JD.com, Tojoytech and Zhongwei Semiconductors participate in the placement.

After a year and a half of waiting, Koma Technology is finally going public.

According to IG, on August 16th, Suzhou Koma Material Technology Co., Ltd. (hereinafter referred to as "Koma Technology") was listed on the GEM with Citic Securities as the sponsor.

Koma Technology (301611) has an issue price of 8.00 yuan/share and a PE ratio of 44.90 times, which is 37.60% higher than the average PE ratio of its peers at 32.63 times.

Koma Technology (301611) has an issue price of 8.00 yuan/share and a PE ratio of 44.90 times, which is 37.60% higher than the average PE ratio of its peers at 32.63 times.

The company specializes in advanced ceramic materials and components for semiconductor equipment. In this field, the domestic substitution rate is less than 20%, and the company's market share among domestic enterprises is as high as 72%, which is why the PE ratio is so high.

However, given the current sluggish market sentiment and trading volume on the A-share market, whether Koma Technology can close higher on its first day of trading is uncertain.

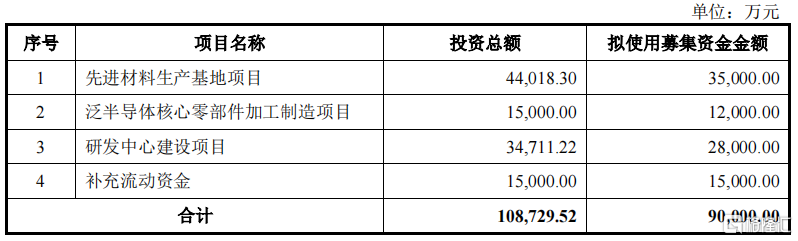

According to the prospectus, 75 million new shares are publicly issued this time, and there is no old stock transfer. Calculated at an issue price of 8.00 yuan per share, the corresponding total amount of funds raised is 0.6 billion yuan, which is less than the previously planned fund raising amount of 0.9 billion yuan.

The use of raised funds is outlined in the prospectus.

At this listing, companies like BOE, Toco Tech, and Zhongwei Semiconductor, which have a strategic cooperation relationship or long-term cooperation vision with Koma Technology's business, participated in the placement.

Entrepreneurial Dr. Liu Xianbing

Koma Technology was founded by Dr. Liu Xianbing. Before returning to China to start his own business, he had many years of study and work experience overseas, which is a common feature among most technology entrepreneurs in China.

Dr. Liu Xianbing was born in 1969. He graduated from the University of Connecticut in 2001 with a Ph.D. in mechanical engineering. In the following 4 years, he conducted postdoctoral research at the University of Connecticut and the University of California, accumulating rich research experience.

In 2005, Dr. Liu joined LTDCeramics, Inc. in Silicon Valley, California as a research and development manager. From May 2007 to October 2008, he also served as the general manager of LCL International, Inc. based in Silicon Valley, California.

It was during this time that Dr. Liu's management skills were greatly enhanced, laying the foundation for his entrepreneurship upon returning to China.

In 2009, Dr. Liu returned to Suzhou and personally founded Koma Limited (predecessor of Koma Technology), where he has been the company's chairman and general manager ever since.

Before the issue, Dr. Liu held 53.37% of the shares directly and, through the jointly-owned enterprises of Suzhou Boying, Suzhou Bocan, and Suzhou Boyi, controlled 6.67% of the company's shares, for a total control of 60.04% of the company's shares.

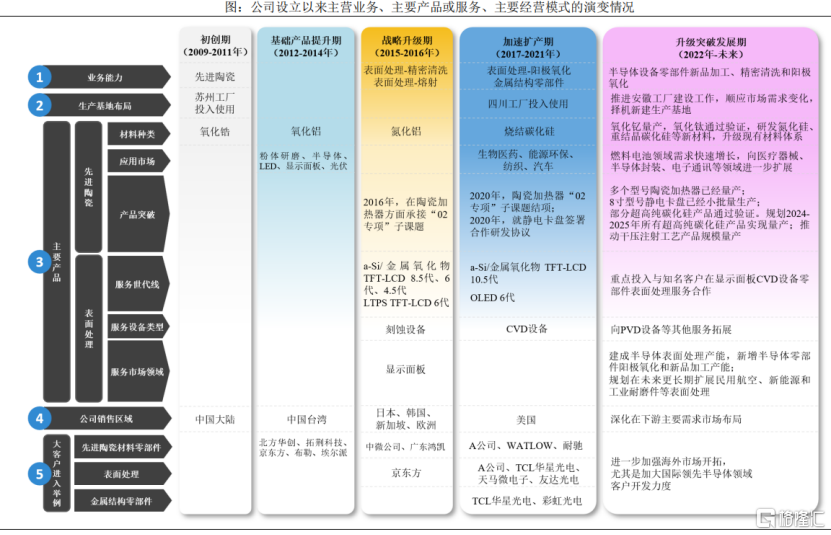

Since its establishment, the company has gone through 5 stages of development: the start-up period, the basic product improvement period, the strategic upgrade period, the accelerated production expansion period, and the upgraded rapid development period. The product line has been greatly improved.

The company's development history is outlined in the prospectus.

The company holds the largest market share of domestic semiconductor ceramic components.

Koma Technology's main business is the research and development, manufacturing, sales, service, and surface treatment services of advanced ceramic materials and other semiconductor equipment components. Its main products include advanced ceramic material components. The company also provides precision cleaning, anodic oxidation, and thermal spraying surface treatment services to its customers.

From 2021 to 2023 (referred to as the "report period"), the company's operating income was 345 million yuan, 462 million yuan, and 480 million yuan, respectively, with a compound annual growth rate of 18.01%. The company's net income attributable to the parent was 67.0888 million yuan, 93.2362 million yuan, and 81.8607 million yuan respectively, with a compound annual growth rate of 10.46% over the past three years.

It can be seen that the company's performance fluctuated in 2023, with a revenue growth rate of only 3.89% and a YoY drop of 12.20% in net income attributable to shareholders.

But in 2024, growth resumed, and the company estimated its performance for the first half of 2024 in the prospectus, with an expected YoY revenue growth rate of 55.93-67.46% in 24H1.

The main audited financial data and financial indicators of the company during the reporting period are from the prospectus.

As an upstream player in the semiconductor industry chain, KOMA TECH's performance is mainly affected by the semiconductor cycle.

Since the second half of 2022, factors such as the consumer electronics cycle, inflation, and changes in US trade policies have caused periodic fluctuations in industry prosperity.

According to data from institutions such as WSTS and ICInsights, it is expected that the global semiconductor industry's capital expenditure growth rate will have a certain decline in 2023 compared to 2022.

However, with the recovery of the cycle and the growth of demand in industries such as new energy vehicles and the Internet of Things, the semiconductor market is expected to recover somewhat in 2024.

In terms of business structure, advanced ceramic material components are currently the company's revenue mainstay, with revenue in the reporting period of 20.7 million yuan, 36.1 million yuan, and 39.5 million yuan, accounting for 60.12%, 78.00%, and 82.19% of operating income, respectively.

The company's advanced ceramics are mainly used in front-end wafer fabrication process equipment, and have already entered etching, film deposition, ion implantation, lithography, and oxidation diffusion equipment.

According to their usage, advanced ceramics can be divided into structural ceramics and functional ceramics, and the company focuses on advanced structural ceramics.

In 2021, the size of China's advanced ceramics market reached 89 billion yuan, of which the size of the advanced structural ceramics market was 18.9 billion yuan, accounting for 21% of China's advanced ceramics market. It is expected that the compound annual growth rate of the Chinese advanced structural ceramics market from 2022 to 2026 will be 11%.

In 2015, the localization rate of China's advanced structural ceramics was only about 5%, and by 2021, it had increased to about 20%.

Among them, in the semiconductor field, the domestication rate of advanced structural ceramic parts required for wafer manufacturing equipment is still relatively low, and the domestication rate was only about 19% in 2021. In the display panel field, the domestication rate was about 30% in 2021.

Therefore, in the future, there is still considerable room for domestic advanced structural ceramics to replace imported ones in the semiconductor and display panel fields.

KOMA TECH has the largest market share in the domestic advanced structural ceramics market among domestic companies in the semiconductor field.

According to the prospectus, KOMA TECH's share in the total procurement scale of advanced structural ceramics of China's semiconductor equipment in 2021 was about 14%; if only considering local companies, KOMA TECH's share was about 72%.

Globally, Japan is the home to many leading competitors in advanced ceramic material components, including Kyocera Group, Japan Alumina, Japan Fine Ceramics, Morgan Advanced Materials, CeramTec, CoorsTek, etc.

The company has entered the supply chain of global well-known semiconductor equipment manufacturers such as Company A, and has established stable and in-depth cooperative relationships with domestic semiconductor equipment leading enterprises such as Naura Technology Group, Advanced Micro-Fabrication Equipment Inc. China, and Top Tech.

During the reporting period, sales to the top five customers accounted for a relatively large proportion of the company's revenue, at 63.75%, 54.01%, and 48.07%, respectively, indicating relatively high customer concentration risks.

珂玛科技(301611)发行价格8.00元/股,发行市盈率为44.90倍,高于同行业32.63倍的平均市盈率,超出幅度约为37.60%。

珂玛科技(301611)发行价格8.00元/股,发行市盈率为44.90倍,高于同行业32.63倍的平均市盈率,超出幅度约为37.60%。