今天,Benzinga的期權掃描器發現Celestica的8個期權交易,這不是典型的交易模式。

The sentiment among these major traders is split, with 12% bullish and 75% bearish. Among all the options we identified, there was one put, amounting to $31,416, and 7 calls, totaling $547,620.

這些主要交易者之間的情緒不一,12%看好,75%看淡。我們發現所有標的物中有一個看跌期權,金額爲31,416美元,以及7個看漲期權,總計547,620美元。

What's The Price Target?

目標價是多少?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $45.0 to $62.5 for Celestica during the past quarter.

通過分析這些合同的成交量和持倉量,大型交易者似乎在過去的季度裏一直密切關注Celestica在45.0到62.5美元的價格區間。

Insights into Volume & Open Interest

成交量和持倉量分析

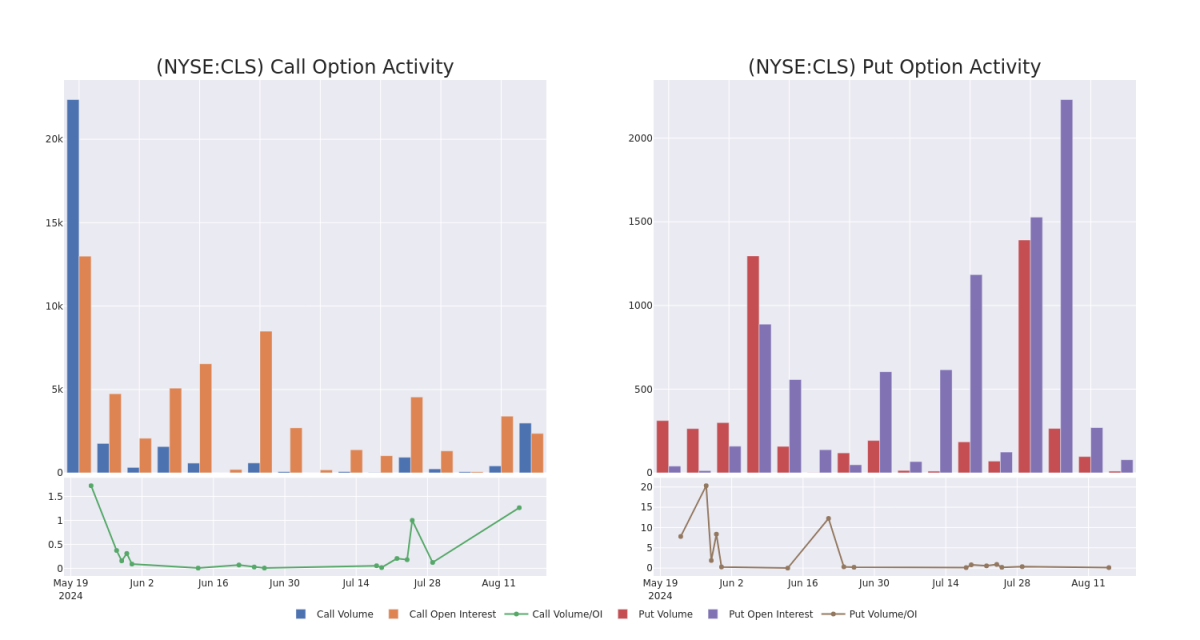

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

這些數據可以幫助您跟蹤Coinbase Glb期權的流動性和利益,以給定的行權價格爲基礎。

This data can help you track the liquidity and interest for Celestica's options for a given strike price.

這些數據可以幫助您追蹤Celestica的期權在特定行權價格上的流動性和興趣。

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Celestica's whale activity within a strike price range from $45.0 to $62.5 in the last 30 days.

下面,我們可以在過去30天內觀察所有Celestica的鯨魚活動在45.0到62.5美元行權價區間內看漲和看跌期權的成交量和持倉量的變化。

Celestica 30-Day Option Volume & Interest Snapshot

Celestica 30天期權成交量和持倉量簡覽

Biggest Options Spotted:

最大的期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CLS | CALL | TRADE | BEARISH | 10/18/24 | $3.6 | $3.4 | $3.45 | $57.50 | $172.5K | 478500 | |

| CLS | CALL | SWEEP | BEARISH | 10/18/24 | $5.1 | $3.6 | $3.6 | $57.50 | $118.4K | 4781.0K | |

| CLS | CALL | TRADE | BEARISH | 09/20/24 | $1.35 | $1.25 | $1.25 | $62.50 | $100.0K | 680203 | |

| CLS | CALL | SWEEP | BEARISH | 10/18/24 | $3.5 | $3.3 | $3.5 | $57.50 | $67.5K | 478735 | |

| CLS | CALL | SWEEP | BULLISH | 08/23/24 | $1.25 | $1.1 | $1.2 | $56.00 | $34.4K | 68391 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CLS | 看漲 | 交易 | 看淡 | 10/18/24 | $3.6 | $3.4 | $3.45 | $57.50 | $172.5K | 478500 | |

| CLS | 看漲 | SWEEP | 看淡 | 10/18/24 | $5.1 | $3.6 | $3.6 | $57.50 | 118.4K | 4781.0K | |

| CLS | 看漲 | 交易 | 看淡 | 09/20/24 | $1.35 | $1.25 | $1.25 | $62.50 | $100.0K | 680203 | |

| CLS | 看漲 | SWEEP | 看淡 | 10/18/24 | $3.5 | $3.3 | $3.5 | $57.50 | $67.5K | 478735 | |

| CLS | 看漲 | SWEEP | 看好 | 08/23/24 | $1.25 | $1.1 | $1.2 | $56.00 | 成交量: $34.4K | 68391 |

About Celestica

關於天弘科技

Celestica Inc offers supply chain solutions. The company has two operating and reportable segments: Advanced Technology Solutions (ATS) and Connectivity & Cloud Solutions (CCS). The ATS segment consists of the ATS end market and is comprised of the Aerospace and Defense, Industrial, health tech, and Capital Equipment businesses. Its Capital Equipment business is comprised of the semiconductor, display, and robotics equipment businesses, and the CCS segment consists of Communications and Enterprise end markets, Enterprise end market is comprised of its servers and storage businesses. The company generates a majority of its revenue from the Connectivity & Cloud Solutions segment.

Celestica Inc提供供應鏈解決方案。該公司擁有兩個運營和報告部門:先進技術解決方案(ATS)和連接與雲解決方案(CCS)。ATS部門包括ATS終端市場,由航空航天與國防、工業、醫療技術和資本設備業務組成。其資本設備業務包括半導體、顯示屏和機器人設備業務,CCS部門包括通信和企業終端市場,企業終端市場由其服務器和存儲業務組成。公司營業收入的大部分來自連接與雲解決方案部門。

Celestica's Current Market Status

Celestica當前市場狀況

- Trading volume stands at 1,013,357, with CLS's price up by 2.14%, positioned at $53.39.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 69 days.

- 成交量爲1,013,357,CLS的價格上漲2.14%,位於53.39美元。

- RSI指標顯示該股票可能接近超買。

- 預計69天內公佈收益報告。

What The Experts Say On Celestica

專家對Celestica的看法

4 market experts have recently issued ratings for this stock, with a consensus target price of $63.25.

4位市場專家最近對這隻股票發表了評級,目標價格爲63.25美元。

- An analyst from Canaccord Genuity persists with their Buy rating on Celestica, maintaining a target price of $70.

- Maintaining their stance, an analyst from CIBC continues to hold a Neutral rating for Celestica, targeting a price of $60.

- An analyst from Stifel has decided to maintain their Hold rating on Celestica, which currently sits at a price target of $58.

- Consistent in their evaluation, an analyst from RBC Capital keeps a Outperform rating on Celestica with a target price of $65.

- Canaccord Genuity的一位分析師堅持給Celestica評定買入評級,保持目標價爲70美元。

- CIBC分析師堅持持有Celestica的中立評級,目標價爲60美元。

- Stifel的分析師決定維持對Celestica的持有評級,目前股價目標爲58美元。

- RBC Capital的分析師在評估中保持對Celestica的跑贏大盤評級,目標價爲65美元。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Celestica with Benzinga Pro for real-time alerts.

期權交易存在更大的風險,但也具有更高利潤的潛力。精明的交易者通過持續教育、策略性的交易調整、利用各種因子和保持與市場的關注來減輕這些風險。關注Celestica的最新期權交易,通過Benzinga Pro獲得實時警報。