To the annoyance of some shareholders, 908 Devices Inc. (NASDAQ:MASS) shares are down a considerable 29% in the last month, which continues a horrid run for the company. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 40% in that time.

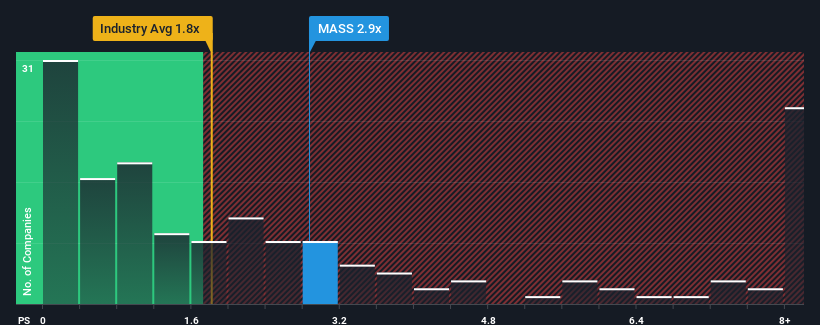

In spite of the heavy fall in price, given close to half the companies operating in the United States' Electronic industry have price-to-sales ratios (or "P/S") below 1.8x, you may still consider 908 Devices as a stock to potentially avoid with its 2.9x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

What Does 908 Devices' P/S Mean For Shareholders?

Recent times have been pleasing for 908 Devices as its revenue has risen in spite of the industry's average revenue going into reverse. It seems that many are expecting the company to continue defying the broader industry adversity, which has increased investors' willingness to pay up for the stock. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think 908 Devices' future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For 908 Devices?

In order to justify its P/S ratio, 908 Devices would need to produce impressive growth in excess of the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 7.5%. Pleasingly, revenue has also lifted 106% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenues over that time.

Looking ahead now, revenue is anticipated to climb by 37% during the coming year according to the five analysts following the company. That's shaping up to be materially higher than the 8.8% growth forecast for the broader industry.

In light of this, it's understandable that 908 Devices' P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From 908 Devices' P/S?

Despite the recent share price weakness, 908 Devices' P/S remains higher than most other companies in the industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that 908 Devices maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Electronic industry, as expected. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. It's hard to see the share price falling strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with 908 Devices, and understanding these should be part of your investment process.

If these risks are making you reconsider your opinion on 908 Devices, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.