"Fan Ecology" opens up a strong space for imagination.

As important engines of global technology innovation, China and the USA always attract the attention of the global financial industry with their dynamic technology fields. In particular, the two countries face many similar technological challenges and development opportunities. For example, in cutting-edge technology fields such as artificial intelligence, cloud computing, semiconductors, and 5G, both China and the USA have invested heavily in research and development and application.

This similar technological development trend makes Chinese and American technology stocks have certain similarities in business models and profitability models, which in turn has spawned mapping effects in the market. Investors often use the business models and competitive patterns of overseas technology giants as reference to invest in technology companies in the A-share and Hong Kong stock markets that have similar potential.

However, as the financial reports season in China and the USA deepens, an obvious trend is gradually emerging: although Chinese and American technology stocks have mapping logic in the early stage due to similar technological trends, the linkage between most Chinese technology stocks and US stocks is not as strong as expected from a fundamental perspective as time goes by, and the mapping effect is gradually showing fatigue.

However, even though the overall mapping effect is weakening, individual bright spots at the stock level in some areas are still not to be ignored. Especially the companies that demonstrate strong commercial self-circulation ability have become the focus of the market.

Recently, the two leading companies in the B-end AI platform field in China and the USA, Palantir and Fourth Paradigm, have successively released their financial results, bringing new insights into investment opportunities for AI in the B-end.

Palantir's financial report is impressive, which has led to a near-three-year high in stock prices post-results. Taking a longer time frame, Palantir has more than doubled in two years, fully reflecting the market's optimistic expectations for the relevant track. Following this, on August 15th, Fourth Paradigm also released its financial report. In the first half of the year, Fourth Paradigm achieved a total revenue of 186.7 billion yuan, a year-on-year increase of 27.1%; the core business "Fourth Paradigm Prophet AI Platform" achieved revenue of 125.1 billion yuan, a year-on-year increase of 65.4%. This beautiful performance has also attracted the attention of investors.

01

Financial Data Analysis: J-Curve in Progress

At the forefront of the wave of AI and big models, Palantir and Fourth Paradigm show a relatively obvious mapping relationship.

From a business model perspective, both companies focus on providing solutions based on big data and AI technology. Palantir is well-known for its powerful data analysis platform, which rebuilds end-to-end data analysis and solutions, emphasizing real-time data and deep insight capabilities. Fourth Paradigm is a leading supplier of enterprise-side AI platforms and solutions in China, dedicated to empowering enterprise digital transformation through AI technology.

From a technological capability perspective, both Palantir and Fourth Paradigm have demonstrated strong technical strength and innovation ability. They both are committed to applying advanced data analysis and AI technologies to practical scenarios, creating greater value for enterprises.

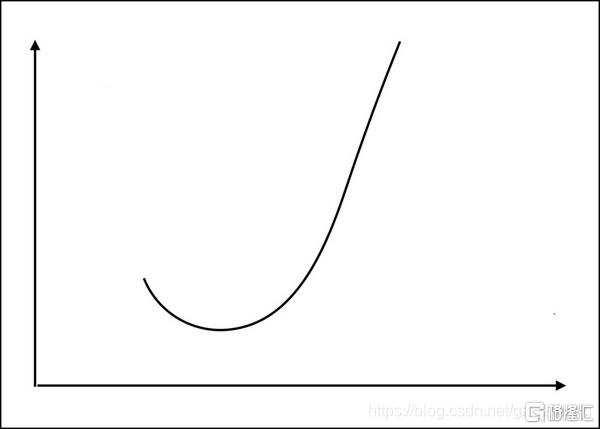

In terms of growth model, both Palantir and Fourth Paradigm have demonstrated typical growth characteristics of growth-type enterprises, and their profit trajectory conforms to a clear J-curve effect. The J-curve effect describes the declining or stagnant stage that a business may experience in the early stages of development, followed by a gradual reaching of a point of balance between profit and loss, ultimately leading to rapid growth. This effect is particularly significant in the growth history of some top technology companies.

The growth path of the J-curve can be summarized into three stages: investment, growth, and innovation. In the early stages, enterprises need to invest heavily in research and development. This stage may be accompanied by a decline in profits or losses, which restricts the growth of the company. Later, with the improvement of product technology and the increase in market acceptance, the enterprise's business grows, and revenue and profits improve. The company starts to emerge from the trough and enters a phase of rapid growth. Finally, after reaching a certain scale, the optimization of cost structure brings about scale effects, lowers costs and improves profitability. The company will continuously introduce new products and technologies to meet the diversified needs of the market, bringing new growth points and broad development space for enterprises.

The J-curve effect reveals an observation to investors: the transformation of technological innovation into productivity is a cyclical process. Therefore, when supporting technological innovation, this characteristic should be fully considered to avoid blind investment in the early stage or missed opportunities in the later stage, in order to achieve the best balance between capital investment and risk tolerance.

When exploring the growth paths of Palantir and Fourth Paradigm, it is not difficult to find that although they started in different market backgrounds and development stages, both of them demonstrated typical J-curve growth features. Leveraging its deep accumulation in the US market, Palantir took the lead in entering a mature stage of stable profitability and high-speed growth; while Fourth Paradigm is accelerating its progress in the Chinese market, demonstrating strong growth momentum and potential.

Since its successful IPO in 2020, Palantir's revenue performance has remained strong. Data shows that from 2018 to 2023, its revenue has achieved significant growth from 4.086 billion US dollars to 15.759 billion US dollars, with a high compound annual growth rate of 32.35%. In the latest financial report, Palantir has further raised its guidance for full-year revenue in 2024, which is expected to reach 2.742 billion US dollars to 2.75 billion US dollars, a year-on-year increase of 23.4%, demonstrating the company's confidence and expectations for the future market.

In contrast to the continuous upward trend in revenue, Palantir's net income growth trajectory clearly depicts a J curve, with a significant transition from a decline to a steady upward trend from the high investment stage to the high growth stage. By the second quarter of 2024, Palantir had achieved seven consecutive quarters of profitability, marking a successful crossing of the J-curve trough and entering a new phase of rapid growth. The product structure features operating income of ¥4.01/¥12.88/¥0.06 billion for 10-30 billion yuan products, respectively.

Similar to Palantir, Fourth Paradigm also showed impressive growth rates. Between 2020 and 2023, the company's revenue soared from ¥0.944 billion to ¥4.207 billion, with a compound annual growth rate of about 46%, far exceeding the industry average and higher than Palantir's.

Similar to Palantir, Fourth Paradigm also follows the J-curve pattern.

The company adheres to a long-term philosophy that views research and development as the fundamental driving force of its development, and spares no effort to increase R&D investment. By the first half of 2024, Fourth Paradigm's R&D investment had reached ¥0.85 billion, with an R&D expense ratio of 45.5%, providing solid support for the company's technological innovation. At the same time, to rapidly expand its market, the company has also invested heavily in related areas, resulting in high levels of sales expenses. In the initial phase of the J-curve, these investments may not immediately bring significant returns, and may even lead to a decline in profits or losses.

However, as Fourth Paradigm gradually enters the high-growth stage and customer base continues to expand, economies of scale begin to emerge. This not only effectively dilutes the company's sales and R&D expense ratios, but also significantly enhances operating margins and drives a qualitative change in the company's financial position. By 2023, the company's loss situation had improved significantly, and in the first half of 2024, the company continued to maintain a clear trend of reducing losses, with a year-on-year reduction of 4.0% in adjusted net loss and an adjusted net loss rate of 9.0%, further validating the company's development results.

As shown in the figure below, Fourth Paradigm has clearly crossed the turning point of the J curve or is entering a fast-growing upward trend.

The development trend of Fourth Paradigm has formed a strong mapping with Palantir, providing positive reference for the future development of Fourth Paradigm. At the same time, major banks are generally optimistic about the profit prospects of Fourth Paradigm. Both China International Capital Corporation and Haitong Securities predict that the company will achieve basic balance of payments in 2025.

The current period is a critical time for Fourth Paradigm, marking the company's transition from the high-risk start-up phase to a stable growth phase, and providing investors with an opportunity to pay attention to and invest in the company. The phase in which Fourth Paradigm is currently located avoids the high risks in the initial phase and the low returns in the later phase, and is therefore a good time to pay attention to and lay out.

02

Platform strategy is the key to entering the upward trend.

It is worth noting that achieving the crossing of the J curve is not easy, and the success of Palantir and Fourth Paradigm is largely due to their excellent platform strategies. China International Capital Corporation pointed out that both companies have used platform-based products to standardize and meet project demand, demonstrating the foresight of their business models.

Palantir has established the infrastructure of its big data software through its Gotham and Foundry platforms, and further introduced the Apollo and AIP platforms to enhance the usability of multiple environments and the data format unification brought by large language models, thereby quickly penetrating the enterprise customer market. Fourth Paradigm, on the other hand, uses the AIOS platform combined with a solution and service-based business model. China International Capital Corporation pointed out that its platform-supported solution and service model is expected to bring business scalability and sustainability.

In the AI industry, especially in B-end applications, due to small fault tolerance, high performance requirements, and strict legal thresholds, it is difficult to land the vertical large models in the industry in a short time. Many vendors choose to land industry vertical large models in the form of projects to reduce the initial difficulty.

In fact, the project-based business model has a long history in the computer industry. It revolves around specific goals or requirements to build a team that concentrates resources to achieve established goals. The advantages of project-based work are clear goals, quick response to market changes, meeting immediate needs, clear division of labor, and clear responsibilities, which help improve efficiency and quality. However, project-based work also has obvious limitations, including a focus on short-term goals, insufficient long-term strategic planning, low resource reuse, and increased operating costs, all of which contribute to the difficulty of companies achieving J-curve curves.

In contrast, platform-based business models, although requiring large initial investments and overcoming greater difficulties and resistance at the outset, are easy to develop into companies running out of the curve. Due to strong network effects, decreasing marginal costs, broad development potential, and market adaptability, the potential for future development is often more anticipated by the market, and the characteristics of J-curve growth are more easily exhibited.

Taking Fourth Paradigm as an example, the company focuses on continuous technological innovation and product iteration, and is committed to providing long-term value to customers. In the early stages, Fourth Paradigm invested heavily in building and improving the Prophet AI platform, which, after 10 years of development, has been iterated from version 1.0 to 5.0. The latest version of the platform, Prophet AI Platform 5.0, is positioned as an industry large model development and management platform. Based on the principle of "predicting the next any modality," the platform can construct large, industry-specific models based on different modal data in each industry scenario, breaking through the limitations of large language models that can only forecast texts and greatly expanding the application areas of large industry models.

Based on the Prophet platform, Fourth Paradigm has end-to-end capabilities to build industry large models, and has further developed the "Prophet Inside" model. This model realizes effective integration of resources and maximizes value creation.

Fourth Paradigm founder and CEO Dai Wenyuan said that this model combines Prophet capabilities with the product research and development capabilities of partners to help transform partner products into intelligent products. At the same time, when selling cooperative products, revenue from the Prophet AI platform will also be further enhanced.

Specifically, on the one hand, Fourth Paradigm uses the 'Inside Prophet' mode to ingeniously embed cutting-edge technology, advanced models and efficient services in the Prophet AI platform into diversified product matrices in a 'building block' way, constructing an integrated model that tightly combines platform, solution and service. This innovative approach not only deepens the exploration of value in segmented fields, but also greatly enhances the capability of empowering enterprises' digital transformation, enabling Fourth Paradigm to flexibly cross over to new business fields and industry frontiers to continuously optimize resource allocation. On the other hand, through the 'Prophet Inside' mode, Fourth Paradigm can better embrace open cooperation, attracting a wide range of ecological partners such as third-party developers and service providers to jointly explore innovative paths and create value.

This open and win-win cooperation model not only enriches the connotation and extension of the ecosystem, but also accelerates the pace of technological innovation and commercial application, injecting a continuous stream of vitality and momentum into the entire ecosystem.

Based on this, Fourth Paradigm has successfully built a benign cycle system with efficient resource integration, deep value creation and significant network effects. This system not only promotes the steady progress of the company on the J-curve, but also lays a solid foundation for its long-term development.

03

'Paradigm Ecosystem' constantly opens up imagination space.

The consensus that 'AI reshapes all industries' has taken root. How to realize more efficient and outstanding work methods has become the core issue. Fourth Paradigm's 'solution' is to build a 'paradigm ecosystem' on the basis of a platform strategy.

At the World Artificial Intelligence Conference (WAIC) in 2024, President Hu Shiwei elaborated on the 'paradigm ecosystem.' Hu Shiwei emphasized: 'If AI is to become a new productive force, the key lies in its substantial contribution to the core competitiveness of the industry.' He further pointed out that 'the core of building a 'paradigm ecosystem' lies in reducing the threshold and cost of applying AI technology to the digital economy and the creation of new quality productive forces.'

On the one hand, Fourth Paradigm relies on the core competitiveness of the Prophet AI platform to continuously expand the application scope of large models in the industry, efficiently create a diversified product ecosystem that is more updated, faster, more cost-effective and better, and launch more than 30 artificial intelligence products in the first half of the year, covering diverse application scenarios and precisely solving industry pain points. For example, the AI digital human video synthesis platform, which integrates multidimensional contents such as text, voice and images and uses the Prophet AI platform's computing power optimization technology, achieves fast and efficient video generation, effectively solving the problems of high cost and stiff expressions in digital human production, reducing enterprise operating costs and demonstrating the huge potential of technological innovation.

On the other hand, in the process of building the 'paradigm ecosystem,' Fourth Paradigm adheres to the principle of open cooperation and works closely with benchmark users and cooperative partners to jointly create a series of large models with demonstrative significance in the industry, such as academic translation, health management and smart water conservancy. As the core components of the ecosystem, these large models not only promote the deep application of technology in specific industries, but also attract more industry participants through the demonstration effect to jointly promote technological progress and industrial upgrading. This model led by technology, industry participation and joint promotion fully demonstrates the strong vitality and broad prospects of the 'ecosystem.'

With the continuous expansion of the boundary of the 'paradigm ecosystem' and the application scope of large models in the industry, Fourth Paradigm has not only opened up broad space for its own development, but also brought unprecedented imagination space to the entire AI industry. This imagination space is not only reflected in the depth and breadth of technological innovation, but also in the unlimited possibilities it stimulates for business model transformation, industrial chain reconstruction and social value creation. Currently, Fourth Paradigm has successfully empowered 14 industries, including transportation, data center, finance, energy and electricity, operators, information technology, intelligent manufacturing and retail, with a total of 185 users and 86 benchmark users, with an average income of 11.48 million yuan, a year-on-year increase of 26.9%. In the future, the company also has huge development potential in public security, public utilities, education and other fields.

Looking to the future, if Fourth Paradigm can continue to rely on the Prophet AI platform, deepen its layout in the AI field, continuously launch innovative products and services, and join hands with more ecological partners, it is expected to replicate the successful path of Palantir and accelerate its transition to a new stage on the J-curve. On the track of global technological competition, the leading technology giants of China and the United States are promoting the boundary expansion of cutting-edge technologies such as AI at an unprecedented speed. In the dialogue between technology and the future, Fourth Paradigm is undoubtedly one of the participants worth looking forward to and paying attention to. (End of the full text)