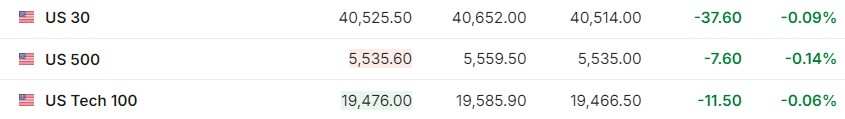

Pre-market trading on Friday, August 16, saw a simultaneous drop in equity index futures in the three major American stock markets.

1. Pre-market trading on Friday, August 16, saw a simultaneous drop in equity index futures in the three major American stock markets. As of press time, Dow Jones futures fell 0.09%, S&P 500 index futures fell 0.14%, and Nasdaq futures fell 0.06%.

2. As of press time, the German DAX index rose 0.54%, the UK FTSE100 index fell 0.47%, the France CAC40 index rose 0.17%, and the Europe Stoxx 50 index rose 0.48%.

3. As of press time, WTI crude oil fell 2.93%, to $75.87 per barrel. Brent crude oil fell 2.52%, to $79.00 per barrel.

2. As of press time, the Deguodaxzhishu rose 0.54%, the UK FTSE100 index fell 0.47%, the France cac40 index rose 0.17%, and the Europe Stoxx 50 Index rose 0.48%.

3. As of press time, crude oil product, WTI, fell 2.93% to $75.87/barrel. Brent crude fell 2.52% to $79.00/barrel.

Market News

Market News

Wells Fargo & Co crazy bullish: the market will see unprecedented growth after the Fed rate cut. Paul Christopher, the head of global investment strategy at Wells Fargo & Co, said that the stock market is about to see unprecedented growth. He pointed out that there are similarities between today's market and 1995, when the stock market was booming, and the S&P 500 Index set 77 historical highs. Christopher said that investors may face a similar environment because of falling inflation, the economy not collapsing, and the Department of Commerce estimate of a 2.8% year-on-year increase in GDP in the second quarter. Christopher said in an interview on Thursday that the Fed is "in a better position if it can be proactive enough." He suggested that Fed officials would cut rates by 50 basis points in September and then cut them "several times" before the end of the year. "We still have a good chance of achieving an economic soft landing," he added.

FOMC voting member Barkin: keep an open mind about rate cuts next month, the Fed cannot "be late." Atlanta Fed President Barkin said that he is open to rate cuts next month and that the Fed "can't afford to be too late" in starting monetary easing policies. "Now that inflation comes into the normal range, we must focus on the other side of the equation, where we have seen a sharp increase in unemployment from the low points," said Barkin, a voting member of the Federal Open Market Committee. "But it does make me think about when the right time is. Therefore, I am willing to take action before the fourth quarter." Waiting for rate cuts is risky. "Since our policy is lagging in both directions, we really can't be late. We must act as soon as possible."

Economic data enhances expectations for a "soft landing" in the US, and the panic index plunges 60%. On Thursday, as the latest retail sales and initial jobless claims data enhanced confidence in a "soft landing" in the US, the stock market climbed and volatility continued to decline. It is worth noting that this round of volatility has seen the largest 7-day drop in history. In the past seven trading days, the VIX index (also known as the panic index) measuring volatility in the S&P 500 index has fallen from 38.57 to 15.30, a 60.3% drop. On Thursday, the VIX index fell to 14.77, the lowest level since July 23, and has now erased the sharp rise on August 5.

US enterprises initiate a buying spree, trillion-dollar "ammunition" helps US stocks rebound. As the US stock market suffered its most severe correction since October last year last week, US companies were among the big buyers on dips. As the S&P 500 index fell for a fourth consecutive week, the department of Goldman Sachs Group responsible for executing stock buybacks for clients received record orders, with trading volume surging 2.1 times the average daily level last year. Corporate clients of Bank of America also kicked off a buying spree, with their stock buyback rate exceeding seasonal levels for 22 consecutive weeks. The buyback frenzy coincides with the recovery of the market, with the S&P 500 index recovering more than half of its summer losses. Against the backdrop of renewed concerns about economic growth and stock valuations, US corporate buybacks have become an important force supporting the stock market. As the second-quarter earnings season draws to a close, these companies are emerging from the lull in buybacks. From the announced plans, their demand will remain strong.

"Cash is king" is sweeping again, and the assets of the US money market have reached a new high. After last week's global risk asset sell-off, investors flocked to high-quality assets, leading to a record high in the size of the US money market mutual fund assets. According to data from the Investment Company Institute, in the week ending August 14, about $28.4 billion flowed into US money market funds, pushing total assets to a historical high of $6.22 trillion, surpassing the previous record of $6.19 trillion set the previous week. Retail investors poured into money market funds amid one of the most aggressive tightening cycles by the Federal Reserve in decades since 2022, even though investors expect the Fed to start cutting rates soon. In addition, as global economic growth expectations have fallen to their lowest level in eight months and US recession expectations have increased, institutional investors have increased their cash asset allocations in August, significantly reducing their long positions in stocks.

Will Powell give any hints about the interest rate cut in September? Next Friday, Fed Chairman Powell is scheduled to speak at the Jackson Hole Economic Symposium hosted by the Kansas City Fed at 10am Eastern Time to discuss the economic outlook. As the Fed is about to cut interest rates from its highest level in more than 20 years, Powell's remarks will be closely scrutinized by the market to look for any hints as to how the Fed chief sees the economy. The Jackson Hole Global Central Bank Annual Meeting has become a window for the Fed to indicate important points in monetary policy as it is about to cut interest rates. Prior to this, several labor market reports, such as US non-farm payrolls, were weaker than expected, and inflation also showed signs of further cooling, making the market more concerned about the risk of a US economic recession. However, Thursday's US retail sales and initial jobless claims data eased some concerns.

Individual stock news

ELX.US's Q2 revenue was CNY 0.627 billion, and the adjusted net profit was CNY 0.213 billion. ELX.US announced the Q2 earnings report as of June 30, 2024: the net revenue was CNY 0.6272 billion, compared to CNY 0.3781 billion in Q2 2023. Net profit was CNY 0.1349 billion, compared to CNY 0.2047 billion in Q2 2023. Net profit was CNY 0.2131 billion, compared to CNY 86.2 million in Q2 2023, without adjusting to US GAAP.

AMAT.US set a new record for Q3 revenue, and Q4 revenue guidance is in line with expectations. AMAT.US Q3 revenue increased by 5.4% YoY to $6.78 billion, a record high, with market expectations of $6.68 billion. Excluding certain items, earnings per share for the third quarter were $2.12, higher than analysts' expectation of $2.03. Nevertheless, the company's Q4 revenue guidance is in line with expectations, disappointing investors who have been hoping for greater returns from its investments in AI. The company expects Q4 revenue to reach around $6.93 billion, on par with analysts' average expected sales. After excluding certain projects, Q4 earnings per share are expected to be about $2.18, compared to analysts' forecast of $2.15.

Bavarian Nordic plans to expand the use of monkeypox vaccines to teenagers, and US monkeypox concept stocks rose in pre-market trading. As the only company in the United States and Europe approved to produce monkeypox (Mpox) vaccines, Bavarian Nordic is now seeking to expand the range of vaccines to teenagers. The company, located in the northern suburbs of Copenhagen, announced on Friday that it plans to submit clinical data to the European Medicines Agency to expand the use of the vaccine to young people aged 12 to 17 in Europe. Prior to this, new cases of monkeypox have been reported in Sweden, Pakistan, and elsewhere. US monkeypox concept stocks rose in pre-market trading, with SIGA Technologies (SIGA.US) up nearly 1%, Emergent Biosolutions (EBS.US) up more than 8%, and GeoVax Labs (GOVX.US) up more than 10%.

Meta's social platform, Threads, launches new features to attract businesses and digital creators. Meta Platforms' new social platform, Threads, has launched some new features that make the social platform more useful for businesses and digital creators. Meta said in a blog post on Thursday that Threads users can now view data, gain insight into post metrics and follower statistics, and write multiple post drafts. The company is also launching a feature that allows users to schedule the publication of multiple posts a few days in advance. These feature updates will first be added to Threads' web platform and will eventually be launched on its mobile app.

As demand for electric vehicles begins to slow and competitors begin to reallocate resources to gasoline-powered cars, Toyota Motor (TM.US) may gradually phase out internal combustion engine cars and instead launch all hybrid models. 'We plan to evaluate one by one whether all hybrid cars are reasonable in the future,' said Toyota's North American sales and marketing director. The assessment includes the company's luxury model Lexus and the 2026 RAV4, America's best-selling sport utility vehicle (SUV). Toyota has already stopped production of the gasoline-powered Camry since the 2025 model year, and the Land Cruiser and Sienna van models are only available in hybrid models.

Important economic data and events notice

20:30 Beijing Time: Initial rate (%) of US building permits in July and Annual rate (%) of US housing starts in July.

22:00 Beijing Time: Preliminary index of US consumer confidence for August from the University of Michigan.

1:00 Beijing Time the following day: The total number of US drills in the week ending August 16.

1:25 Beijing Time the following day: FOMC Voting Committee member for 2025, and Chicago Fed President Guolsby attended a fireside chat.

At 02:45 Beijing time the next day, US Democratic presidential candidate Harris gave a speech in North Carolina, explaining some details of her economic plan.

03:30 Beijing time the next day: CFTC releases weekly position report.

At 04:15 Beijing time the next day, 2025 FOMC voting member and Chicago Federal Reserve President Goolsbee gave an interview.

3. 截至发稿,WTI原油跌2.93%,报75.87美元/桶。布伦特原油跌2.52%,报79.00美元/桶。

3. 截至发稿,WTI原油跌2.93%,报75.87美元/桶。布伦特原油跌2.52%,报79.00美元/桶。