Decoding Mastercard's Options Activity: What's the Big Picture?

Decoding Mastercard's Options Activity: What's the Big Picture?

Financial giants have made a conspicuous bullish move on Mastercard. Our analysis of options history for Mastercard (NYSE:MA) revealed 11 unusual trades.

花旗集團對萬事達看好,分析該公司期權歷史記錄發現11筆飛凡交易。

Delving into the details, we found 45% of traders were bullish, while 45% showed bearish tendencies. Out of all the trades we spotted, 5 were puts, with a value of $555,010, and 6 were calls, valued at $629,551.

具體看,我們發現45%的交易者看好,而45%的交易者看淡。在我們發現的所有交易中,有5手看跌期權,價值55.5萬美元,有6手看漲期權,價值62.9萬美元。

Projected Price Targets

預計價格目標

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $380.0 to $480.0 for Mastercard during the past quarter.

分析這些合同的成交量和持倉量,發現大戶在過去一個季度一直關注萬事達的股價窗口在380.0至480.0美元之間。

Analyzing Volume & Open Interest

分析成交量和未平倉合約

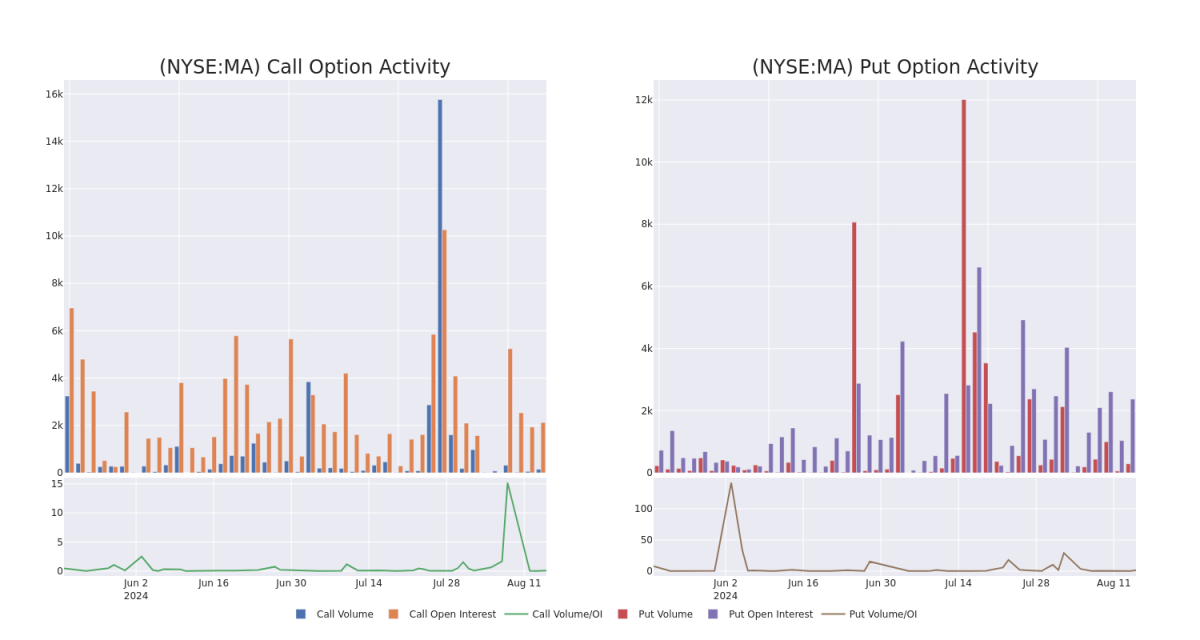

In today's trading context, the average open interest for options of Mastercard stands at 408.64, with a total volume reaching 377.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Mastercard, situated within the strike price corridor from $380.0 to $480.0, throughout the last 30 days.

在今天的交易環境中,萬事達期權的平均持倉量爲408.64,總成交量達到377.00。隨附的圖表描述了過去30天內,萬事達高價值交易中在380.0至480.0美元行權價走勢的看漲和看跌期權成交量和持倉量變化情況。

Mastercard Option Activity Analysis: Last 30 Days

萬事達期權活動分析:過去30天

Biggest Options Spotted:

最大的期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MA | CALL | TRADE | BEARISH | 01/16/26 | $58.2 | $55.95 | $56.5 | $470.00 | $344.6K | 545 | 61 |

| MA | PUT | SWEEP | BULLISH | 01/16/26 | $27.4 | $26.9 | $26.9 | $440.00 | $228.6K | 91 | 85 |

| MA | CALL | SWEEP | BEARISH | 06/20/25 | $108.5 | $106.9 | $106.9 | $380.00 | $128.2K | 16 | 12 |

| MA | PUT | TRADE | NEUTRAL | 01/17/25 | $21.45 | $20.6 | $21.0 | $470.00 | $128.1K | 243 | 61 |

| MA | PUT | TRADE | BULLISH | 01/17/25 | $26.5 | $25.25 | $25.7 | $480.00 | $97.6K | 647 | 39 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 馬薩諸塞州 | 看漲 | 交易 | 看淡 | 01/16/26 | $58.2 | $55.95 | $56.5 | $470.00 | $344.6K | 545 | 61 |

| 馬薩諸塞州 | 看跌 | SWEEP | 看好 | 01/16/26 | $27.4 | $26.9 | $26.9 | $440.00 | $228.6K | 91 | 85 |

| 馬薩諸塞州 | 看漲 | SWEEP | 看淡 | 06/20/25 | $108.5 | $106.9 | $106.9 | $380.00 | $128.2K | 16 | 12 |

| 馬薩諸塞州 | 看跌 | 交易 | 中立 | 01/17/25 | $21.45 | 20.6美元 | $21.0 | $470.00 | $128.1K | 243 | 61 |

| 馬薩諸塞州 | 看跌 | 交易 | 看好 | 01/17/25 | $26.5 | $ 25.25 | $25.7 | 該公司的股票上週五收於$74.31。 | $97.6K | 647 | 39 |

About Mastercard

關於Mastercard Mastercard是一家支付業務領域的全球科技公司。 我們的使命是使用安全的數據和網絡、夥伴關係和激情,連接並推動一個惠及每個人、無處不在的包容性數字經濟,使交易變得安全、簡單、智能和可訪問。 我們的創新和解決方案幫助個人、金融機構、政府和企業實現其最大的潛力。 跨越210多個國家和地區的聯繫,我們正在建設一個可持續的世界,爲所有人釋放無價的可能性。

Mastercard is the second-largest payment processor in the world, having processed close to over $9 trillion in volume during 2023. Mastercard operates in over 200 countries and processes transactions in over 150 currencies.

萬事達是全球第二大支付處理器,在2023年處理了超過9萬億美元的交易量。萬事達在全球200多個國家和地區運營,可以處理超過150種貨幣的交易。

In light of the recent options history for Mastercard, it's now appropriate to focus on the company itself. We aim to explore its current performance.

鑑於萬事達最近的期權歷史,現在適當關注公司本身。我們將探討其當前表現。

Mastercard's Current Market Status

萬事達目前的市場狀況

- Currently trading with a volume of 1,882,834, the MA's price is up by 1.86%, now at $468.71.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 70 days.

- 萬事達的成交量爲1,882,834,漲幅1.86%,目前股價爲468.71美元。

- RSI讀數表明該股目前可能接近超買水平。

- 預計在70天內發佈收益。

Expert Opinions on Mastercard

萬事達專家意見

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $529.8.

過去30天中,總共有5位專業分析師對該股票進行了評估,並設定了平均目標價爲529.8美元。

- Maintaining their stance, an analyst from Keybanc continues to hold a Overweight rating for Mastercard, targeting a price of $515.

- Maintaining their stance, an analyst from Barclays continues to hold a Overweight rating for Mastercard, targeting a price of $536.

- An analyst from Susquehanna persists with their Positive rating on Mastercard, maintaining a target price of $540.

- Consistent in their evaluation, an analyst from Citigroup keeps a Buy rating on Mastercard with a target price of $538.

- An analyst from BMO Capital persists with their Outperform rating on Mastercard, maintaining a target price of $520.

- Keybanc的一位分析師繼續維持對萬事達的超配評級,目標價爲515美元。

- 巴克萊銀行的一位分析師繼續維持對萬事達的超配評級,目標價爲536美元。

- Susquehanna的一位分析師繼續維持對萬事達的積極評級,維持目標價爲540美元。

- 花旗集團的一位分析師繼續保持對萬事達的買入評級,目標價爲538美元。

- BMO Capital的一位分析師繼續維持對萬事達的跑贏大盤評級,維持目標價爲520美元。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期權與僅交易股票相比是一種更具風險的資產,但它們具有更高的利潤潛力。認真的期權交易者通過每日學習,進出交易,跟隨多個指標並密切關注市場來管理這種風險。